21st Feb 2025. 10.29am

Weekly Briefing – Friday 21st February

| Market | Movement this week (%)* |

|---|---|

| FTSE 100 | -0.64% |

| FTSE 250 | -0.68% |

| FTSE All-Share | -0.65% |

| AIM 100 | -0.84% |

| AIM All-Share | -0.86% |

* Price movement from Monday's open at 8am

Regency View:

Weekly Briefing – Friday 21st February

Market Overview

Dear Investor,

This week has been dominated by Donald Trump’s decision to hold direct talks with Vladimir Putin—without involving Kyiv—sending European leaders scrambling to reassess their defence strategies.

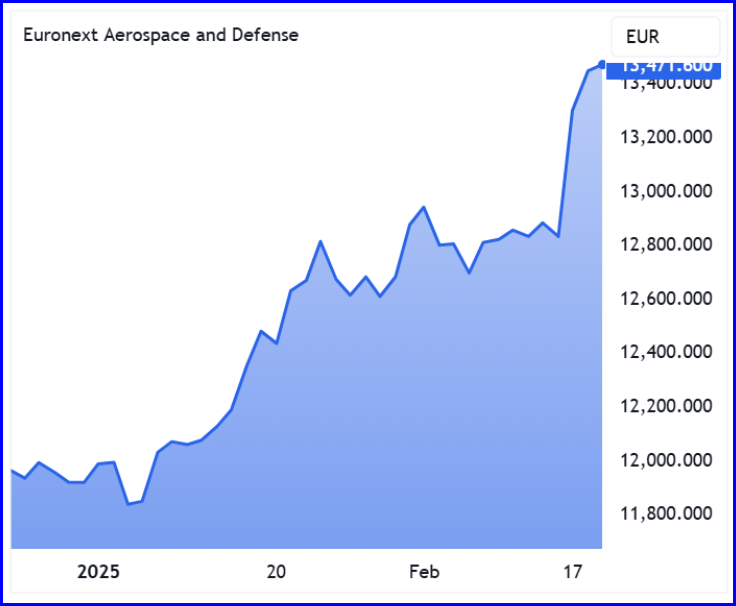

Trump’s inflammatory remarks, labelling Ukrainian President Volodymyr Zelenskyy a “dictator” and casting doubt on Ukraine’s ability to endure, have only deepened tensions. The immediate reaction has been a clear commitment from European leaders to step up defence spending, a move that has driven European defence stocks to record highs.

The Stoxx Europe aerospace and defence index has hit its highest level in decades as investors anticipate a long-overdue expansion of European military budgets. With Trump pushing NATO allies to raise spending beyond 2% of GDP—floated as high as 5%—and the UK committing to a pathway toward 2.5%, the defence sector is seeing a fundamental re-rating. Bond yields have also reacted, with German and UK 10-year yields climbing as markets adjust to the prospect of looser fiscal discipline in the face of security concerns.

At the core of this shift is the realisation that Europe can no longer rely on the US as a guaranteed backstop for its security. The strategic calculus is changing, and defence firms are responding by positioning themselves for a major ramp-up in production. The prospect of large-scale European rearmament, long resisted due to ethical concerns and budget constraints, is now firmly on the table.

While the diplomatic fallout from Trump’s approach to negotiations with Russia plays out in real-time, the key takeaway for investors is that defence spending in Europe is entering a new era. The surge in defence stocks reflects a market that is now pricing in sustained, structural growth for the industry rather than just short-term geopolitical volatility. Much will depend on how negotiations unfold, but one thing is clear: markets are adjusting to the reality that US security guarantees can no longer be taken for granted.

Wishing you a fantastic weekend,

Tom

Market Movers

On the rise: Ithaca Energy (LSE:ITH) +9.5% on the week

Ithaca Energy’s jumped this week following a trading update that underscored the company’s transformation in 2024.

The integration of Eni UK’s assets has reshaped Ithaca into a major force in the North Sea, with production hitting the top end of guidance, costs coming in lower than expected, and a robust financial performance that delivered a Q4 EBITDAX of $642 million.

Ithaca exited 2024 as the largest resource holder in the UK Continental Shelf (UKCS), with 658 mmboe of 2P reserves and 2C resources, and reached peak production rates of 138 kboe/d in Q4. With output remaining strong into early 2025, the company now stands as the UKCS’s second-largest independent producer.

Cost discipline has been a key theme, with operating expenses per barrel falling below market guidance, and capital costs landing within expectations. The company’s balance sheet is also in a much stronger position, thanks to a successful $2.25 billion refinancing, which enhances financial flexibility.

The company said it remains committed to its $500 million dividend target for both 2024 and 2025, reinforcing its focus on shareholder returns – which alongside the promising strategic develops caused the shares to move higher.

REGENCY VIEW:

Ithaca Energy’s chunky 14.9% forward dividend yield and low 9x P/E ratio make it a tempting pick for income hunters, but volatility in revenue over the past two years has raised some concerns about earnings stability. The stock remains firmly on our watchlist though.

ZOO Digital’s share price took a hit this week after the company issued a trading update that, while showing clear signs of recovery, fell short of market expectations.

The small-cap tech stock reported that full-year revenues for FY25 are set to rise 24% to at least $50.5 million, marking a return to EBITDA profitability of $1 million—an improvement from last year’s $13.6 million loss. However, despite this turnaround, these figures still undershot analyst forecasts, prompting a sharp reaction in the stock price.

ZOO has taken significant steps to stabilise its business, including cutting fixed costs by 20% and improving gross margins to 36%. The company expects its cash balance at year-end to exceed $1 million, with additional invoice discounting facilities largely untouched. While these measures provide a firmer footing for the business, the near-term outlook remains clouded by project delays and uncertainties around the timing of revenue recognition.

Encouragingly, ZOO has secured key new client engagements, including a high-profile appointment as a Preferred Fulfilment Vendor for Amazon Prime Video. The company is also seeing an uptick in customer discussions, with licensing activity outpacing new original programming. However, dubbing revenues are expected to decline in FY26, though a shift toward higher-margin work should support stronger profitability.

ZOO’s next update is due in April, but for now, investors are weighing up the mixed signals—improving financials against lingering short-term uncertainty.

REGENCY VIEW:

Zoo Digital’s sharp drop reflects a tough period, with revenue falling sharply and deep losses weighing on investor confidence. A forward P/E of 5.2 might catch the eye, but with profitability under pressure and the balance sheet looking fragile, the risks remain significant.

Sector Snapshot

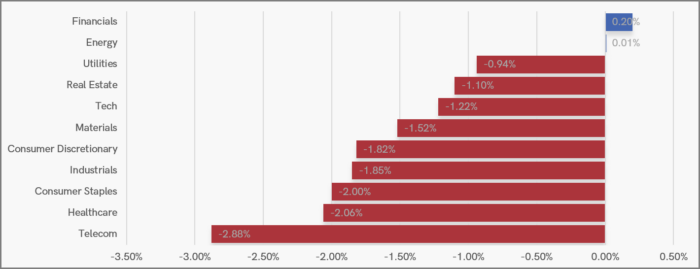

This week has brought a broad round of profit-taking, with nine of the eleven UK sectors in the red. Notably, Financials—the standout performer over the past three months—continues to show clear relative strength.

UK Price Action

After a strong start to the year, the FTSE has paused for breath this week, extending the pullback that began late last week. This two-legged decline has slipped through the first ascending trendline, but there’s no clear signal yet that the broader trend is reversing.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.