21st Mar 2025. 10.55am

Weekly Briefing – Friday 21st March

| Market | Movement this week (%)* |

|---|---|

| FTSE 100 | 0.41% |

| FTSE 250 | -0.02% |

| FTSE All-Share | +0.36% |

| AIM 100 | +1.20% |

| AIM All-Share | +0.94% |

* Price movement from Monday's open at 8am

Regency View:

Weekly Briefing – Friday 21st March

Market Overview

Dear Investor,

This week, the OECD published its latest economic outlook, and it made for interesting reading. The headline takeaway? Global growth is set to slow, inflation might prove stickier than hoped, and escalating tariffs are adding another layer of complexity to the picture.

The report downgraded its growth projections, with global GDP expected to ease from 3.2% in 2024 to 3.1% in 2025 and 3.0% in 2026. While those figures suggest a steady rather than dramatic slowdown, the underlying risks paint a more uncertain picture. The U.S.-China tariff battle has escalated, with the OECD assuming that existing and announced tariffs—including a broad-based 25% levy on U.S. imports of steel and aluminium—will remain in place. But the real sting is the U.S. decision to slap an additional 25% tariff on all imports from Canada and Mexico (excluding potash and energy), with full retaliatory measures expected from both neighbours.

This has particularly bleak implications for Canada and Mexico, whose economies are set to take the hardest hit. Mexico is now projected to enter a recession, with GDP contracting by 1.3% in 2025 and another 0.6% in 2026, while Canada’s growth is expected to stall at just 0.7% in both years. The U.S. will also feel the pinch, with GDP growth slowing from 2.8% this year to 2.2% in 2025 and just 1.6% in 2026.

In Europe, the impact of tariffs will be less direct, but heightened geopolitical uncertainty is likely to weigh on sentiment. The Eurozone is expected to see modest growth of 1.0% in 2025, rising to 1.2% in 2026, while the UK is projected to expand by 1.4% next year before cooling slightly to 1.2% in 2026. Meanwhile, Japan’s economy is forecast to get a short-lived boost from strong wage growth and corporate profits, lifting GDP from 0.1% this year to 1.1% in 2025 before it slows again.

Emerging markets tell a mixed story. China is expected to keep up a steady pace, with GDP growth at 4.8% in 2025 before easing slightly to 4.4% in 2026. India remains the outlier, with robust growth of 6.4% in FY 2024-25 and 6.6% the following year, while Brazil faces a sharp slowdown, dragged down by the effects of U.S. tariffs on steel and aluminium exports.

Inflation, meanwhile, remains a thorn in the side of central banks. The OECD now expects G20 inflation to ease from 5.3% this year to 3.8% in 2025 and 3.2% in 2026, but warns that core inflation in advanced economies could remain above target for longer. In the U.S., Canada, and Mexico, inflation would likely be lower under a scenario where exemptions from higher tariffs under the USMCA are maintained, potentially allowing for a slightly less restrictive monetary policy path.

Ultimately, the outlook suggests a tougher environment for businesses and investors alike. Higher trade costs, persistent inflation pressures, and slowing growth make for a delicate balancing act for policymakers—and a landscape where market opportunities will require careful navigation.

Wishing you a fantastic weekend,

Tom

Market Movers

On the rise: Phoenix Group Holdings (LSE:PHNX) +9.7% on the week

Phoenix Group Holdings’ share price surged higher on Monday following the release of its 2024 full-year results, which showcased significant progress across its key financial metrics. Investors reacted positively to the company’s strong cash generation, earnings growth, and upgraded financial targets, reinforcing confidence in its long-term strategy.

Phoenix exceeded its operating cash generation (OCG) target two years ahead of schedule, delivering £1.4bn in 2024, a 22% increase from the previous year. This achievement has allowed the company to upgrade its three-year cash generation target to £5.1bn from the previous £4.4bn, highlighting its ability to generate excess cash while maintaining a progressive dividend policy.

Additionally, Phoenix made meaningful progress in reducing its debt, repaying £250m in 2024 and a further $250m post-year-end, supporting its long-term goal of lowering its leverage ratio.

Earnings also saw impressive growth, with adjusted operating profit rising 31% to £825m, driven by strong performance in both its Pensions and Savings and Retirement Solutions businesses. Notably, the capital-light Pensions and Savings division saw a 66% jump in adjusted operating profit, reflecting higher assets under administration and improved margins. The company’s Retirement Solutions segment also continued to expand, writing £6.1bn in premiums with a reduced capital strain.

The market responded positively to the results, driving the share price higher as investors welcomed the company’s upgraded targets and commitment to long-term shareholder returns.

REGENCY VIEW:

Phoenix Group offers an attractive 9.6% dividend yield and trades at a modest 9.6x forward earnings, making it appealing for income-focused investors. However, weak profitability metrics, including a negative return on capital and a low operating margin, highlight the challenges in its turnaround efforts.

Qinetiq’s share price tumbled from recent highs this week after the company’s latest trading update pointed to persistent headwinds in its UK Intelligence and US sectors. The short-cycle contract delays flagged in January have continued, impacting revenue growth and prompting a restructuring of its US business. Although longer-term contracts in the UK Defence sector have remained stable, the company has had to resize parts of its UK Intelligence operations to align with weaker near-term demand.

The most striking development in the update was the announcement of a £140m goodwill impairment charge on the US business, reflecting both market conditions and a reassessment of the division’s long-term prospects. Additionally, a further £35-40m in one-off exceptional costs, largely non-cash, was identified in the company’s year-end balance sheet review. These charges, combined with weaker-than-expected performance in higher-margin US product sales, have taken a toll on investor confidence.

Despite these challenges, Qinetiq maintains a strong cash position, with cash conversion expected to remain robust and net debt holding steady at 0.5x EBITDA. Management remains confident in the long-term outlook, with FY26 revenue growth expected to improve to 3-5% and margins expanding to 11-12%. The company also continues to benefit from rising defence spending across the UK, Europe, and NATO allies, which aligns well with its mission-critical capabilities.

REGENCY VIEW:

Qinetiq’s valuation remains reasonable, with a forward P/E of 11.6x and a PEG ratio of 0.8 suggesting solid earnings growth relative to price. While near-term momentum is weak, the company’s strong cash generation, double-digit returns on capital, and a growing order book should support long-term stability.

Sector Snapshot

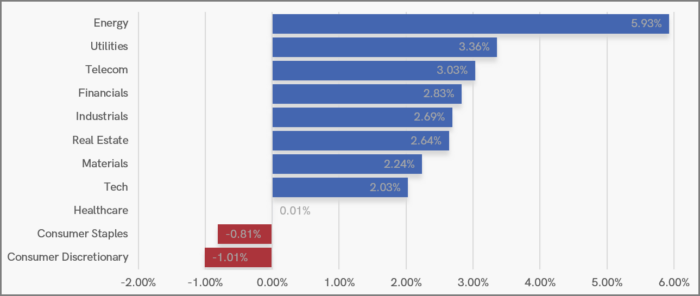

Energy was the standout performer this week, rising 5.93% as oil prices bounced from recent lows, driven by renewed demand optimism and supply constraints. Utilities and Telecom also saw solid gains, benefiting from their defensive appeal in a market balancing risk and stability.

On the downside, Consumer Staples and Consumer Discretionary stocks struggled, with supermarket stocks taking a sharp hit amid fears of an escalating price war, which has put pressure on margins and investor sentiment.

UK Price Action

The FTSE 100 has spent the week stabilising, holding firm above its 50-day moving average. This resilience is encouraging, particularly within the broader long-term uptrend and the breakout at the start of the year. Looking ahead, we expect the index to use recent inflection points as a base for consolidation within a sideways range.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.