22nd Aug 2025. 10.09am

Weekly Briefing – Friday 22nd August

| Market | Movement this week (%)* |

|---|---|

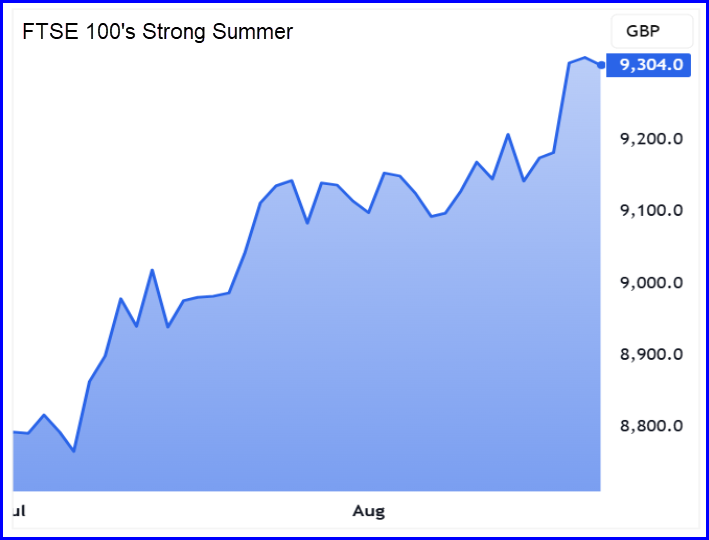

| FTSE 100 | +1.88% |

| FTSE 250 | +0.44% |

| FTSE All-Share | +1.69% |

| AIM 100 | +0.05% |

| AIM All-Share | +0.07% |

* Price movement from Monday's open at 8am

Regency View:

Weekly Briefing – Friday 22nd August

Market Overview

Dear Investor,

This week the FTSE 100 reminded us why it so often outperforms when the macro picture gets messy. Consumer stocks and healthcare were the stars of the show, helping the index push higher even as fresh inflation data confirmed the Bank of England will be in no rush to cut rates. In other words, defensives did exactly what they’re supposed to do they kept the market moving forward while rate-sensitive sectors like housebuilders took a knock.

The inflation number, rising at its fastest pace in well over a year, set the tone. It’s now hard to imagine another rate cut arriving before 2026, and traders wasted no time shifting capital towards businesses that can protect margins in a high-cost world. Banks and insurers chipped in too, which gave the FTSE another layer of support. The result was a week where steady cash flows and pricing power were valued above all else.

Across the pond, things looked different. Wall Street’s tech rally hit turbulence as Apple, Amazon and Alphabet all came under pressure, with investors suddenly less convinced that AI hype will translate into immediate returns. The Nasdaq in particular bore the brunt of the selling, while defensives like healthcare and staples saw inflows but not enough to save the broader indices.

Europe wasn’t much cheerier, with the Stoxx 600 and leading benchmarks in France and Germany drifting lower. Even prior leaders like SAP and ASML felt the pinch, weighed down by stretched valuations. Against that backdrop, the FTSE’s performance stood out as a reminder that the UK market’s tilt toward global consumer brands, banks and utilities can be an advantage when sentiment gets shaky.

Wishing you a fantastic weekend,

Tom

Market Movers

On the rise: Ithaca Energy (LSE:ITH) +21.1% on the week

Shares in Ithaca Energy took off this week after the company raised its production outlook alongside its first-half 2025 results. Average daily production more than doubled year-on-year to 123,600 barrels of oil equivalent, while adjusted EBITDAX climbed above $1.1 billion. Operating costs fell sharply to $17.5 per barrel, and the balance sheet was strengthened with liquidity of over $1.2 billion.

Full-year production guidance was upgraded to a range of 119,000 to 125,000 barrels of oil equivalent per day, supported by strong operational delivery and cost control. Ithaca also declared a first interim dividend of $167 million, reaffirmed its $500 million shareholder payout target for 2025, and confirmed plans to accelerate a second interim dividend to December following robust cash generation.

The company reported progress across its growth portfolio, including ongoing development at Rosebank, an 18-month licence extension at Cambo and advancement of the Tornado gas project. Ithaca also completed the acquisition of Japex UK E&P in July and is awaiting approval to finalise its purchase of a 46% stake in the Cygnus field from Spirit Energy, alongside ongoing well activity across Captain, Cygnus and the J Area fields.

REGENCY VIEW:

Ithaca Energy screens well on both quality and value, with strong operating margins and an EV/EBITDA multiple that suggests the market is still applying a discount relative to cash flow generation. A forecast dividend yield above 10% adds income appeal, though earnings are expected to dip this year as production and investment plans shift the profile of returns.

WH Smith dropped almost 40% this week following a profit warning tied to accounting issues in its North American business…

The company disclosed that earnings had been overstated by about £30 million after supplier income was recognised too early, prompting it to cut its expected profit for the division to around £25 million from previous guidance of £55 million. The adjustment marked a sharp reversal from April, when the group had forecast full-year profit broadly in line with market expectations of about £183 million.

As a result, WH Smith now expects group pre-tax profit for the year to August 31 to be about £110 million, compared with analyst estimates closer to £140 million. The retailer has appointed Deloitte to conduct an independent review of the accounting practices, while PwC remains its external auditor. The company said it would provide further details when it releases preliminary results in November.

The accounting setback comes during a wider reshaping of the business. Earlier this year, WH Smith sold its UK high street operations to Modella Capital in order to focus on its international travel retail arm, which has grown rapidly through acquisitions such as the $400 million purchase of Marshall Retail Group in the US. The company has also drawn the attention of activist investor Palliser Capital, which took a 5% stake in June, highlighting both the recovery of its travel business and concerns over its longer-term share price performance.

REGENCY VIEW:

WH Smith’s valuation sits in line with the wider consumer space, but profitability metrics look thin with modest returns on capital and slim operating margins. A forward P/E of around 13 and a dividend yield just above 3% offer some support, though the balance sheet and accounting review now place the focus squarely on execution.

Sector Snapshot

This snapshot covers the past seven trading days, so there are some small differences compared with the Market Overview. Even so, the story is the same: defensives once again did the heavy lifting. Healthcare and Consumer Staples topped the sector rankings, reflecting investors’ focus on steady earnings and margin protection at a time when stubborn inflation has all but closed the door on early rate cuts. Tech also edged higher, suggesting there’s still appetite for growth when it comes with strong balance sheets.

On the downside, rate-sensitive areas like Real Estate and Industrials struggled to make progress, while Energy fell sharply as concerns over supply-demand dynamics weighed on sentiment. The pattern highlights a clear preference for businesses with pricing power and predictable cash flows, echoing the FTSE 100’s broader resilience when the macro picture turns choppy.

UK Price Action

This week’s move on the FTSE underscored a classic price action theme: periods of tight consolidation often resolve in the direction of the prevailing trend. Wednesday’s breakout was clean and carried the index well clear of its recent range, reinforcing the strength of the ongoing uptrend.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.