22nd Nov 2024. 10.28am

Weekly Briefing – Friday 22nd November

| Market | Movement this week (%)* |

|---|---|

| FTSE 100 | +1.77% |

| FTSE 250 | +0.21% |

| FTSE All-Share | +1.53% |

| AIM 100 | +0.97% |

| AIM All-Share | +0.33% |

* Price movement from Monday's open at 8am

Regency View:

Weekly Briefing – Friday 22nd November

Market Overview

Dear Investor,

Nvidia once again delivered a stellar quarter, cementing its place as a cornerstone of the AI-driven tech boom. For the third quarter ending October, the company posted $35.1 billion in revenue—a 94% year-over-year leap and comfortably ahead of the $33.25 billion analysts had projected. This growth might not match the blistering pace of Q2, but it still underscores the company’s knack for staying ahead of the AI curve.

The numbers from Nvidia’s data centre segment were particularly striking, with revenue climbing 112% year-over-year to $30.8 billion. This is where the story of Nvidia’s dominance really unfolds. Big tech players like Microsoft, Google, and Meta are pouring billions into data centres to power their AI ambitions, and Nvidia’s GPUs remain the gold standard.

What caught my attention this quarter was the performance of Nvidia’s new Blackwell chips. Despite whispers of production hiccups and overheating issues earlier in the year, CEO Jensen Huang reassured us that Nvidia shipped more Blackwell units than initially forecast. The demand for these chips is so strong it’s expected to exceed supply well into 2026—a clear signal of how deeply Nvidia has entrenched itself in this market.

Financially, Nvidia continues to operate like a well-oiled machine. Gross margins hit 75%, right in line with expectations, while adjusted net income reached a hefty $20 billion. Earnings per share landed at $0.78, a comfortable beat over the consensus. These results not only reflect Nvidia’s execution but also its ability to navigate an environment where competition and supply chain constraints remain very real pressures.

Looking ahead, Nvidia’s guidance for Q4 stands at $37.5 billion in revenue, give or take a couple of percent. That’s solidly within Wall Street’s range and hints at a steady runway for growth. Still, supply chain constraints with partners like TSMC and the inevitable rise of competitors chasing their slice of the AI pie will be themes to watch.

If this quarter showed us anything, it’s that Nvidia remains the company to beat in the AI space. The question isn’t whether they can keep growing, but how high the ceiling might be. Let’s see how this story evolves in the quarters ahead.

Wishing you a fantastic weekend,

Tom

Market Movers

On the rise: Sage Group (LSE:SGE) +19.8% on the week

Sage Group surged higher on Wednesday following the release of its strong full-year results for the year ended September 30, 2024. The company reported impressive growth in both its recurring revenue model and overall financial performance. Underlying total revenue rose by 9% to £2.33 billion, driven by a robust performance across all regions and particularly strong gains in North America and the UKIA (UK, Ireland, Africa, and APAC). Sage’s subscription-based model continued to show resilience, with underlying annualised recurring revenue (ARR) increasing by 11% to £2.34 billion, reflecting both new customer acquisitions and retention of existing clients.

The company also demonstrated a solid 21% increase in underlying operating profit to £529 million, contributing to a notable expansion in operating margin, which rose by 220 basis points to 22.7%. EBITDA followed suit, growing by 16% to £622 million with a corresponding increase in margin to 26.6%. These results were accompanied by a 30% surge in free cash flow, reaching £524 million, underscoring Sage’s strong cash generation capabilities. Moreover, the company’s impressive underlying cash conversion rate of 123% highlighted its ability to efficiently translate revenue into cash.

Sage’s focus on cloud solutions continued to pay off, with Sage Business Cloud revenue increasing by 16% to £1.87 billion. The company’s cloud-native revenue growth was particularly notable, rising by 23% to £732 million. Additionally, Sage introduced Sage Copilot, a generative AI-based digital assistant, which has been rolled out to over 8,000 customers, further enhancing its product offerings.

The company also announced a shareholder return initiative, including a proposed final dividend of 13.50p per share, increasing the full-year dividend by 6% to 20.45p. Alongside this, Sage unveiled a share buyback programme of up to £400 million, reflecting its robust financial position and the Board’s confidence in the company’s future prospects.

REGENCY VIEW:

Sage Group continues to show impressive financial resilience, posting a solid 6% revenue growth to £1.15 billion in the first half of fiscal 2024. Even in a tricky economic climate, the company keeps its profitability strong, with a return on equity of 22.3% and a dependable dividend yield, all while doubling down on its strategic push to deliver cloud-based solutions that empower small and medium-sized businesses.

Shares in Big Yellow Group dropped this week despite reporting a modest 3% increase in revenue to £103.0 million for the six months ending September 30, 2024. Store revenue saw a 4% rise, with like-for-like store revenue up 3%, driven by higher rental income.

However, occupancy levels showed slight declines, with like-for-like occupancy dropping by 1.5 percentage points to 80.9%. This was compounded by a 1% fall in store EBITDA, reflecting rising operating costs, particularly property taxes and energy. Adjusted profit before tax rose 3% to £54.9 million, although EPRA earnings per share decreased by 3% due to the dilution effect from new shares issued in 2023.

Despite these challenges, Big Yellow said it remains committed to long-term growth, with a focus on expanding its store pipeline. During the period, the company opened a new 65,000 sq ft freehold store in Slough and successfully transferred customers from a nearby leasehold store. The Group also secured planning approvals for key London sites, such as West Kensington and Kentish Town, and has a pipeline of 13 proposed stores. When fully developed, this expansion will increase the Group’s storage capacity by 1.0 million sq ft, representing significant potential for future revenue and earnings growth.

Despite a challenging macro environment marked by high operating costs and interest rates, Big Yellow’s financial position remains strong. Net debt decreased significantly to £359.5 million, down from £495.3 million in the prior year, and the Group’s liquidity is solid, with available committed liquidity of £214.6 million. The company is optimistic about future growth, particularly through its well-de-risked development pipeline, which is expected to drive significant net operating income increases over the next few years.

REGENCY VIEW:

Big Yellow Group has posted steady revenue growth, with a 3% increase in the first half of 2024, reaching £103 million. However, its future growth potential looks pressured, with a -27.3% forecast for EPS and concerns over its ability to deliver consistent profit growth amidst a challenging market environment.

Sector Snapshot

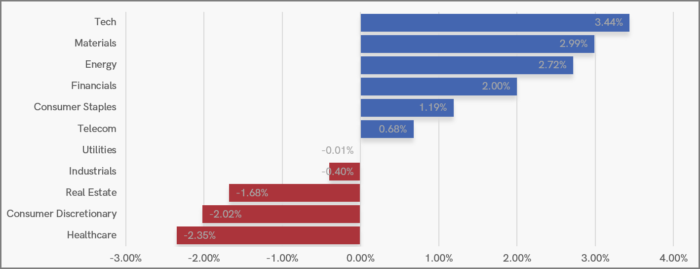

This week’s UK sector snapshot paints a mixed picture. Five sectors posted gains of more than 1% over the past seven sessions, while three ended with losses exceeding 1%. Leading the way was the Tech sector, buoyed by another impressive earnings report from US-listed Nvidia, which lifted sentiment across the board. Materials also had a solid week, showing resilience despite the US dollar’s continued rise following Trump’s election victory.

On the other end of the spectrum, Healthcare struggled, dragged down by weakness in biotech and life sciences stocks. Consumer Discretionary also showed softness, with investors growing increasingly cautious about spending trends ahead of the festive season.

UK Price Action

This week, the FTSE 100 rallied strongly from a key support zone near 8,000. This level, which aligns with the 2023 highs, has proven resilient, holding firm during a summer retest and once again attracting buyers. The index is now testing the descending retracement line, drawn from its recent series of lower swing highs. The question remains whether the short-term downtrend will overpower the long-term uptrend, or if the latter will reassert itself in the coming sessions.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.