31st Jan 2025. 11.00am

Weekly Briefing – Friday 31st January

| Market | Movement this week (%)* |

|---|---|

| FTSE 100 | +1.95% |

| FTSE 250 | +1.92% |

| FTSE All-Share | +1.92% |

| AIM 100 | +0.87% |

| AIM All-Share | +0.41% |

* Price movement from Monday's open at 8am

Regency View:

Weekly Briefing – Friday 31st January

Market Overview

Dear Investor,

The US-China ‘AI war’ went up several notches this week following the shockwaves sent through Wall Street by Chinese AI start-up DeepSeek.

Nvidia, the undisputed leader in AI hardware, saw its share price plummet by 17% at one point, wiping out nearly $600bn in market value. The trigger? DeepSeek’s latest AI model, R1, which has matched the capabilities of OpenAI and Meta’s offerings—despite being developed with a fraction of the budget and, crucially, far fewer Nvidia chips than expected.

This breakthrough has rattled investors for two reasons. First, it challenges the widely held assumption that AI progress is dictated by ever-increasing compute power—a principle Nvidia has relied on to justify its dominant market position. Second, it raises concerns that China is successfully adapting to US export controls, with companies like Huawei developing alternative AI chips that reduce reliance on Nvidia’s ecosystem. These factors, combined with Nvidia’s already sky-high valuation, led to a rush for the exits.

Looking ahead, this development raises broader questions about the future of the AI race. If China continues making progress in AI despite US restrictions, Washington may respond with further sanctions—escalating tensions and complicating supply chains for global tech firms. Meanwhile, the rise of alternative AI chipmakers could shift the balance of power in the sector, particularly if companies start looking beyond Nvidia’s high-priced GPUs.

For investors, the key question is whether Nvidia’s recent slump is a temporary blip or the start of a deeper shift in AI market dynamics. With earnings just around the corner and geopolitical tensions mounting, the sector is entering a critical phase—one where innovation, regulation, and competition will shape the winners and losers of the AI arms race.

Wishing you a fantastic weekend,

Tom

Market Movers

On the rise: Airtel Africa (LSE:AAF) +12.7% on the week

Airtel Africa have topped the FTSE’s highest risers list this week after delivering a strong set of quarterly results, highlighting solid revenue growth, rising customer numbers, and an expanding mobile money business.

The company’s total customer base grew by 7.9% to 163.1 million, with a notable 13.8% increase in data customers. Mobile money subscribers rose by 18.3% to 44.3 million, driving an annualised transaction value of $146 billion. Revenue for the nine-month period climbed 20.4% in constant currency, with mobile money and data services seeing particularly strong growth of 29.6% and 29.5%, respectively.

Despite ongoing currency devaluation challenges, Airtel Africa’s cost efficiency programme helped to improve EBITDA margins sequentially, rising from 45.3% in Q1 to 46.9% in Q3. Profit after tax received a boost from currency appreciation in key markets, with the naira and Tanzanian shilling strengthening in the most recent quarter. While reported currency revenue declined by 5.8% due to FX pressures, the company’s operational performance remained strong, underpinned by continued investment in network expansion and digital services.

Investor confidence was further bolstered by the announcement of a second $100 million share buyback programme, reflecting management’s belief in the company’s long-term growth prospects and consistent cash generation. With signs of currency stabilisation in some regions and a positive regulatory shift in Nigeria allowing tariff adjustments, Airtel Africa is well-positioned to navigate challenges while capitalising on strong demand for its services.

REGENCY VIEW:

Airtel Africa continues to be a standout in emerging markets, with solid revenue generation and a focus on improving operational efficiencies, which aligns well with our long-term bullish stance on the stock. Having recommended it to our FTSE investor clients, we remain confident in its growth trajectory, despite the recent challenges, and believe its strong dividend yield and significant market position make it an attractive prospect for those seeking value in telecoms.

Shares in Anglo American have fallen this week after BHP signaled it is unlikely to return with another takeover bid, citing Anglo’s rising share price as a dealbreaker.

The Australian mining giant had been keeping a close watch on Anglo’s progress following its £39bn takeover attempt last year but now views the stock as too expensive to justify a renewed offer in the near term, according to people familiar with the matter.

Anglo has seen its share price surge 40% over the past 12 months, driven by investor optimism around its restructuring efforts, while BHP’s own shares have fallen 17% amid weaker iron ore prices and ongoing concerns over China’s real estate sector. This valuation shift has made a fresh bid less attractive for BHP, which had originally pursued Anglo to strengthen its copper portfolio.

The restructuring plan launched by Anglo last year has been well received, with the company successfully securing $4.9bn for its Australian coal assets and progressing toward the sale of its nickel mines in Brazil. Meanwhile, the planned spinout of its South African platinum business and a potential IPO of its De Beers diamond unit could further reshape the company. While some analysts believe a bid could resurface once these changes are complete, BHP’s cautious stance suggests that, for now, the deal is off the table.

REGENCY VIEW:

Anglo American is facing a tough market environment, with weakening profitability and negative earnings growth weighing on sentiment. While its valuation isn’t stretched, the stock’s momentum remains lackluster, and with analysts trimming forecasts, the near-term outlook looks uncertain.

Sector Snapshot

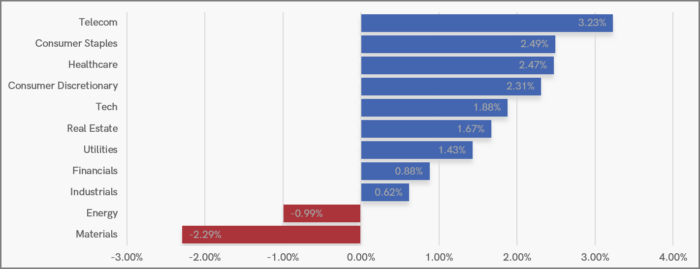

Telecom stocks are leading the UK Sector Snapshot this week following Airtel Africa’s strong trading update. Consumer stocks are also have another strong showing with Staples and Discretionary both making gains.

Underperforming this week are Energy stocks with Brent crude now more that 7% off the January highs. Materials are also having a tough week with concerns over global growth taking their toll.

UK Price Action

It’s been an impressive week of price action from the FTSE. Having used the broken resistance as support, the index has powered higher – indicating that the breakout remains very much in play.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.