2nd May 2025. 11.02am

Weekly Briefing – Friday 2nd May

| Market | Movement this week (%)* |

|---|---|

| FTSE 100 | +1.69% |

| FTSE 250 | +2.64% |

| FTSE All-Share | +1.80% |

| AIM 100 | +5.54% |

| AIM All-Share | +4.62% |

* Price movement from Monday's open at 8am

Regency View:

Weekly Briefing – Friday 2nd May

Market Overview

Market Overview

Dear Investor,

It’s been another eventful week in the markets, with earnings season firmly taking centre stage and the oil market continuing to grapple with a mixture of bearish pressure and mixed fundamental signals.

On the earnings front, HSBC kicked things off with a solid profit before tax of $9.5 billion for Q1 2025, with a standout performance in the Wealth business, Foreign Exchange, and Debt and Equity Markets. Lloyds, meanwhile, also reported a respectable 4% increase in net income year-over-year, despite the challenges posed by higher operating costs and impairment charges.

Over in the tech space, Amazon, Meta, and Microsoft all posted impressive numbers. Amazon’s cloud services and AI demand continued to surge, although the potential impact of tariffs remains a key point of interest. Meta’s 16% year-over-year revenue growth, primarily driven by ad performance, shows its business is firing on all cylinders. Meanwhile, Microsoft’s 13% revenue increase, largely driven by the cloud and AI, speaks to the sustained demand in these areas.

Turning to the oil market, prices have dropped this week, weighed down by concerns over demand growth and potential supply rises. We’ve seen continued uncertainty over the US-China trade dispute, and whispers that Saudi Arabia may be ready to let oil prices linger lower for longer have also added to the bearish sentiment. With OPEC+ likely to increase output in June, we might see further downward pressure in the near term.

Wishing you a fantastic weekend,

Tom

Market Movers

On the rise: Howden Joinery (LSE:HWDN) +9.6% on the week

Howden Joinery’s share price jumped higher this week following a solid April trading update that confirmed a positive start to 2025 and reaffirmed confidence in the Group’s full-year outlook.

The company reported underlying group revenue growth of 3% for the first 16 weeks of the year, with international sales particularly strong, up 17% on the same basis. UK revenues also saw modest growth despite a slower start to the year and two fewer trading days in January.

Investors responded positively to management’s reassurance that trading remains in line with expectations, particularly against a strong comparative period last year. Encouragingly, Howden is maintaining a careful balance between pricing and volume, having implemented price increases across all markets at the start of the year without denting demand.

The update also included operational highlights: between 20 and 25 new depots are set to open in the UK this year, with around 60 revamps planned for existing sites. In parallel, the company is rolling out new kitchen ranges, expanding its fitted bedroom offer, and ramping up digital tools like CRM and click-and-collect to support trade customers and drive deeper customer engagement.

REGENCY VIEW:

Howden continues to score highly on quality metrics, with a 25% return on equity and solid operating margins supporting its status as a well-run business. The shares aren’t especially cheap at 16.6x forward earnings and nearly 19% off their highs, but with a strong balance sheet and ongoing buyback, they’re well supported for long-term holders.

Petrofac has been one of the biggest fallers this week, with shares tumbling sharply on Tuesday and Wednesday before being suspended from trading on Thursday.

The sell-off in the share price came as no surprise to investors closely following the company’s restructuring saga, but the speed and severity of the decline served as a reminder of just how fragile sentiment remains around the stock.

The sell-off was largely triggered by growing anticipation of the May 1st trading suspension, which had been flagged by the company in March due to its inability to publish full-year 2024 results on time. With many investors choosing to exit ahead of the deadline, the final two trading sessions turned into a disorderly rush for the exit.

For long-term holders, the suspension marks yet another painful chapter in a drawn-out decline. Once a FTSE 100 oil services heavyweight, Petrofac has spent the past several years battling legacy legal issues, project cost overruns, and growing debt burdens. The hope now is that the restructuring will finally draw a line under these issues and give the business a chance to reset. But until trading resumes and the numbers are published, investors remain firmly in the dark.

REGENCY VIEW:

While Petrofac has confirmed that the sanction hearing for its restructuring plan will take place between 30 April and 2 May, and that results will follow shortly thereafter, there are still unanswered questions about what the company will look like post-restructuring — and what, if anything, will be left for shareholders. The latest updates point to significant dilution and a capital structure heavily skewed in favour of secured creditors.

Sector Snapshot

Technology extended its lead at the top of the leaderboard this week, with Telecoms and Consumer Discretionary also showing healthy demand as investors continued to favour growth-sensitive areas of the market.

At the other end of the spectrum, Materials lagged once again, joined by Energy and Consumer Staples — all sectors facing pressure from weaker commodity trends, cautious positioning around China, and defensive rotation fading. Overall, the market mood appears increasingly risk-on, with cyclical and rate-sensitive sectors back in favour.

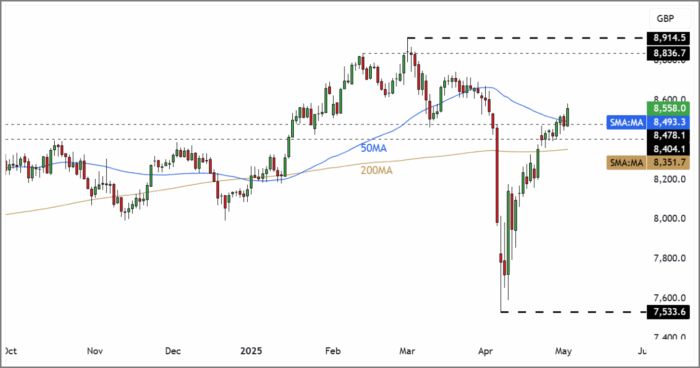

UK Price Action

The FTSE has continued to climb with a solid start to earnings season underpinning the index. Prices have broken back above the 50-day moving average, but the bulls should be aware that the climb has had much less momentum than the preceding sell-off.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.