26th Jul 2024. 10.16am

Weekly Briefing – Friday 26th July

| Market | Movement this week (%)* |

|---|---|

| FTSE 100 | +1.20% |

| FTSE 250 | -0.37% |

| FTSE All-Share | +0.97% |

| AIM 100 | -1.19% |

| AIM All-Share | +0.33% |

* Price movement from Monday's open at 8am

Regency View:

Weekly Briefing – Friday 26th July

Market Overview

Dear Investor,

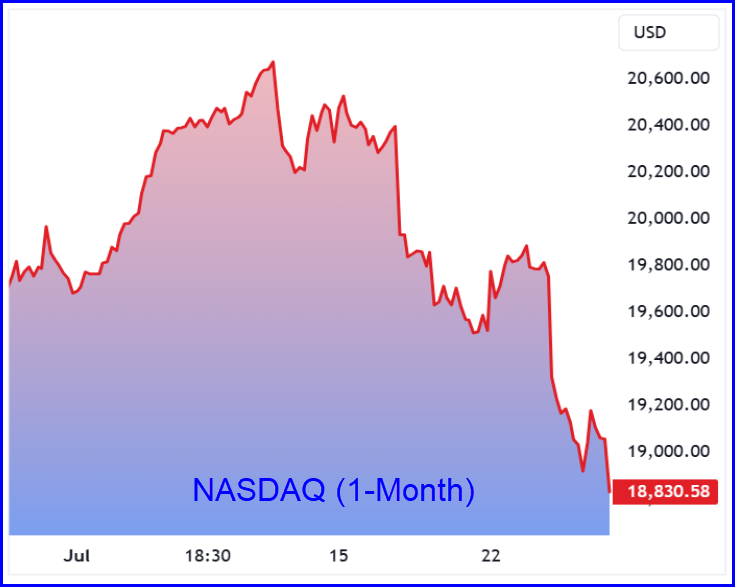

Wednesday marked the worst day for US stocks in more than 18 months, as weak results from heavyweights Tesla and Alphabet deepened a tech sector sell-off.

The S&P 500 index dropped 2.3%, its biggest fall since December 2022, while the tech-heavy Nasdaq Composite tumbled 3.6%, the steepest decline since October 2022.

Tesla’s disappointing earnings were a significant factor in this decline. The electric vehicle maker saw its profits slump by 45%, missing analysts’ expectations. This news triggered a 12.3% drop in Tesla’s shares, the worst daily performance for the company since 2020. Despite a modest revenue increase, the substantial miss on profit projections and the delay of the much-anticipated robotaxi launch weighed heavily on investor sentiment.

Alphabet, Google’s parent company, also added to the sell-off. The company reported a 14% revenue increase to $84.7 billion, slightly beating expectations, but it wasn’t enough to satisfy investors. Alphabet’s shares fell 5%, their worst day since January, partly because advertising revenue from YouTube missed consensus estimates. These results heightened concerns that the broader market has become overly reliant on the performance of a few major tech stocks, known as the “Magnificent Seven.”

The tech sector’s decline wasn’t limited to Tesla and Alphabet. Nvidia, the poster boy for AI, saw its shares drop 6.8%, making it the biggest drag on the S&P 500 by market cap. Other semiconductor stocks like Super Micro Computer and ASML Holdings also took significant hits, contributing to the broader Nasdaq’s decline. The Nasdaq is now down more than 8% from its July high, and below its 50-day moving average. While pullbacks are a natural part of any uptrend, this one may be making big tech bulls start to sweat, as two large negative gaps in less than two weeks signal a significant ramp-up in selling pressure.

Wishing you a fantastic weekend,

Tom

Market Movers

On the rise: Compass Group (LSE:CPG) +5.6% on the week

Shares in Compass Group gapped higher this week after the company reported strong third-quarter results, which exceeded market expectations. The global food services provider achieved a 10.3% increase in organic revenue for the quarter ending 30 June 2024, reflecting continued growth across all its operational regions.

The report highlighted impressive regional performances, with North America, Europe, and the Rest of World achieving organic revenue growth rates of 9.9%, 12.0%, and 8.5%, respectively.

Additionally, the company’s net new business growth accelerated during the quarter, signalling a strong pipeline of future opportunities. Compass also announced strategic investments, including a substantial $500 million share buyback program, of which $300 million has already been completed.

Despite potential foreign exchange challenges that are expected to negatively impact revenue and operating profit, the company’s positive earnings report and revised full-year guidance have strengthened investor sentiment.

The outlook for the year remains optimistic, with expectations for underlying operating profit growth to exceed 15% on a constant-currency basis and organic revenue growth to surpass 10%.

REGENCY VIEW:

Compass are in great shape and have consistently delivered strong post-pandemic trading updates. With the shares rallying back towards a key area of resistance created by the April swing highs, we will be watching closely to see if Compass can maintain a breakout to new trend highs.

Shares in Yu Group dropped sharply this week following the release of an underwhelming trading update.

Despite reporting impressive figures for the first half of the year, including a 60% increase in revenues and a substantial rise in cash reserves to £86.8 million, the company’s share price fell sharply on Tuesday and Wednesday.

The primary driver behind this decline appears to be the disappointing monthly average bookings. Although Yu Group’s revenue growth and cash position were strong, the update highlighted a 9% decline in monthly average bookings. This decline is significant because it reflects a drop in the volume of new business the company is securing, which directly affects future revenue streams.

Investors reacted negatively to these signals, focusing on the potential for squeezed margins and the impact on future earnings. The combination of strong current financials but weaker forward-looking metrics led to a sharp sell-off in the company’s shares, reflecting investor apprehension about the impact of these issues on Yu Group’s long-term performance.

REGENCY VIEW:

The lower booking figures are expected to put pressure on Yu’s operating margins. With reduced bookings, the company faces challenges in maintaining the high profitability that the market had anticipated based on its revenue growth.

Sector Snapshot

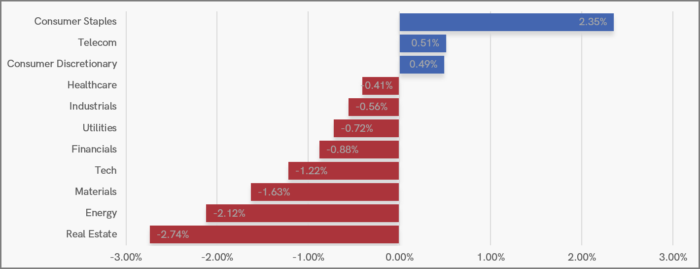

Consumer Staples and Consumer Discretionary are showing relative strength for a second consecutive week.

Materials have continued to weaken and a sell-off in REITS (real estate investment trusts) has dragged the Real Estate sector lower.

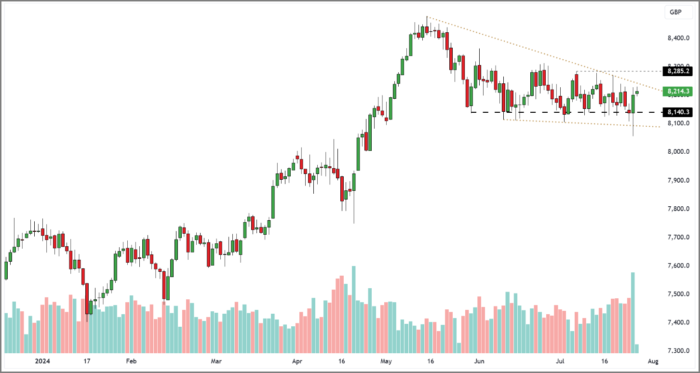

UK Price Action

We saw an increase in volume and volatility this week. The FTSE threatened to break below its summer wedge only to bounce back and retest the top of the wedge. This ‘fakeout’ below the wedge is a bullish sign and tips the probabilities in favour of a breakout to the upside.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.