28th Jun 2024. 11.29am

Weekly Briefing – Friday 28th June

| Market | Movement this week (%)* |

|---|---|

| FTSE 100 | -0.16% |

| FTSE 250 | -0.37% |

| FTSE All-Share | -0.18% |

| AIM 100 | -1.26% |

| AIM All-Share | -1.07% |

* Price movement from Monday's open at 8am

Regency View:

Weekly Briefing – Friday 28th June

Market Overview

Dear Investor,

It’s been an intriguing, albeit somewhat alarming, week in global politics. The US presidential debate painted a disheartening picture, as a stumbling Joe Biden sparred with convicted felon Donald Trump, heightening concerns about the future state of US leadership.

US investors maintained their composure amid the looming political uncertainties, with the S&P 500 hovering near record highs and the dollar index holding steady for the week. The resilience of corporate earnings, which continue to exceed expectations despite global challenges, may be providing a stabilising influence. Additionally, the Federal Reserve’s cautious approach to interest rates has offered reassurance amidst fears of inflationary pressures.

Closer to home, UK Prime Minister Rishi Sunak is desperately trying to avert a whitewash in the upcoming general election. Despite his efforts in a heated TV debate against Labour leader Sir Keir Starmer, polls suggest a massive Labour victory, which could dramatically reshape the political landscape in the UK. Sunak’s campaign, marked by errors and the “gamblegate” betting scandal involving Tory candidates, struggles to gain traction as the election looms.

Meanwhile, in France, the worrying rise of the far-right is gaining momentum. Marine Le Pen’s National Rally party is challenging the traditional powers of President Emmanuel Macron, particularly in military and foreign policy domains. Le Pen’s bold assertions about limiting Macron’s influence over critical national issues, such as Ukraine and defence, signal potential instability in France’s political future. The prospect of a far-right prime minister, brings uncertainty to France’s role in the EU and NATO, which could have far-reaching implications for international relations.

These developments underscore a period of significant political turbulence across major Western democracies. As investors, it’s crucial to be prepared for potential market volatility stemming from these political uncertainties.

Wishing you a fantastic weekend,

Tom

Market Movers

On the rise: DS Smith (LSE:SMDS) +16.1% on the week

DS Smith saw a significant rise in its share price on Thursday as Brazilian pulp maker Suzano announced it was ending discussions to acquire International Paper.

Suzano stated that International Paper did not engage with the highest price Suzano was willing to offer. Consequently, Suzano decided not to pursue the acquisition, citing its commitment to capital discipline.

Earlier, DS Smith had agreed to be acquired by International Paper for £5.8 billion in April.

Reports indicated that a potential deal between Suzano and International Paper was contingent on International Paper abandoning its bid for DS Smith.

DS Smith’s share price gapped higher on Thursday and the shares are up more than 17% from their June lows.

REGENCY VIEW:

DS Smith has demonstrated strong pricing power, successfully raising prices to offset inflationary pressures while maintaining robust demand. Effective hedging has helped navigate the energy crisis, and revenue and earnings projections for FY23 are positive.

Sustainability is a key growth driver, with plans to produce 100% reusable packaging by next year and remove 1 billion pieces of plastic from shelves by 2025. Demand for sustainable packaging is increasing, driven by consumers, investors, and regulations.

It’s been a tough couple of weeks for Ocado, with its shares being hit by several pieces of negative newsflow…

The company’s challenges began with a major setback on June 20, 2024, when it announced that Canadian supermarket chain Sobeys had paused the construction of a new robotic warehouse and ended their exclusive partnership. This news led to a 17.6% drop in Ocado’s share price. The decision by Sobeys raised concerns about Ocado’s growth prospects, as the company has heavily invested in selling its software and robotic solutions to traditional supermarket chains worldwide to enhance their ecommerce operations.

Further compounding Ocado’s troubles was the recent move by another key partner, Kroger in the US, to shut down three sites powered by Ocado. This development cast additional doubt on Ocado’s ability to sustain and expand its business model, which depends on these high-profile partnerships to drive growth and profitability.

On June 25, 2024, Ocado’s shares took another hit when Morgan Stanley downgraded the stock, cutting its price target from 345p to 215p. The downgrade was directly linked to Sobeys’ decision to halt the warehouse project and terminate the exclusivity of their partnership. Morgan Stanley’s assessment suggested that these setbacks could significantly hinder Ocado’s ability to develop and launch new projects, further eroding investor confidence.

REGENCY VIEW:

Ocado’s demotion from the FTSE 100 to the FTSE 250, along with ongoing investor scepticism, underscores the significant challenges the company faces. Despite reporting strong digital sales growth in recent quarterly results, the loss of exclusive partnerships and site closures has issues cast serious doubt on its leaderships ability to deliver on strategic plans.

Sector Snapshot

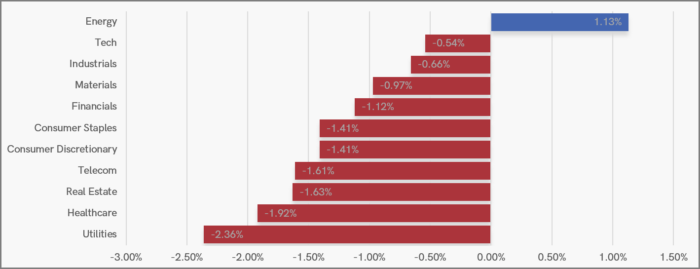

Energy is the only UK sector to make gains over the last seven sessions with BP and Shell ticking higher as brent crude continues to recover.

We are seeing weakness in Utilities and Healthcare, two defensive sectors – indicating the FTSE’s current pullback could be more to do with sector rotation than risk aversion.

UK Price Action

In last week’s UK Price Action we mentioned that “a weekly close back below the triangle would signal a false breakout” and this has broadly played out this week with the FTSE drifting back below the 50 day moving average (MA).

All eyes will now be on short-term support at 8,136 as a break below this level could trigger a deeper retracement.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.