30th Aug 2024. 10.07am

Weekly Briefing – Friday 30th August

| Market | Movement this week (%)* |

|---|---|

| FTSE 100 | +1.40% |

| FTSE 250 | -0.01% |

| FTSE All-Share | +1.18% |

| AIM 100 | -0.12% |

| AIM All-Share | -0.30% |

* Price movement from Monday's open at 8am

Regency View:

Weekly Briefing – Friday 30th August

Market Overview

Dear Investor,

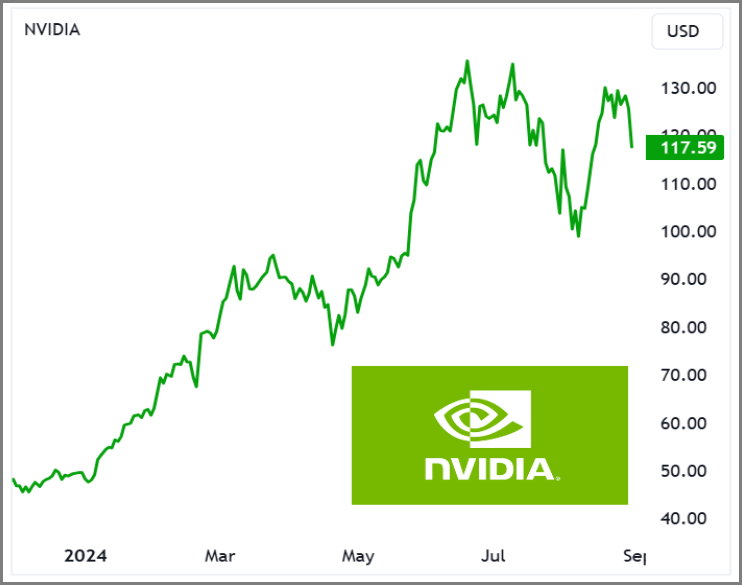

Expectations are funny things, in the stock market, they tend to take on a life of their own. When expectations run too far ahead of reality, they can create an environment ripe for disappointment. This is precisely what happened with Nvidia’s latest earnings release. Despite posting extraordinary numbers, Nvidia’s shares fell due to sky-high investor expectations.

Nvidia reported revenue of $30 billion for the quarter ending July 28, 2024, up 122% from the same period last year and surpassing analysts’ forecasts of $28.7 billion. Earnings per share reached 68 cents, slightly above estimates, and net income soared to $16.6 billion. Yet, Nvidia’s guidance for the next quarter—$32.5 billion in revenue—barely exceeded expectations, leading to a muted market reaction and a drop in the share price.

Part of the reason for this tempered response is Nvidia’s recent track record of exceptional performance, which had driven its stock price up about 160% this year, making it a key contributor to the S&P 500’s gains. Delays in the production of its next-generation Blackwell AI chips also contributed to investor caution. Despite several billion dollars in expected revenue from Blackwell, concerns about Nvidia’s ability to sustain its rapid growth amid production challenges tempered market enthusiasm.

Ultimately, while Nvidia’s numbers were strong, the market’s reaction highlights how inflated expectations can overshadow even stellar results, prompting a revaluation of share prices to better align with realistic growth prospects.

Wishing you a fantastic weekend,

Tom

Market Movers

On the rise: Bunzl (LSE:BNZL) +10.9% on the week

Bunzl’s share price surged on Tuesday after the company released an impressive half-year report, which included a significant upgrade to its operating profit forecast for the full year.

Several factors contributed to the optimistic outlook. One of the main drivers was Bunzl’s successful acquisition strategy. The company announced seven acquisitions in various sectors and geographies, including its first entry into the Finnish market. These acquisitions have already begun to contribute positively to Bunzl’s revenue and profit growth.

In addition to acquisitions, Bunzl’s own-brand products have continued to perform well. The demand for these products has remained strong, which has supported overall revenue stability and profitability. Bunzl’s focus on increasing the penetration of its own brands has been an effective margin management strategy, helping to boost the company’s operating margins despite a challenging economic environment marked by inflationary pressures and deflation in some markets.

Bunzl’s upgraded profit forecast reflects its expectation of continued strong performance for the rest of 2024. The company now anticipates that its adjusted operating profit will show a strong increase compared to 2023, a more optimistic view than its previous forecast of only a slight improvement over last year’s levels.

REGENCY VIEW:

Bunzl’s focus on strategic acquisitions has strengthened its market position, but the stock’s forward PE of 17.5 seems high compared to peers and forecast earnings growth. Additionally, its small dividend yield makes the stock appear expensive relative to its growth prospects.

Music equipment company, Focusrite’s share price gapped lower on Wednesday following the release of its trading update, which highlighted significant challenges, particularly within its Content Creation division.

Although Focusrite expects to meet revenue forecasts with approximately £157 million for the fiscal year 2024, the update revealed that the Content Creation division is struggling due to broader macroeconomic issues, channel consolidation, and an oversupply of products.

The trading update also forecasted that EBITDA for FY24 would be around £25 million, a decline driven by increased shipping and logistics costs as well as pressures on product margins. Focusrite noted that planned product launches in the final quarter have been negatively affected by a major reseller’s decision to reduce its stocking policy and ongoing port congestion. These logistical challenges have exacerbated the financial pressures on the company, affecting both its operational efficiency and profitability.

In addition, rising global shipping costs and higher promotional spending to drive sales amidst a tough market environment have further strained Focusrite’s financial performance. The combination of these factors has led to a significant decrease in Focusrite’s share price, reflecting investor concerns over the company’s ability to navigate these issues effectively and maintain its growth trajectory.

REGENCY VIEW:

Focusrite is a far cry from the lockdown stock that soared during the pandemic, when its shares tripled in value from 2020 to 2021. The stock has since fallen more than 80% over the last two years, reflecting ongoing challenges in its Content Creation division, persistent shipping and logistics issues, and a significant reduction in market demand.

Sector Snapshot

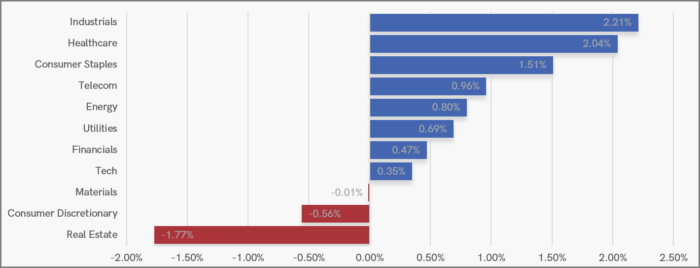

We’re seeing some broad-based gains this week with Industrials, Healthcare and Consumer Staples all up more than 1.5% during the last seven sessions.

Real Estate is lagging as investors start to bet that the Bank of England won’t be as quick to cut rates as previously expected. BoE Governor Andrew Bailey has indicated that it’s still too early to declare victory over inflation – causing the British pound to hit 2-year highs against the US dollar this week.

UK Price Action

In last week’s UK Price Action we highlighted that consolidation near recent highs suggested a “bullish outlook”, and this has played out this week with the FTSE pushing towards a retest of the May highs.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.