27th Sep 2024. 10.35am

Weekly Briefing – Friday 27th September

| Market | Movement this week (%)* |

|---|---|

| FTSE 100 | +0.99% |

| FTSE 250 | +1.33% |

| FTSE All-Share | +1.01% |

| AIM 100 | +0.27% |

| AIM All-Share | -0.27% |

* Price movement from Monday's open at 8am

Regency View:

Weekly Briefing – Friday 27th September

Market Overview

Dear Investor,

China is pulling out all the stops to counter slowing growth. The People’s Bank of China announced a range of stimulus measures this week, including a cut to the benchmark interest rate and a reduction in the reserve requirement ratio (RRR).

These moves inject around RMB 1 trillion ($142 billion) into the banking system, aimed at boosting liquidity, encouraging investment, and stabilizing financial markets. With the property sector struggling and deflationary pressures weighing on consumer demand, these steps come at a critical time. Economists have already revised growth forecasts lower, with some now doubting China will hit its 5% target for the year.

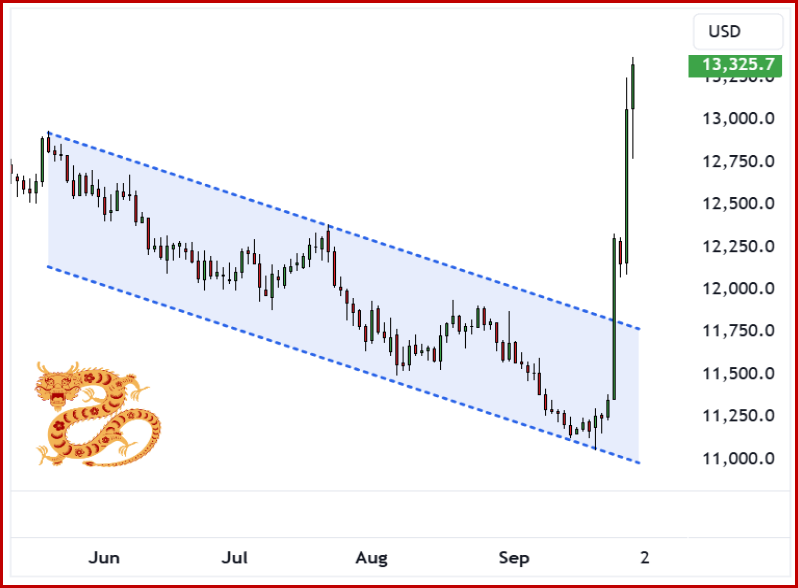

The market’s reaction was swift. The China A50 index broke out of a four-month-long descending channel, rallying sharply as investor confidence surged. This technical breakout, fuelled by strong volume, signals a shift in momentum. Investors are now eyeing the potential for further gains as this stimulus package starts to work its way through the economy.

This stimulus could create opportunities across several sectors. Mining stocks, for example, could continue to see a lift as increased infrastructure spending is likely to drive demand for raw materials such as copper and iron ore. Financial stocks with significant exposure to China, including banks and insurers like HSBC and Prudential, may benefit from heightened lending and investment activity. Luxury goods stocks are also well-positioned to take advantage of this stimulus, with China’s consumer base being a critical driver for high-end retail and fashion sales globally. As the stimulus boosts consumer confidence, we could see renewed spending in this space.

While it remains to be seen how successful these stimulus measures will be, markets have reacted positively so far. The focus now shifts to how these moves will ripple through global markets, particularly in sectors tied closely to Chinese growth.

Wishing you a fantastic weekend,

Tom

Market Movers

On the rise: Anglo American (LSE:AAL) +15.7% on the week

Copper giant Anglo American surged higher this week, riding the wave of optimism that swept through the mining sector following China’s announcement of sweeping stimulus measures.

Alongside many of the FTSE’s leading miners, Anglo American benefited from renewed investor confidence, as China’s commitment to boosting economic growth is expected to drive increased demand for industrial metals. With China being the world’s largest consumer of copper, any positive economic developments there tend to have an outsized impact on companies like Anglo American.

The more than 15% jump in Anglo’s share price underscores the market’s bullish sentiment toward metals and mining stocks, which have been under pressure amid concerns over slowing global growth. China’s stimulus has sparked hopes for a rebound in infrastructure projects and manufacturing activity, both of which are heavy consumers of copper and other raw materials. The surge wasn’t limited to Anglo American; other mining giants such as Rio Tinto, Glencore, and Antofagasta also saw their share prices climb, as investors positioned themselves for potential gains from an uptick in commodity demand.

For Anglo American, the rally represents a significant rebound after a challenging period marked by weaker demand and declining commodity prices. With China’s latest measures aimed at stimulating economic activity, the outlook for copper—and Anglo American’s earnings—has turned more optimistic, setting the stage for potential longer-term gains.

REGENCY VIEW:

Anglo American’s share price has seen strong recent momentum, with a 6-month gain of 19.3%, but the company’s financials reflect ongoing challenges, including a significant 37.6% drop in EPS for the latest interim period. Despite a market-leading position and a recovering share price, Anglo’s high valuation ratios, weak profitability metrics, and declining free cash flow highlight ongoing risks amid volatile commodity prices.

Phoenix Copper’s share price plunged this week after the company reported a larger-than-expected loss of $1.10 million for the six months ended 30 June 2024. This compares to a loss of $0.63 million in the same period last year, triggering a negative reaction from investors.

The widening losses came despite significant progress at the Empire Mine project. Concerns have emerged over increased spending on capital investments, as well as rising operational costs, particularly in materials like steel and diesel. These factors likely contributed to the selloff.

Additionally, Phoenix’s recent refinancing of loans and the $80 million copper bond issuance may have raised questions about the company’s financial strategy. Investors could be worried about how the company will meet cash flow needs before reaching full production.

The market’s response overshadowed several positive developments. These include the publication of Phoenix’s first mineral reserve statement for the Empire Mine, showcasing strong copper, gold, and silver reserves, as well as the completion of the Pre-Feasibility Study (PFS), which forecasted attractive returns.

However, with production not yet underway and concerns about financing, investor confidence in Phoenix Copper’s short-term outlook appears shaken.

REGENCY VIEW:

Despite its low valuation metrics, such as a forward PE ratio of 1.2, the lack of revenue and continued operational losses raise concerns about the company’s short-term outlook, particularly in light of its financing needs.

Sector Snapshot

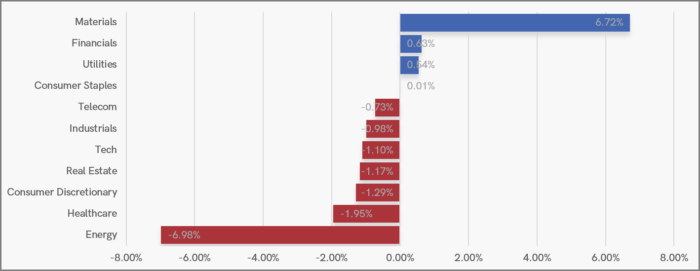

Materials are topping the strength charts for a second consecutive week due to the Chinese stimulus package. Energy on the other hand has failed to maintain last weeks strength and dropped to the bottom of our charts as oil continues to sink.

UK Price Action

It’s been another week of consolidation around the 50-day moving average for the FTSE 100 with prices starting to coil within a small wedge pattern. Whilst the FTSE’s recent price action is indicative of a market in equilibrium, the long-term uptrend should give traders and investors a bullish bias.

FTSE 100 Rolling Daily Futures

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.