2nd Feb 2024. 11.00am

Weekly Briefing – Friday 2nd February

| Market | Movement this week (%)* |

|---|---|

| FTSE 100 | +0.11% |

| FTSE 250 | -0.13% |

| FTSE All-Share | +0.07% |

| AIM 100 | +1.24% |

| AIM All-Share | +0.97% |

* Price movement from Monday's open at 8am

Regency View:

Weekly Briefing – Friday 2nd February

Market Overview

Dear Investor,

This week, the world’s financial markets were closely attuned to the deliberations of two major central banks, the Federal Reserve and the Bank of England, as they provided insights into their monetary policy decisions and economic outlooks.

On Wednesday, Federal Reserve Chair Jay Powell addressed speculation surrounding potential interest rate cuts in March. Powell moved to temper market expectations, stating that a reduction in rates during the upcoming meeting is not the “base case.” Despite concerns over falling inflation, Powell emphasised the need for “greater confidence” that the decrease is sustainable before committing to any adjustments.

The Federal Open Market Committee unanimously decided to maintain the benchmark federal funds rate at its current level between 5.25% and 5.5%. Powell acknowledged the strength of the U.S. economy and labour market, signalling a cautious optimism but maintaining a vigilant stance on inflation. Traders on Wall Street initially threw their toys out the pram, causing a sharp drop on the S&P 500, but the index has since bounced back.

On Thursday, the Bank of England under Governor Andrew Bailey echoed a similar sentiment to the Fed. Bailey held interest rates steady at 5.25%, emphasising the necessity for “more evidence” that inflation is on a consistent downward trajectory before considering rate cuts.

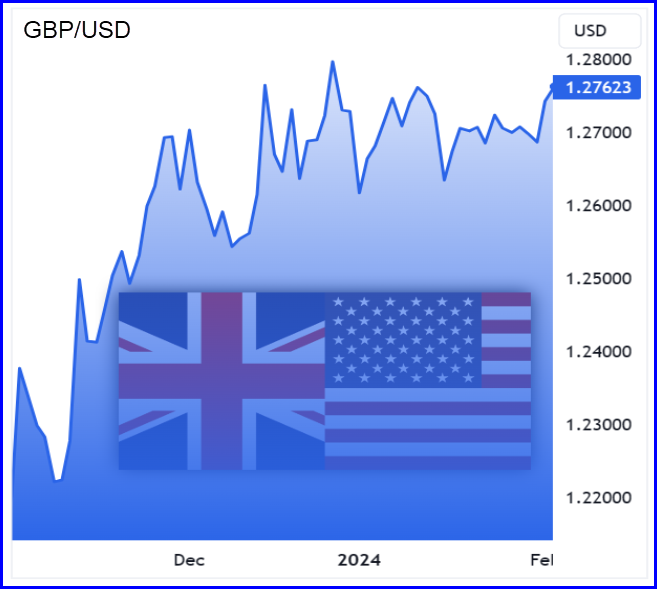

Bailey highlighted persistently high service price inflation and the fading impact of falling energy prices, signalling that the bank is not ready to declare its mission accomplished in taming inflation. Traders adjusted their expectations, with swaps markets reflecting a 55% chance of a rate reduction by May, down from 60% earlier in the day. The FTSE was relatively unmoved and so were the currency markets with GBP/USD counting to chop sideways in a tight range.

Both central banks tip toed cautiously amid economic uncertainties, citing the need for additional evidence before implementing any policy changes. For how long they can maintain this delicate dance remains to be seen, investors want rate cuts, and they want them now!

Wishing you a fantastic weekend,

Tom

Market Movers

On the rise: Serabi Gold (AIM:SRB) +23.7% on the week

Serabi Gold’s share price surged higher on Wednesday following the renewal of its trial mining license for the Coringa mine in Brazil. The National Mining Agency granted a three-year extension to the license, allowing the company to transport up to 50,000 tonnes of ore annually from Coringa to the Palito Complex for processing.

The environmental agency, SEMAS, is currently evaluating Serabi Gold’s application for an installation license for Coringa. Despite this, the company’s trial mining operating license (GUOL) remains active and valid.

With the renewed license, Serabi Gold can move forward with plans to install a crusher and ore sorter at Coringa. The ore sorter is expected to be operational by the fourth quarter of 2024, enhancing efficiency and productivity at the mining site.

The company’s CEO, Mike Hodgson, expressed satisfaction with the news, highlighting the pivotal agreements reached with indigenous communities in July and additional agreements signed in December. He emphasised that the new license allows the company to continue its current operations and proceed with planned installations, contributing to the overall permitting success at Coringa. Hodgson mentioned that the annual limitation of 50,000 tonnes of transported ore is sufficient for 2024, allowing them to focus on completing the final steps for full permitting at Coringa.

REGENCY VIEW:

Serabi is a high-quality mining stock with stable margins and a strong debt-free balance sheet. The shares trade on a forward PE multiple of 5.1. This valuation compares favourably to its peer group and to forecasted EPS growth of 54.9%. We monitor the stock closely and AIM Investor members will be notified when we believe there are sufficient catalysts in place to buy the stock.

Speedy Hire sank this week after issuing a profit warning, citing an expected shortfall in full-year profits compared to earlier forecasts.

The drop is linked to challenges in the construction sector and a mild winter impacting the company’s performance. Despite progress in its Velocity Strategy and securing new contracts, the firm reported a slowdown in revenue growth from national customers, with a 3% increase at the end of the third quarter compared to 5% at the half-year mark.

Revenue from regional customers remained 6% down year-on-year, consistent with the first-half position. The warmer winter affected revenue from seasonal products, and there were delays in mobilizing new contract wins.

The company secured over £40 million in annualized revenue from new multi-year contracts during the period. However, it noted that the full benefit of new contract revenues would be marginal in FY24, with the complete effect expected in FY25. Net debt increased to £117.3 million by December 31 due to the acquisition of GPH.

Looking ahead, Speedy Hire expressed confidence in the long-term benefits of its Velocity strategy but acknowledged weakness in certain end markets and seasonal product lines. The company expects full-year profits to be below previous expectations due to delays in mobilizing significant contract wins and challenges in its end markets.

REGENCY VIEW:

While Speedy Hire’s valuation has moved into bargain basement territory, profit warnings of this nature rarely come in isolation. The shares have printed a large negative gap on the price chart this week – creating a burst of bearish momentum which is likely to see some follow through during the coming months.

Sector Snapshot

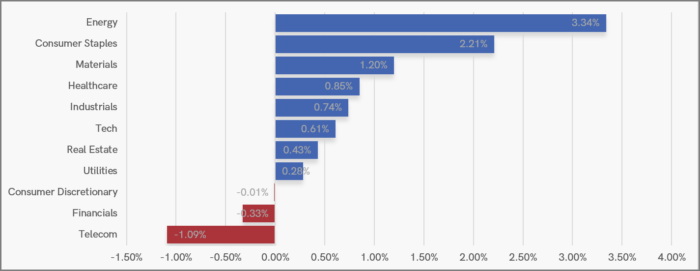

It’s been a strong week for Energy with Shell raising its dividend after reporting the second highest cashflow in its history. Consumer Staples have also shown strength this week with Diageo rallying following a solid trading update.

Telecoms are the laggard this week with BT and Airtel Africa failing to inspire investors with their latest trading updates.

UK Price Action

The FTSE has managed to consolidate last week’s gains and hold above the volume-weighted average price (VWAP) and descending trendline from the New Year highs.

A retest of the major resistance zone at 7,700 – 7,750 looks the most likely scenario to play out over the coming sessions.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.