21st Jun 2024. 10.49am

Weekly Briefing – Friday 21st June

| Market | Movement this week (%)* |

|---|---|

| FTSE 100 | +0.80% |

| FTSE 250 | +1.35% |

| FTSE All-Share | +0.87% |

| AIM 100 | -0.48% |

| AIM All-Share | -0.54% |

* Price movement from Monday's open at 8am

Regency View:

Weekly Briefing – Friday 21st June

Market Overview

Dear Investor,

It’s been a big week for the UK economy, with several key data releases providing a mix of optimism and caution.

On Wednesday, the Office for National Statistics reported that inflation hit the Bank of England’s (BoE) 2% target in May, first time in three years that this milestone has been reached.

However, while headline inflation hitting the target is certainly a positive sign, the story beneath the surface is a bit more complex. Prices for services rose more than expected, prompting investors to rethink the likelihood of imminent interest rate cuts. As a result, there were modest upticks in both sterling and bond yields.

True to form, the BoE played it safe on Thursday, deciding to hold interest rates steady at 5.25%. This “finely balanced” decision might have dashed some hopes for a pre-election rate cut, but it wasn’t entirely unexpected.

The Monetary Policy Committee’s seven-to-two vote reflected a cautious optimism, with some members suggesting that a rate reduction could be on the table as early as August, provided there’s more evidence of a sustained drop in inflation. BoE Governor Andrew Bailey underscored the need for certainty, emphasising that inflation must remain low before any rate cuts are considered.

Rounding out the week, this morning brought some unexpectedly good news on the retail front. British retail sales rebounded sharply in May, with a 2.9% increase in the quantity of goods purchased, thanks to warmer weather boosting spending on clothing and furniture. This was significantly higher than the 1.5% rise economists had forecast.

Adding to the positive sentiment, consumer confidence rose for the third consecutive month in June, reaching its highest level since November 2021, although it still lags behind pre-pandemic levels.

These data releases together paint a picture of a UK economy that’s cautiously moving in the right direction. The inflation rate hitting the BoE’s target is certainly a milestone worth celebrating, but the persistent strength in core and services inflation suggests there are still challenges ahead. The BoE’s cautious approach to interest rates reflects this nuanced reality, balancing the need for economic stability with the pressures of inflation.

Wishing you a fantastic weekend,

Tom

Market Movers

On the rise: Games Workshop (LSE:GAW) +12.8% on the week

Games Workshop’s share price surged higher this week following a bullish trading update that showcased significant growth.

The miniature figures maker announced that for the 53 weeks ended 2 June 2024, it expects core revenue to be no less than £490 million, a substantial increase from £445 million in the previous year.

In addition to strong core revenue, Games Workshop also reported an increase in licensing income, which is projected to be £30 million compared to £25 million in the previous year.

The Group’s estimated profit before tax (PBT) is expected to reach at least £200 million, up from £171 million last year.

Games Workshop maintained a solid track record of returning value to shareholders. The company declared and paid dividends totalling £138 million, equivalent to 420 pence per share. This is a slight increase from the previous year’s £136 million and 415 pence per share.

REGENCY VIEW:

Games Workshop’s growth in licensing income underscores the company’s successful expansion into new revenue streams, leveraging its intellectual property through strategic partnerships and licensing deals. However, the shares trade on a forward PE ratio of 22, and this looks expensive relative to single digit forecast growth in earnings per share.

Berkeley Group’s share price sank this week following the publication of their Final Results, which revealed several issues and trends that concerned investors.

The company’s financial performance showed a decline, with revenue falling by 3.4% to £2.5 billion and pre-tax profit decreasing by 7.7% to £557 million. Despite being somewhat expected, these figures highlighted the significant challenges housebuilder Berkeley is facing in the current market.

One major factor contributing to the decline is the impact of higher interest rates. The increased borrowing costs have slowed down property transactions and reduced buyer enthusiasm, affecting the entire UK housing market. Berkeley mentioned that the lack of urgency among buyers is expected to persist until interest rates begin to decrease.

In response to these challenging conditions, Berkeley is making strategic adjustments. They announced the establishment of a Build to Rent platform, aiming to capitalise on the high demand for rental properties in London and the Southeast. However, this shift in strategy, while potentially beneficial in the long term, also introduces new risks and uncertainties.

REGENCY VIEW:

While Berkeley has a strong order book and has secured 80% of its sales for the next year, it still faces ongoing political and macroeconomic volatility. The value of net reservations has been consistent but at levels about a third lower than the previous year. And with the BoE keeping rates on hold, we expect housebuilders to continue to struggle for now.

Sector Snapshot

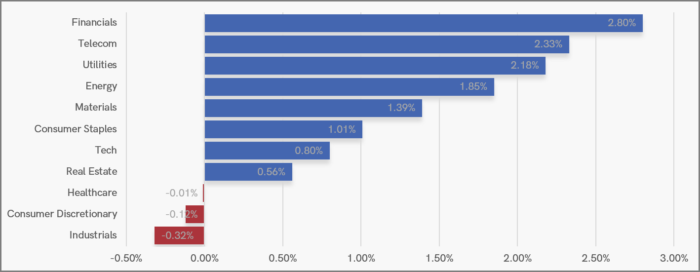

After a defensive few week’s, our UK Sector Snapshot has a more bullish look to it with Financials leading the pack and eight of the eleven sectors making gains.

However, defensive Utilities and Telecoms have continued to show strength – indicating the underlying caution that remains in the market.

UK Price Action

Yesterday’s price action saw the FTSE break and close above the descending triangle pattern that we highlighted in last week.

A weekly close above the triangle should reignite the FTSE’s long-term uptrend. However, a weekly close back below the triangle would signal a false breakout.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.