26th Jan 2024. 12.53pm

Weekly Briefing – Friday 26th January

| Market | Movement this week (%)* |

|---|---|

| FTSE 100 | +2.01% |

| FTSE 250 | +2.14% |

| FTSE All-Share | +2.02% |

| AIM 100 | +2.51% |

| AIM All-Share | +1.77% |

* Price movement from Monday's open at 8am

Weekly Briefing – Friday 26th January

Market Overview

Dear Investor,

Tesla have had a tough week. From warnings about potentially lower sales growth to being overtaken by China’s BYD as the world’s top electric-vehicle manufacturer, this week’s newsflow has left investors on edge.

The week began with Tesla cautioning investors about a potential significant drop in sales growth for its electric vehicles in 2024. In an earnings report, the company cited concerns about slowing consumer demand, increased competition, and persistently high interest rates that have dampened the impact of previous price cuts. Tesla’s annual sales of 1.8 million vehicles in 2023 were impressive, but the warning signalled a shift into a new era of lower sales growth and tighter margins.

Adding to Tesla’s challenges, China’s BYD overtook Tesla as the world’s best-selling electric-vehicle maker in the fourth quarter of 2023. While Tesla delivered 484,000 cars in the last quarter, surpassing analyst expectations, BYD reported record sales of 526,000 battery-only vehicles during the same period. This development underscores the rapid rise of BYD, a Chinese company that was relatively unknown just a decade ago, and highlights the intense competition in the electric vehicle market.

Amidst these developments, Tesla’s CEO, Elon Musk made headlines by demanding a larger stake in the company in exchange for developing AI products. Musk, who currently owns 13% of Tesla, insisted on increasing his stake to 25%, emphasising his desire to be an “effective steward of very powerful technology”.

While Musk envisions Tesla as an AI and robotics juggernaut, the company’s stock performance has been lackluster compared to its tech peers. The challenges of price cuts, rising costs, oversupply, and weakening demand have contributed to Tesla’s struggles in recent months. Additionally, the stock has fallen 16.3% year to date, making it the worst-performing stock among major tech companies.

Wishing you a fantastic weekend,

Tom

Market Movers

On the rise: Tullow Oil (LSE:TLW) +10.6% on the week

Shares in Tullow Oil jumped this week after the oil producer reported a revenue of $1.6 billion in 2023, marking a shift from an investment focus to delivering free cash flow growth.

Rahul Dhir, Tullow’s CEO, emphasised the successful execution of their business plan in 2023, resulting in a significant move towards free cash flow growth. He highlighted the company’s commitment to achieving $600 million in free cash flow over the next two years and reaching the target of $800 million from 2023 to 2025 at $80 per barrel.

In 2023, Tullow’s working interest production averaged 63 kboepd, including 6 kboepd of Jubilee gas. Notably, four Jubilee producer wells and three Jubilee water injection wells were successfully brought onstream, contributing to a material increase in Jubilee production.

Looking ahead to 2024, Tullow anticipates an average working interest production of 62 to 68 kboepd, including 7 kboepd of gas. Five Jubilee wells (three producers and two water injectors) are expected to come online, concluding the drilling program approximately six months ahead of schedule.

Financially, Tullow projects a capital expenditure of $250 million in 2024, with around 60% allocated to Jubilee and 25% to non-operated assets. The company also plans a decommissioning spend of $50 million for the UK and Mauritania, with a $20 million provisioning for Ghana and Gabon.

REGENCY VIEW:

Tullow is on track to deliver its targeted $800 million free cash flow over the 2023 to 2025 period, with over $600 million expected to be generated in 2024 to 2025 at $80 per barrel.

The shares trade on a highly attractive forward valuation (forward PE 1.6), but bargain hunters should beware as the business has a debt laden balance sheet which could see investors get heavily diluted.

ZOO Digital’s share price dropped sharply this week following the issuance of an earnings warning by the company.

The warning was prompted by challenges related to delays in product delivery, specifically in the completion of entertainment projects such as subtitling and dubbing.

Despite the positive development of production projects resuming after the resolution of Hollywood strikes in November, ZOO highlighted that the finalization of these projects was taking longer than initially forecasted.

This unforeseen delay is expected to result in lower-than-anticipated revenue for the fourth quarter, contributing to more substantial losses for the entire fiscal year than previously estimated. The company, however, expressed confidence in a return to profitability in the next fiscal year.

Despite these financial setbacks, ZOO emphasised its positive outlook, stating that its largest customer has provided orders that give a pipeline for the next two quarters, indicating a potential strong recovery of revenues.

The company also mentioned that this pipeline aligns with its investment strategy. However, the prolonged completion times for entertainment products have impacted short-term financial performance and market confidence.

REGENCY VIEW:

While ZOO’s top line growth has been consistent in recent years, operating margins and profitability has been much less predictable. Current forecasts indicate that ZOO will sink to a net loss of -$18.9m (FY24). The shares have gapped significantly lower this week and gaps of this nature tend to have follow-through during the short-term.

Sector Snapshot

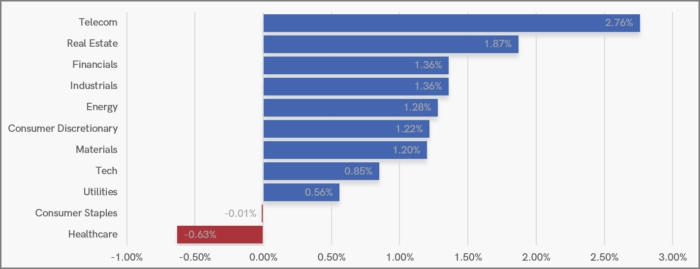

We’ve seen a broad-based recovery this week with seven of our eleven sectors making gains of more than +1% on the week.

Healthcare and Consumer Staples are showing relative weakness, but both of these sectors have been strong earlier in the month and Healthcare is the UK market’s second strongest sector on a one-month basis.

UK Price Action

What started as a low-volatility pullback at the start of the week has picked up pace with prices clawing back almost all of last week’s losses.

The market has now broken above the volume-weighted average price (VWAP) anchored to the New Year highs – an area that is confluent with the descending trendline from the New Year highs. Whether the market will be strong enough to finish the week above these resistance levels remains to be seen.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.