28th Feb 2025. 10.42am

Weekly Briefing – Friday 28th February

| Market | Movement this week (%)* |

|---|---|

| FTSE 100 | +1.26% |

| FTSE 250 | -1.4% |

| FTSE All-Share | +0.92% |

| AIM 100 | -1.80% |

| AIM All-Share | -1.72% |

* Price movement from Monday's open at 8am

Regency View:

Weekly Briefing – Friday 28th February

Market Overview

Dear Investor,

This week, it was Europe’s turn to head to Washington, with Starmer and Macron making their pitches to Trump. As ever, the meetings were a mix of warm words and hard bargaining, but the biggest takeaway was the prospect of a US-UK trade deal that could spare Britain from Trump’s latest round of tariffs.

Trump made it clear that he sees the UK as a “very different place” from the EU, suggesting that a deal could come together “as quickly as it can be done.” While a full free trade agreement remains unlikely, avoiding tariffs would be a significant boost for UK businesses, particularly exporters already facing enough headwinds. The pound held steady, and UK-listed firms with US exposure found some support as markets took note.

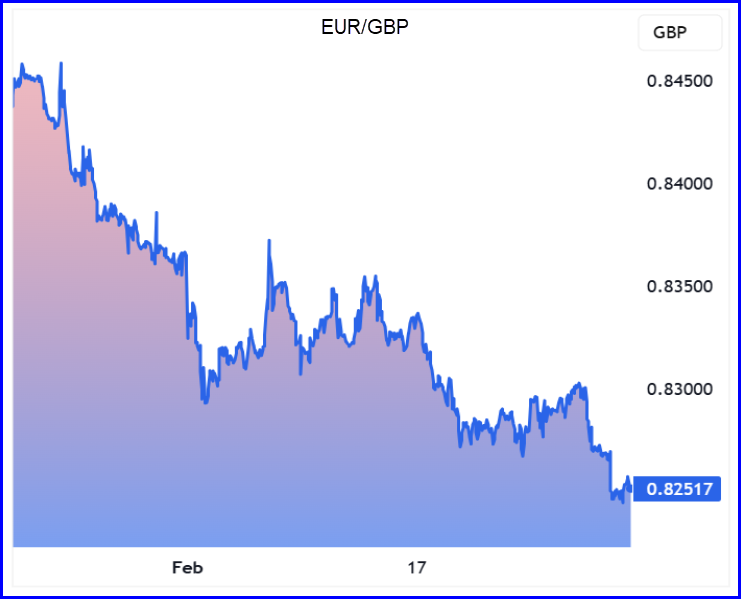

The same can’t be said for Europe. Trump is threatening 25% tariffs on EU exports, reinforcing the view that relations between Washington and Brussels are set to remain tense. European equities wobbled, and the euro softened as markets priced in the growing risk of trade disruption. The divergence between how the UK and EU are being treated here could be significant—especially if UK firms gain a relative advantage in transatlantic trade.

Beyond economics, Ukraine was high on the agenda. Trump is set to meet Zelenskyy, and while he insists he believes Putin will “keep his word” on a peace deal, his stance on US security guarantees remains murky. He made it clear that American business interests in Ukraine—not military support—would act as a deterrent against further Russian aggression. Markets have learned to take Trump’s foreign policy with a pinch of salt, but any shift in US involvement will have major implications for European security and investor sentiment.

With Starmer hosting European leaders in London this weekend and US-UK trade talks now formally underway, the market focus will be on whether negotiations translate into something tangible. For now, it’s more warm words than hard commitments, but given the way Trump operates, that could change overnight.

Wishing you a fantastic weekend,

Tom

Market Movers

On the rise: Rolls Royce (LSE:RR.) +22.1% on the week

Rolls-Royce rocketed higher on Thursday following a blockbuster set of full-year results that showcased a company firing on all cylinders…

Underlying operating profit surged to £2.5 billion, a sharp increase from £1.6 billion last year, with margins expanding to 13.8% as strategic initiatives took hold. Free cash flow more than doubled to £2.4 billion, leaving the group with a net cash position of £475 million—an impressive turnaround from the prior year’s £1.95 billion net debt.

The strong financial performance prompted Rolls-Royce to reinstate its dividend at 6p per share and announce a £1 billion share buyback for 2025. CEO Tufan Erginbilgic highlighted the company’s transformation, noting that mid-term targets, originally set for 2027, are now expected to be achieved two years ahead of schedule. Guidance for 2025 sees operating profit climbing to £2.7 billion–£2.9 billion, with free cash flow expected to match that range.

Investors cheered the upgrades, with the stock rallying on the news, as the company laid out an even more ambitious roadmap for 2028. Mid-term targets now include underlying operating profit of £3.6 billion–£3.9 billion, free cash flow of £4.2 billion–£4.5 billion, and a return on capital of up to 21%, underscoring the long-term earnings potential of the business.

REGENCY VIEW:

Rolls-Royce Holdings has seen impressive momentum in its recent performance, with shares up over 70% in the past year, driven by solid earnings and a £1bn buyback. While its valuation sits at an eye-wateringly high P/E ratio of 33.3, the company’s strong free cash flow generation and improving operating margins suggest that it may continue to benefit from its recovery in the coming years.

Aston Martin’s share price took a hit this week after the company released its preliminary results for the year ending 31 December 2024. While total average selling prices (ASP) increased by 6% to £245,000, driven by demand for bespoke and special models, overall revenue fell by 3% to £1.58 billion. This decline was primarily due to a 9% drop in wholesale volumes, affected by new model launch timings, supply chain issues, and weaker demand in China.

Full-year adjusted EBITDA dropped by 11% to £271 million, and the company posted an adjusted EBIT loss of £83 million. Although H2 2024 saw growth from new model launches and a 10% increase in wholesale volumes, overall financial performance struggled. Gross margin decreased by 220 basis points to 36.9%, largely due to product mix challenges, delivery timing, and foreign exchange headwinds. The Q4 performance was especially tough, with a 23% drop in gross profit and a significant decline in margin.

Despite these setbacks, Aston Martin is optimistic about 2025, anticipating a return to positive adjusted EBIT and free cash flow in H2, bolstered by the upcoming launch of its Valhalla hybrid supercar. The company is also focused on cost optimization and operational improvements, with CEO Adrian Hallmark expressing confidence in the brand’s transformation, backed by strategic shareholder support and a strong product lineup.

Liquidity remains strong, with £514 million in cash and available facilities. However, net debt rose to £1.16 billion, mainly due to increased gross debt and foreign exchange impacts. While the company faces challenges, investors will be closely monitoring the successful execution of its transformation plan, particularly the performance of new models and the crucial Valhalla launch.

REGENCY VIEW:

Aston Martin continues to struggle, with significant losses persisting across key metrics, including a year-to-date drop of over 40% in share value. Despite some growth in revenue, the company’s balance sheet remains under pressure, and with no dividend payments and mounting debt, it’s clear that the road to recovery will be long and uncertain.

Sector Snapshot

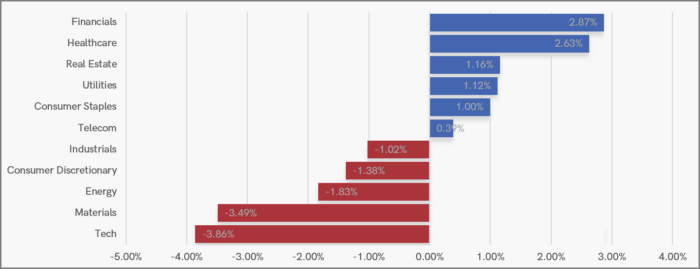

We’re seeing a split pack this week, but some very familiar themes…

Financials are strong again, building on the relative strength we highlighted during last week’s market-wide pullback. Materials and Energy remain weak as Trump’s tariff wars impact the outlook for global growth.

UK Price Action

After a two-legged pullback, it’s been a trend continuation week for the FTSE…

Prices have broken out of a small retracement channel and pushed higher in-line with the dominant trend.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.