23rd May 2025. 10.55am

Weekly Briefing – Friday 23rd May

| Market | Movement this week (%)* |

|---|---|

| FTSE 100 | +1.02% |

| FTSE 250 | -0.61% |

| FTSE All-Share | +0.82% |

| AIM 100 | +0.60% |

| AIM All-Share | +0.75% |

* Price movement from Monday's open at 8am

Regency View:

Weekly Briefing – Friday 23rd May

Market Overview

Dear Investor,

Keir Starmer’s proposed EU trade deal may not have sent the FTSE soaring overnight, but it marks a meaningful shift in tone that could slowly reshape the outlook for UK stocks. After years of post-Brexit friction, the agreement looks to reduce barriers on key exports such as food and chemicals, and bring the UK’s carbon trading in line with the EU’s system. These aren’t headline-grabbing reforms, but they matter. For sectors that have struggled with added costs and red tape since 2020, it’s a welcome tailwind.

The food and drink industry stands to benefit first. By easing sanitary checks and streamlining paperwork, UK producers will find it easier and cheaper to access their biggest trading partner. For investors, that could breathe life into names like Cranswick or Hilton Food Group, which have been squeezed by cost inflation and trade delays. A smoother path into Europe doesn’t just cut costs it also brings pricing power back into play, something the sector has lacked for some time.

Carbon trading alignment is another area with potential to reprice risk. With the EU’s carbon border tax coming into force, UK firms faced a cliff edge. Starmer’s deal avoids that by linking the UK and EU systems, potentially saving hundreds of millions in levies. Energy-intensive manufacturers, especially in steel, cement and chemicals, could see those savings fall straight to the bottom line. It’s also a plus for utilities like SSE or Drax, which manage large carbon positions and have been caught between policy divergence.

Then there’s defence. The UK’s re-entry into the EU’s €150 billion procurement framework is a door flung wide open for domestic players. BAE Systems and QinetiQ may now bid for cross-border projects, something that had been off-limits. In a world where defence budgets are expanding and EU nations are coordinating more closely, that’s a strategic opportunity. It also speaks to a broader trend that Starmer’s deal may be technical in places, but it’s rebuilding bridges that had been left to crumble.

The market hasn’t rushed to reprice all this just yet, which creates a window. While sentiment remains cautious, the groundwork for a more stable and predictable UK-EU trading relationship is now being laid. That matters for investor confidence and for foreign capital flows. In short, it’s not a light-switch moment, but it is a directional one and in a market starved of clear catalysts, that makes it worth paying attention to.

Wishing you a fantastic weekend,

Tom

Market Movers

On the rise: Vodafone (LSE:VOD) +10.7% on the week

Vodafone’s share price has surged to six-month highs following the release of its FY25 results, with investors responding positively to signs that its turnaround strategy is starting to deliver. The company hit its guidance for the year, reporting €11 billion in adjusted earnigns and €2.5 billion in adjusted free cash flow. While non-cash impairments in Germany and Romania pushed the group into a reported loss, the launch of a new €2.0 billion buyback programme and the €13.3 billion raised from disposals in Spain and Italy helped reinforce confidence in the group’s capital position and commitment to shareholder returns.

Organic service revenue rose by 5.1 percent, with broad-based growth across Africa, Türkiye, and the UK offsetting continued weakness in Germany. The UK delivered 1.9 percent growth, supported by improving customer satisfaction, while Africa and Türkiye continued to post double-digit gains. Management expects Germany to return to growth this year, with the reshaped European footprint and a simpler operating model now better aligned with long-term free cash flow generation.

With the merger with Three UK still on track for the first half of 2025, Vodafone now sees two-thirds of its free cash flow coming from growth markets. Chief Executive Margherita Della Valle described this as the start of a new phase of sustainable growth, with improving customer experience and a leaner capital structure providing the foundation. Investors appear to agree, and the recent share price strength reflects a growing belief that the worst of Vodafone’s restructuring pain may now be behind it.

REGENCY VIEW:

Vodafone (VOD) remains in our list of open positions, and recent momentum – up 18.5% over the past three months suggests sentiment is shifting. Despite weak profitability and a heavy debt load, the 5.4% yield, low valuation metrics, and price strength near 52-week highs continue to support our stance on the stock.

Shoe Zone’s share price fell sharply on Thursday after the company swung to a half-year loss and warned of a significantly reduced full-year profit, triggering fresh concerns over the strength of high street spending.

The interim results showed a £2.3m pre-tax loss for the 26 weeks to 29 March 2025, compared to a £2.6m profit in the same period last year. Revenues dropped 6.5% to £71.5m, with store sales down over 10% as the company operated 31 fewer sites. Digital growth softened the blow, rising 6.4%, but this wasn’t enough to offset the drag from physical retail. Gross margins were also squeezed by higher container costs and a heavy February promotion, while product returns and inflationary headwinds added pressure to profits.

Perhaps most concerning for investors was the downgrade to full-year profit expectations, with guidance now halved to £5m. The decision not to pay an interim dividend added to the gloom, alongside a net cash balance of just £1.7m — down from £4.1m a year ago — signalling reduced financial headroom as the company presses ahead with its store conversion programme.

REGENCY VIEW:

Shoe Zone looks cheap on paper with a forward P/E of 9.5 and EV/EBITDA of just 2.5, but the market isn’t biting and for good reason. Earnings are falling, the dividend’s been scrapped, and with net cash nearly gone and momentum firmly negative, the story here feels more like a value trap than a recovery play.

Sector Snapshot

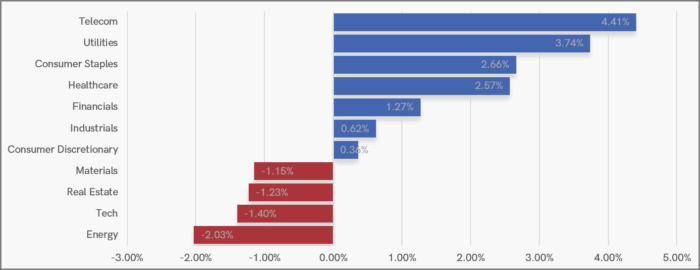

Defensive sectors took the lead this week, with Telecoms, Utilities and Consumer Staples climbing to the top of the leaderboard as investors pivoted towards more stable ground. Healthcare followed suit, suggesting a cautious tilt in positioning amid shifting rate expectations and global uncertainty.

Meanwhile, cyclicals lagged behind. Energy and Tech both struggled, with Materials and Real Estate also losing ground. The rotation hints at a market leaning back on reliability rather than risk.

UK Price Action

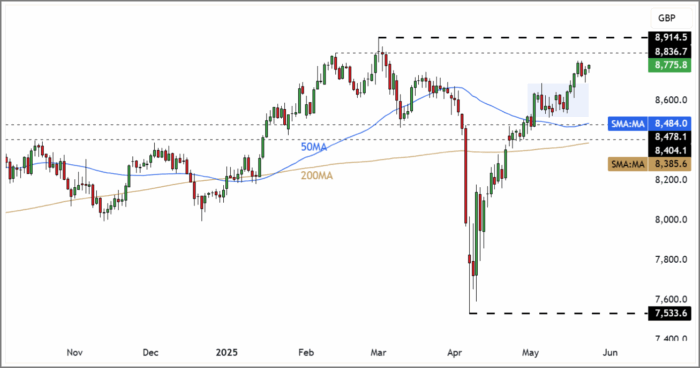

This week has seen the FTSE break above the small consolidation range that we identified last week. The index is now faced with the major resistance created by the Feb/Mar swing highs.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.