29th Nov 2024. 10.51am

Weekly Briefing – Friday 29th November

| Market | Movement this week (%)* |

|---|---|

| FTSE 100 | +0.20% |

| FTSE 250 | +1.03% |

| FTSE All-Share | +0.30% |

| AIM 100 | -0.12% |

| AIM All-Share | -0.14% |

* Price movement from Monday's open at 8am

Regency View:

Weekly Briefing – Friday 29th November

Market Overview

Dear Investor,

Black Friday has arrived, and let’s be honest—it’s more than just a shopping event. For Amazon and the broader retail sector, it’s the equivalent of a final exam. The results today will give us key insights into consumer confidence, e-commerce dynamics, and how the retail industry plans to close out 2024.

For Amazon, the stakes couldn’t be higher. Black Friday has historically been a sales juggernaut, fuelled by the company’s mastery of logistics, irresistible lightning deals, and the ever-loyal Prime membership base. Last year, Black Friday made a noticeable dent in Amazon’s Q4 revenues, and this year, the company’s guidance of 7% to 11% sales growth suggests they’re betting on another strong performance. With today’s event kicking off the holiday shopping season, how well Amazon capitalises on consumer demand could make or break its Q4 targets.

Of course, this year is a little different. Rising interest rates and inflation have squeezed household budgets, leaving many shoppers more cautious. But where there’s a challenge, there’s also an opportunity. Consumers are hunting for value, and Black Friday’s deep discounts might be exactly what nudges them into spending on big-ticket items like electronics, home goods, and apparel—all categories where Amazon typically shines.

Amazon isn’t the only player with skin in the game. The broader retail sector is under pressure to show its cards today, with competitors like Walmart and Target ramping up their own efforts. Black Friday often decides who will win the holiday season, and the companies that get pricing, inventory, and digital strategy right are likely to see their stocks rewarded in the weeks ahead.

So, what should we watch for as the day unfolds? Total online sales, average basket size, and the strength of key product categories will tell us a lot about both the current state of consumer spending and how retailers are positioned heading into 2025. For Amazon, the pressure is on to turn record web traffic into meaningful sales, especially with Wall Street keeping a close eye on its performance.

As analysts, we know Black Friday is more than a single day. It’s a moment that shapes expectations for the retail landscape as a whole. Whether today’s numbers dazzle or disappoint, they’ll set the tone for what’s ahead.

Wishing you a fantastic weekend,

Tom

Market Movers

On the rise: Direct Line Group (LSE:DLG) +48.2% on the week

Direct Line’s share price surged more than 35% on Thursday after the UK motor insurer rejected a takeover bid from larger rival Aviva, signalling confidence in its future prospects.

Aviva had offered £3.3bn for the company, a proposal comprising both cash and shares, which would have valued each Direct Line share at 250p. However, Direct Line’s board dismissed the offer, describing it as “highly opportunistic” and “substantially undervalued” in light of the company’s ongoing turnaround efforts.

This marks the second time in 2024 that Direct Line has been targeted by a potential acquirer, with the company previously rejecting a £3.1bn bid from Belgian insurer Ageas in February. The rejection has been seen as a vote of confidence in Direct Line’s newly implemented strategic plan, led by CEO Adam Winslow, who took over in 2024. Under his leadership, Direct Line has been focused on returning to profitability after suffering from rising claims costs in the wake of the pandemic.

The company has already made progress toward its cost-saving goals, including a planned £100 million in savings by the end of 2025, and has started restructuring with the recent announcement of job cuts.

REGENCY VIEW:

The turnaround strategy, alongside its solid market position as the first UK car insurer to sell directly to customers, has helped reinforce the company’s value and led to the strong market response following the rejection of Aviva’s bid. Direct Line now faces a critical period, with Aviva having until December 25 to decide whether to make a firm offer or walk away. The stock’s impressive rise is a clear signal from investors that they believe in Direct Line’s future growth potential, independent of a takeover.

Pets at Home’s (PETS) share price fell this week following the release of its FY25 interim results, which highlighted a subdued pet retail market impacting performance. While the Vet Group delivered strong double-digit revenue growth and robust new pet registrations, retail revenue was flat due to challenging market conditions and transitional impacts from its new digital platform. The company revised its FY25 profit expectations to reflect only modest growth compared to last year.

Despite near-term headwinds, management emphasized confidence in long-term growth trends, citing a stable but higher pet population and historical market growth rates averaging 4% annually. CEO Lyssa McGowan stressed that periods of slower growth are typically short-lived and pointed to investments in digital platforms, store expansions, and automation as key drivers of future growth.

The October Budget added further pressure, introducing planned increases to the National Living Wage and employer National Insurance contributions, which will add £18 million in costs by FY26. Pets at Home plans to offset these impacts through productivity improvements and efficiency measures in its operations.

With free cash flow up 43.3% to £33.1 million and an interim dividend increased by 4.4%, the company’s financial position remains robust. However, investor concerns over retail softness and near-term profitability challenges weighed on the share price, reflecting caution despite the company’s strategic investments and market leadership.

REGENCY VIEW:

Pets at Home has had a tough year, with its price down nearly 30% over the last 12 months. While the company continues to deliver steady revenue growth, up 5% in FY 2024, the momentum just isn’t there right now. However, the stock still looks interesting for long-term investors, especially with its solid 6.07% dividend yield and a relatively low P/E ratio of 10.1, which indicates value. It’s a bit of a mixed bag—if you’re looking for stability and income, this could be one to keep an eye on, but don’t expect fireworks in the short term.

Sector Snapshot

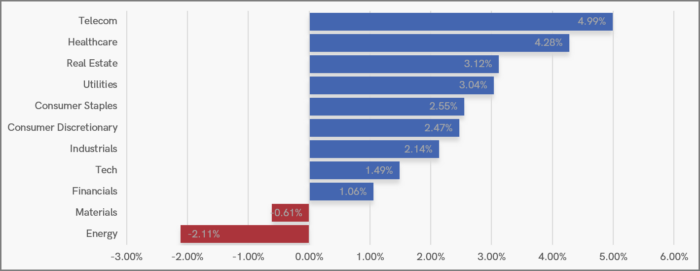

This 7-day sector snapshot captures the momentum from last week’s rally, which explains why there’s plenty of blue on the board. Leading the charge this week are Healthcare and Real Estate, two sectors that had been lagging behind as some of the UK market’s weakest performers over the past three months.

On the flip side, Materials and Energy find themselves at the bottom of the rankings, weighed down by the strong dollar—a headwind amplified by Donald Trump’s election win.

UK Price Action

This week, the FTSE’s price action has been all about digesting last week’s rally from support. The market has been hovering near last week’s highs, locked in a series of tight-range days. This kind of ‘high and tight’ consolidation often signals bullish intent, as price compression tends to break in the direction of the prevailing trend and momentum.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.