22nd Dec 2023. 11.14am

Weekly Briefing – Friday 22nd December

| Market | Movement this week (%)* |

|---|---|

| FTSE 100 | +1.72% |

| FTSE 250 | +1.95% |

| FTSE All-Share | +1.75& |

| AIM 100 | +2.36% |

| AIM All-Share | +1.81% |

* Price movement from Monday's open at 8am

Regency View:

Weekly Briefing – Friday 22nd December

Market Overview

Dear Investor,

This week’s unexpectedly soft UK inflation figures serve as a stark illustration of an unfortunate trend that has been unfolding throughout the year: a growing perception of the Bank of England’s lack of credibility.

The discrepancy between the Bank’s projections and the actual economic outcomes, particularly regarding inflation, has raised doubts about the institution’s ability to accurately forecast and effectively manage the economy.

In recent months, the Bank of England has found itself repeatedly surprised by economic data. The sharp drop in November’s inflation, falling to 3.9%, was significantly below both economist predictions and the Bank’s earlier projections. This divergence underscores the challenge the Bank faces in accurately gauging and responding to economic shifts.

The disparity between the Bank’s decision to maintain interest rates at a 15-year high of 5.25% while financial markets anticipate multiple rate cuts next year adds to the perception of a disconnect between the Bank’s actions and prevailing market sentiments.

Additionally, Governor Bailey’s initial dismissal of inflation as ‘transitory’ before implementing a series of consecutive rate hikes has further contributed to concerns regarding the Bank’s ability to swiftly adapt to changing economic conditions. The fear that the Bank might be slow to change course again, despite evident shifts in inflation and economic growth, has fuelled apprehensions about potential policy inertia. Bailey’s task in the New Year will be to regain lost credibility!

Wishing you a very merry Christmas and a prosperous New Year,

Tom

Market Movers

On the rise: Petrofac (LSE:PFC) +66.5% on the week

Petrofac experienced a significant surge in its stock value this week as short sellers decided to close their positions following a substantial new order announcement by the oil and gas installation specialist.

Previously, Petrofac had been heavily shorted due to considerable debts, profit warnings, and bribery scandals, making it a target for short selling.

However, the recent announcement of a sizable contract worth US$1.4 billion with TenneT hinted at a potential shift in sentiment. The contract forms part of TenneT’s landmark 2 Gigawatt (2GW) Programme, comprising several high-voltage direct current (HVDC) offshore grid connection systems, each with a transmission capacity of 2 gigawatts.

Petrofac’s total orders have now reached US$6.8 billion and are anticipated to reach US$8 billion by year-end.

Despite the substantial rise in stock value, which brought the market value to just £174 million at 33.6p, Petrofac’s current standing is significantly lower than its peak value of nearly £3 billion five years ago.

REGENCY VIEW:

Whilst there is increased positivity surrounding Petrofac’s contract momentum, there remains concerns about the company’s net debt with is expected to increase from interim results. Any free cash flow generated is likely to be counterbalanced by collateral required for guarantees related to the newly acquired substantial contracts.

Shares in Superdry slumped this week after the Highstreet fashion house release a profit warning.

Despite efforts to cut costs and manage inventory, the company faced challenges due to a tough retail market and weather-related setbacks.

Sales in both retail and wholesale experienced significant declines during the first half of the year. This was primarily due to warmer weather affecting the demand for seasonal collections, resulting in a delayed uptake of the Autumn/Winter range. Retail sales were down by 13.1% year-on-year, impacted by the late start to the end-of-season summer sale and reduced spending on digital marketing for Ecommerce.

Wholesale sales also saw a substantial decline of 41.1% year-on-year. While part of this decrease was expected due to the decision to exit the US wholesale operation, timing differences and channel underperformance further contributed to the drop.

Although recent improvements in weather conditions positively affected sales, especially in the UK and Europe, they remained approximately 7% lower than the previous year on a like-for-like basis for the 6 weeks following the half-year mark.

Despite making strides in operational improvements, such as selling intellectual property rights in the South Asian region and progressing with cost-cutting measures, the company struggled due to ongoing challenging trading conditions. As a result, profits for the year are expected to reflect these difficulties, prompting the company to plan a more detailed interim results update scheduled for January.

REGENCY VIEW:

Superdry’s top line revenues have been in decline for the last five years and management have struggled to maintain consistent margins. As a consequence, profitability remains some distance away, making Superdry a low-quality investment.

Sector Snapshot

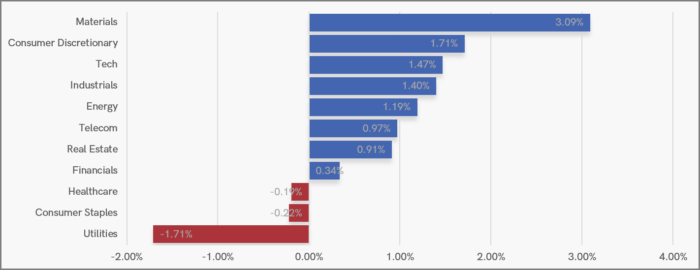

There’s a very ‘risk on’ feel to this week’s UK Sector Snapshot with Materials and Consumer Discretionary leading the market, and defensive Utilities and Consumer Stapels lagging.

This divergence in risk on risk off sectors paints a bullish picture for UK stocks as we head into the final stretch of the year.

UK Price Action

The FTSE put in another retest of resistance this week following the weak inflation data.

Interestingly, the market was not strong enough to maintain the breakout and a bearish ‘fakeout’ pattern has formed. A pullback toward to a volume weighted average price (VWAP) looks likely.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.