28th Mar 2025. 10.53am

Weekly Briefing – Friday 28th March

| Market | Movement this week (%)* |

|---|---|

| FTSE 100 | +0.34% |

| FTSE 250 | +0.01% |

| FTSE All-Share | +0.31% |

| AIM 100 | +1.55% |

| AIM All-Share | +1.27% |

* Price movement from Monday's open at 8am

Regency View:

Weekly Briefing – Friday 28th March

Market Overview

Dear Investor,

This week’s Spring Statement was meant to be a steadying moment for the UK economy—Rachel Reeves laying out her plan for fiscal discipline while keeping a bit of firepower in reserve. But within hours, Donald Trump threw a spanner in the works with his announcement of 25% tariffs on foreign-made cars.

For the Chancellor, this is a real headache. The £9.9bn of headroom she’s set aside for economic shocks now looks precariously small. The Office for Budget Responsibility (OBR) wasted no time in warning that a full-blown trade war could wipe it out entirely. If the US pushes ahead with tariffs and the UK retaliates, the OBR estimates a 1% hit to GDP at its peak—enough to weigh heavily on next year’s growth.

The UK car industry is right in the firing line. The US is the second-largest export market for UK-made cars, and brands like Jaguar Land Rover, Bentley, and Aston Martin—none of which produce in the US—are in a tough spot. Some ultra-premium manufacturers might absorb the costs or pass them on to customers, but for most automakers, it’s a serious threat to market access. Reeves is already in ‘intense negotiations’ with US counterparts to secure an exemption, but Trump isn’t exactly known for making concessions.

And this isn’t just about tariffs. The OBR is also flagging broader risks to UK productivity. If growth undershoots even slightly—just 0.1% less per year over the next five years—Reeves’ fiscal buffer disappears. Factor in inflation uncertainty, ongoing geopolitical risks, and the possibility of further tax rises, and the road ahead looks increasingly challenging.

For markets, the reaction has been cautious. The FTSE 100 is holding up near its recent highs, but UK-focused stocks—especially in autos—are feeling the pressure. Sterling has held its ground against the dollar as investors weigh up the risk of weaker growth and tighter fiscal policy.

The Spring Statement was supposed to offer clarity, but instead, it’s raised more questions about how resilient the UK economy really is. With Reeves now playing defence on multiple fronts, this year’s Autumn Budget could be even trickier than expected.

Wishing you a fantastic weekend,

Tom

Market Movers

On the rise: Next (LSE:NXT) +11.5% on the week

Next topped the FTSE’s highest risers this week following a market-beating set of numbers, with the retailer reporting impressive sales and profit growth for the year to January 2025. Total Group sales rose by 8.2%, reaching £6.32 billion, while profit before tax grew 10.1% to £1.01 billion.

Full-price sales saw a strong increase of 5.8%, and Next’s international expansion continues to gather momentum, with sales through third-party aggregation platforms surging 36%. This growth highlights Next’s ability to tap into new revenue streams and strengthen its global presence.

Next’s pre-tax earnings per share (EPS) increased by 11.6%, boosted by ongoing share buybacks, while post-tax EPS saw a solid rise of 9.9%. The retailer also raised its sales and profit guidance for the year to January 2026, with full-price sales now expected to rise by 5.0%, up from the previous 3.5%. Profit guidance was increased by £20 million to £1.066 billion, reflecting a 5.4% rise, and post-tax EPS is expected to grow by 8.5%. This upward revision reflects the company’s confidence in its ability to continue delivering solid performance in a challenging retail environment.

The retailer’s strong performance is underpinned by its strategic shift towards becoming a platform for third-party brands, with non-Next branded sales now accounting for 20% of total sales. The online channel continues to grow, particularly internationally, with sales on third-party platforms increasing by 36% and Next’s international business seeing a 25% rise in total sales. This growth, combined with Next’s established brand strength, positions the company for continued success as it leverages its platform and supply chain infrastructure to reach new markets and customers.

REGENCY VIEW:

Next continues to deliver strong financial performance, with an 8.2% forecasted EPS growth and a well-covered dividend yield of 2.49%. Its high return on capital and operating margins highlight a well-run business with a strong competitive position in the retail sector.

Predator Oil & Gas tumbled this week following its latest operational update, which, despite outlining steady progress in Trinidad and Morocco, failed to spark enthusiasm among investors.

The company confirmed that its acquisition of CEG Trinidad remains on track, adding 272 bopd to its production profile once completed. It also announced the commencement of oil sales from the Bonasse field and detailed ongoing well workovers aimed at increasing output. However, initial production targets remain modest, with Bonasse building towards just 35 bopd, which may have disappointed those looking for a more immediate impact on revenues.

While the company is fully funded for all its firm commitments in 2025, its focus on cash flow conservation and a cautious approach to discretionary spending could have contributed to the market’s reaction. Management highlighted the potential for production uplifts through wax treatment technology and future drilling, but these developments remain some way off. Investors may also have taken note of the company’s statement that production revenues are considered discretionary cash rather than central to its cash flow models, suggesting limited near-term financial transformation despite the operational progress.

The broader market backdrop may also have played a role in the share price decline, with investor sentiment towards small-cap oil and gas stocks remaining fragile. While Predator’s emphasis on maintaining a debt-free position and securing production revenues aligns with a prudent strategy in uncertain market conditions, it does little to address the near-term share price weakness. With further workovers and testing ahead, the company will need to demonstrate tangible production increases to regain investor confidence.

REGENCY VIEW:

Predator Oil & Gas remains a highly speculative microcap with no revenue and a track record of operating losses, making it a challenging proposition for investors. While recent volume spikes hint at speculative interest, the share price remains under significant pressure, and without a clear path to profitability, the risks remain elevated.

Sector Snapshot

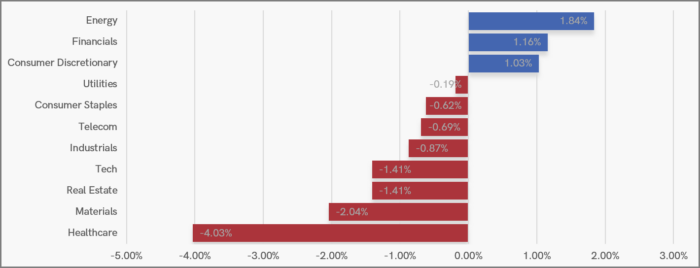

This week, UK sectors reflected the ongoing anticipation of stubborn inflation and the prospect of higher-for-longer interest rates. Energy and Financials emerged as the top performers, buoyed by firm oil prices and stable rate expectations. Consumer Discretionary also posted gains, driven by Next’s impressive results.

On the downside, Healthcare took the heaviest hit, with losses concentrated in the Pharma and Life Sciences sub-sectors, as rate-sensitive areas came under pressure. Materials and Real Estate also struggled, while Tech and Industrials saw modest declines. Defensive sectors like Utilities, Consumer Staples, and Telecoms remained relatively steady, as investors balanced caution with selective risk-taking.

UK Price Action

It’s been another week of tight consolidation for the FTSE – forming a clearly defined short-term range.

This intensifying period of price compression signals that we may be gearing up for a decisive directional move soon.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.