23rd Aug 2024. 10.59am

Weekly Briefing – Friday 23rd August

| Market | Movement this week (%)* |

|---|---|

| FTSE 100 | -0.12% |

| FTSE 250 | +0.27% |

| FTSE All-Share | -0.05% |

| AIM 100 | +0.10% |

| AIM All-Share | +0.28% |

* Price movement from Monday's open at 8am

Regency View:

Weekly Briefing – Friday 23rd August

Market Overview

Dear Investor,

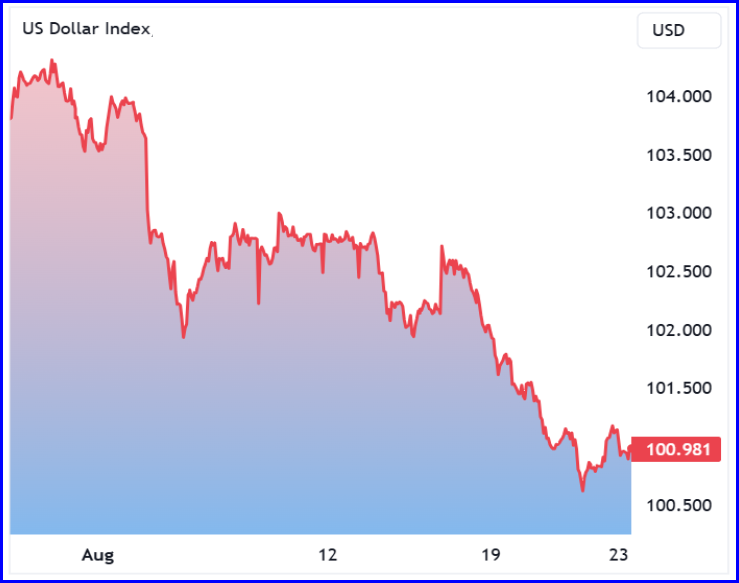

This week has been defined by the decline of the US dollar as investors adjusted their expectations for more aggressive interest rate cuts from the Federal Reserve. This anticipation has rippled through currency, commodity, and money markets.

In currency markets, the euro and the British pound have surged to one-year highs against the dollar, driven by expectations of a dovish Federal Reserve compared to more stable outlooks from the European Central Bank and Bank of England.

Commodities have felt the impact, with gold hitting a record high of $2,531 per troy ounce. The prospect of lower US interest rates has increased the appeal of non-yielding assets like gold.

Money markets have attracted nearly $90 billion in inflows as investors seek higher yields before rate cuts potentially reduce returns. These funds offer a safer haven while maintaining liquidity.

For our FTSE Investor and AIM Investor services, the effects have been mixed. Our precious metals holdings have benefited from gold’s strength, while stocks that import dollars and generate revenue in sterling have gained from the weaker dollar. However, exporters face challenges as the stronger pound makes UK goods more expensive for overseas buyers.

We continue to monitor these developments closely and will adjust our strategies as needed.

Wishing you a fantastic weekend,

Tom

Market Movers

On the rise: Helium One Global (LSE:HE1) +42.9% on the week

Helium One’s share price has continued to surge higher this week, driven by mounting optimism surrounding its Tanzanian helium project. The recent boost in the stock is largely due to the company’s successful deepening of the Itumbula West-1 well.

The well has now reached a new total depth of 1,129 meters, with drilling encountering significant helium and hydrogen shows. These levels are notably higher than those observed in earlier phases, which has increased investor confidence.

The company is preparing to begin extended well testing (EWT) across two key intervals: the fractured Basement and the faulted Karoo Group. This upcoming testing phase is expected to provide further insights into the potential of the helium reserves.

The successful drilling and positive preliminary results have fuelled excitement among investors, who are anticipating that the EWT could confirm the commercial viability of Helium One’s Tanzanian assets.

REGENCY VIEW:

Helium One Global is grabbing the headlines due to the progress it is making at its Tanzanian project, but investors should not forget that it remains a highly speculative investment. The company faces significant financial challenges, including ongoing losses and minimal revenue. It represents a high-risk, high-reward opportunity, with potential upside contingent on future exploration success.

BT’s share price dropped sharply on Tuesday following the announcement that Sky had chosen CityFibre as its second broadband partner, in a move that signals growing competition in the UK’s telecoms market.

This development is particularly significant as Sky has historically relied exclusively on BT’s Openreach network to serve its broadband customers. With over 6.5 million subscribers, Sky is one of the largest broadband providers in the UK, and its decision to diversify its network partnerships poses a direct threat to BT’s market share.

The market reacted swiftly to this news, with BT’s share price falling by 6.4% to £1.36 by the close of trading on Tuesday. Investors appear concerned about the potential erosion of BT’s customer base and the impact on its revenues as more broadband providers, including Sky, look to reduce their dependency on Openreach by partnering with alternative network operators like CityFibre.

The share price drop reflects broader worries about increased competition in the fibre broadband market, where altnets like CityFibre are rapidly expanding their infrastructure. CityFibre’s network has already passed 3.8 million premises, with ambitions to reach at least 8 million in the coming years. As these networks grow, they present a viable alternative to BT’s Openreach, potentially leading to further shifts in market dynamics.

REGENCY VIEW:

BT’s top line has been in steady decline for the past five years. However, double-digit margins ensures the business generates plenty of cash and a forward dividend yield of 5.8% looks attractive.

Long-term we believe BT lack financial quality. It’s debt laden balance sheet is likely to weigh heavy on the business and we see few catalysts to propel the stock higher once the short squeeze has finished.

Sector Snapshot

This week’s sector snapshot reflects a bearish trend, with significant losses in the Energy sector. FTSE heavyweights BP and Shell have both dropped over 3% in the past seven sessions.

Conversely, Consumer Discretionary is outperforming, driven by robust Q2 earnings from JD Sports.

UK Price Action

The FTSE has experienced a week of sideways consolidation, with the market essentially holding steady near last week’s highs. This consolidation following last week’s strong recovery suggests a bullish outlook.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.