24th Nov 2023. 11.02am

Weekly Briefing – Friday 24th November

| Market | Movement this week (%)* |

|---|---|

| FTSE 100 | -0.43% |

| FTSE 250 | -0.52% |

| FTSE All-Share | -0.43% |

| AIM 100 | -0.41% |

| AIM All-Share | -0.27% |

* Price movement from Monday's open at 8am

Regency View:

Weekly Briefing – Friday 24th November

Market Overview

Dear Investor,

Chancellor Jeremy Hunt’s Autumn Statement brought significant changes to the UK’s fiscal landscape. With a focus on individual finances, the key highlights included tax cuts, pension reforms, alterations to savings schemes, adjustments in housing policies, and measures to support low-income households.

The tax reductions encompassed a cut in national insurance contributions for both employed and self-employed individuals, providing tangible benefits to millions. Pension reforms aimed at empowering workers with greater control over their retirement funds were also introduced, alongside alterations to Individual Savings Accounts (ISAs) and extended tax advantages for specific investments.

Across financial markets, the response to these fiscal changes was clearest in the bond market. The Debt Management Office’s announcement of a smaller-than-expected reduction in gilt issuance for the fiscal year surprised investors. This, coupled with additional gilt auctions scheduled before year-end, led to a rise in gilt yields. Long-term gilt yields experienced a significant increase following the statement, which diverged from the recent global bond rally.

In the stock market, the FTSE had a muted reaction, while in currency markets the pound strengthened against a basket of major currencies.

Wishing you a fantastic weekend,

Tom

Market Movers

On the rise: Sage (LSE:SGE) +12.4% on the week

Sage Group reported strong financial results for the full year. They achieved a 12% growth in recurring revenue, reaching £2.096 billion, driven significantly by a 25% growth in Sage Business Cloud, totalling £1.628 billion.

The accounting software company’s overall revenue increased by 10% to £2.184 billion, with an 18% jump in underlying operating profit to £456 million and a healthy 16% rise in adjusted earnings (EBITDA) to £553 million. However, the statutory operating profit fell by 14% due to certain one-off charges.

Sage Group displayed robust financial health with an impressive cash conversion rate of 116%, maintaining a strong balance sheet with £1.3 billion in cash and available liquidity. They proposed a final dividend and announced a share buyback program, aligning with their commitment to shareholder returns.

Strategically, Sage achieved an 11% increase in annualised recurring revenue to £2.188 billion, focusing on expanding their cloud solutions and investing in innovation through acquisitions.

Looking forward, the company has a positive outlook for the 2024 financial year, expecting organic revenue growth in line with the previous year and aiming for increased operating margins.

REGENCY VIEW:

Sage is a top-quality business which generates high levels of recurring revenue, boasts double digit operating margins and have very strong cashflow.

However, with such quality comes a premium valuation and Sage currently trades on a eye-wateringly high forward PE ratio of 31.3. This looks expensive relative to its peer group and relative to forecast growth in EPS of 16.7%.

Kingfisher, the company behind B&Q and Screwfix, faces profit worries due to lower sales in France. Unusually warm weather affected the sale of insulation, plumbing, and heating products, leading to the company’s second profit warning in just over two months.

Kingfisher’s expected pre-tax profits are now £30 million less than previously predicted, largely due to slow sales in the French retail market. Chief executive Thierry Garnier highlighted that the French market’s weakness, coupled with delayed sales of specific products due to the warm autumn weather, led to the revised profit guidance.

This latest warning follows a previous adjustment in September, where Kingfisher reduced its annual profit forecast from £634 million to £590 million, citing tougher trading conditions in France and Poland.

Sales performance reflected a 3.9% drop in like-for-like group sales, totalling £3.2 billion in the three months leading to October 31. The decline was notably influenced by a significant 8.6% drop in French sales, amounting to £1 billion. In contrast, the UK market showed resilience with a 1.1% sales increase to £1.5 billion.

REGENCY VIEW:

The DIY boom experienced during the pandemic has reversed and Kingfisher is suffering as a result.

However, its not all doom and gloom, Kingfisher’s improved digital and trade offerings in the UK, suggest potential for expansion into other markets.

The shares are starting to move into bargain basement territory, but high levels of debt on the balance sheet should make investors cautious.

Sector Snapshot

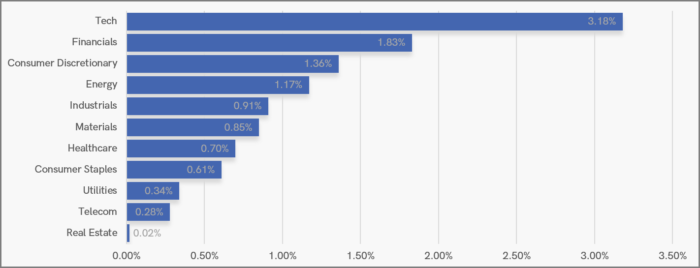

This week’s UK Sector Snapshot is dominated by strength in Tech. The sector has seen a resurgence after U.S chipmaker Nvidia’s blockbuster set of Q3 numbers on Monday.

Financials are also showing strength after a period of underperforming – London Stock Exchange and Standard Chartered have made strong gains this week.

UK Price Action

When analysing the FTSE’s price chart, the first and most important observation to make is its range-bound market structure. Clearly defined support and resistance zones have confined the FTSE’s movement since summer.

Given the FTSE’s range bound structure, the very best trading opportunities will lie at the extremes of the range.

Recent price action has seen the FTSE climb higher from the bottom of the range, retesting the base of a wedge consolidation pattern that broke during October’s sell-off.

With the FTSE now sat mid-range we can see that prices are effectively being funnelled between the Volume Weighted Average Price (VWAP) anchored to the September highs (representing the average position of FTSE bears), and the VWAP anchored to the October lows (reflecting the FTSE bulls’ average position). A resolution of this market squeeze should see a retest of the range extremes.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.