24th May 2024. 9.47am

Weekly Briefing – Friday 24th May

| Market | Movement this week (%)* |

|---|---|

| FTSE 100 | -1.39% |

| FTSE 250 | -0.73% |

| FTSE All-Share | -1.26 |

| AIM 100 | +1.41% |

| AIM All-Share | +1.19% |

* Price movement from Monday's open at 8am

Regency View:

Weekly Briefing – Friday 24th May

Market Overview

Dear Investor,

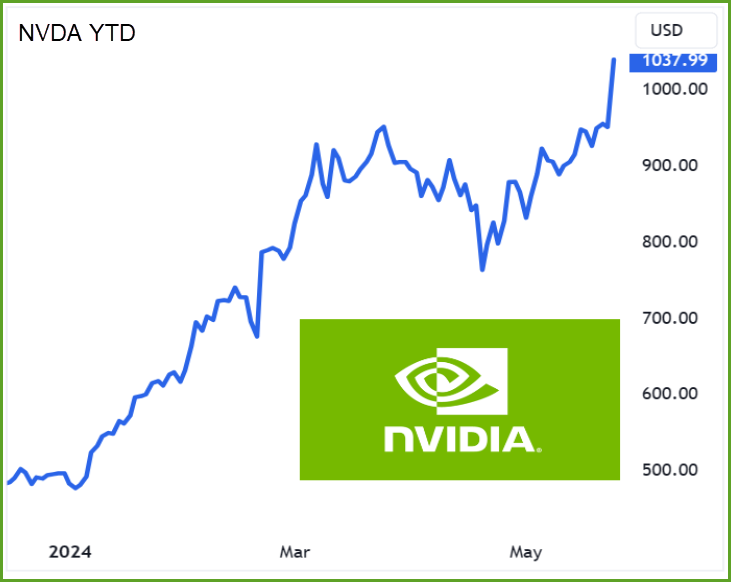

Nvidia shares skyrocketed past the $1,000 mark this week, a testament to the chipmaker’s stellar fiscal first-quarter performance that beat analyst expectations. This meteoric rise underscores the insatiable demand for Nvidia’s AI chips, and CEO Jensen Huang sweetened the deal by revealing that their next-generation AI chip, Blackwell, will start generating revenue later this year.

Nvidia’s earnings report was nothing short of a blockbuster. The company posted an impressive earnings per share of $6.12 adjusted, comfortably outpacing the consensus estimate of $5.59. Revenue for the quarter surged to $26.04 billion, blowing past the anticipated $24.65 billion.

Looking ahead, Nvidia projected sales of $28 billion for the current quarter, setting a high bar and outperforming Wall Street’s forecast of $26.61 billion. The company reported a jaw-dropping net income of $14.88 billion for the quarter, a quantum leap from $2.04 billion in the same period last year.

So, what’s driving this tech juggernaut’s astounding growth? Major players like Google, Microsoft, Meta, Amazon, and OpenAI are investing heavily in Nvidia’s graphics processing units (GPUs) for their AI applications. Nvidia’s data centre segment, which includes these AI chips and other critical components for big AI servers, experienced a mind-boggling 427% year-over-year revenue increase, reaching $22.6 billion.

CEO Jensen Huang couldn’t contain his excitement about the future impact of Nvidia’s Blackwell AI GPU, predicting it will bring in substantial revenue by the fourth quarter. Alongside their core AI and data centre businesses, Nvidia also reported booming sales of networking parts, with revenue tripling from the previous year, driven by their InfiniBand products.

In terms of rewarding shareholders, Nvidia went all out. The company repurchased $7.7 billion worth of shares and paid $98 million in dividends during the quarter. They also announced a juicy increase in their quarterly cash dividend from 4 cents per share to 10 cents on a pre-split basis, and 1 cent per share post-split.

Nvidia is not just riding the AI wave—they’re creating it. The company’s ability to consistently exceed expectations and drive technological innovation positions it as a dominant force in the AI and computing world.

Wishing you a fantastic weekend,

Tom

Market Movers

On the rise: Marks and Spencer (LSE:MKS) +5.3% on the week

Marks and Spencer shares surged to the top of the FTSE 100 this week after posting impressive full-year results. The company’s shares jumped on Wednesday following a 58% rise in profit before tax, outperforming analysts’ expectations of a 35% increase. M&S reported revenue growth of 9.3%, reaching £13 billion, driven by strong demand for clothing and food.

Food sales rose by 13% due to the popularity of the ‘Dine-In’ offer, and clothing sales increased by 5.3%. Profit before tax and adjusting items was £716.4 million, with adjusted basic earnings per share up 45.6% to 24.6p. M&S announced the potential to restore sustainable dividend payments, proposing a final dividend of 2p per share, totalling 3p for the year.

The strong results reflect the success of CEO Stuart Machin and Chair Archie Norman’s turnaround plan, which includes revamping stores and enhancing product lines. Machin highlighted consistent growth in both the Food and Clothing & Home segments, marking 12 consecutive quarters of sales growth. M&S also reported improvements in product quality and value perception, investing £60 million in price adjustments.

M&S’s joint venture with Ocado saw revenue increase by 11.2% to £2.47 billion. However, M&S’s share of the adjusted loss increased due to higher interest costs and a write-off of a deferred tax asset.

REGENCY VIEW:

M&S has been the best-performing retail stock in the UK during the past two years, and its turnaround has been impressive given the tough macro conditions. The outlook for the future remains positive with the business continuing to make efficiency gains.

However, the stock trades on a forward PE of 11.5 and this looks expensive relative to its peer group and the long-term challenges facing high street stores.

Shares in Premier African Minerals fell this week in response to an equity raise worth £1.25 million to help address issues during the ramp-up of the Zulu lithium plant in Zimbabwe.

CEO George Roach expressed optimism about the mining operations and ore grades, which are currently mitigating the ore sorter deficiencies. Extensive test work is about to begin, and the company may consider replacement ore sorters if the original supplier does not resolve the issues.

An internal review of production costs, which have not been independently verified, indicates an average overall delivered China port cost per ton of US$834 for 2024, with future costs expected to be below US$800 per ton.

Inspections required as a prelude to export have commenced, and the company does not anticipate any delays in obtaining the necessary permits.

Roach acknowledged that there will likely be further challenges in optimizing the flotation circuit. However, he noted that resolving these issues has led to improvements in plant availability, recoveries, and concentrate grade.

Despite the challenges, the company remains encouraged by the fact that it is producing saleable spodumene.

REGENCY VIEW:

PREM’ Zulu project in Zimbabwe is hailed as the world’s fifth largest lithium deposit and is the company’s key asset in its exploration portfolio. However, PREM has been dogged by production delays and remains pre-revenue – making it a high-risk investment.

We tend to avoid loss-making exploration companies like PREM, as the risk of shareholder dilution, production problems and geopolitical risk rarely justify the potential reward.

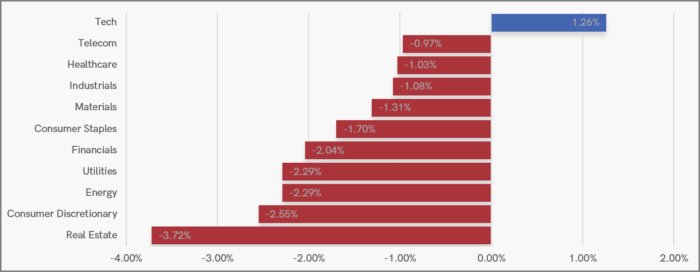

Sector Snapshot

This week’s sector snapshot is a sea of red as we see broad-based profit taking with the FTSE set for its largest weekly loss since January.

The only sector in the blue is Tech – sector sentiment has been boosted by Nvidia’s market-beating numbers.

Languishing at the lows is Real Estate and Consumer Discretionary – two sectors tied to interest rate expectations.

UK Price Action

The small consolidation range that we identified last week as been broken to the downside. This is likely to lead to a deeper retracement towards the volume-weighted average price (VWAP) anchored to the April swing lows.

Disclaimer: All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.