20th Sep 2024. 10.53am

Weekly Briefing – Friday 20th September

| Market | Movement this week (%)* |

|---|---|

| FTSE 100 | -0.17% |

| FTSE 250 | +0.22% |

| FTSE All-Share | -0.10% |

| AIM 100 | +0.50% |

| AIM All-Share | +0.08% |

* Price movement from Monday's open at 8am

Regency View:

Weekly Briefing – Friday 20th September

Market Overview

Dear Investor,

Central bankers took centre stage this week, with major decisions that have sent US stocks to new highs and the US dollar to new trend lows.

On Wednesday, Federal Reserve Chair Jay Powell grabbed headlines by announcing a bold half-point rate cut, kicking off the Fed’s first easing cycle in over four years. This move was seen as a tactical recalibration to address softening inflation and a cooling labour market while aiming to sustain economic growth.

Across the Atlantic, the Bank of England followed up with a decision to hold interest rates steady at 5%. While inflation in the UK held at 2.2% in August, the Monetary Policy Committee hinted at potential rate cuts as soon as November, signalling a gradual approach to policy loosening. Governor Andrew Bailey emphasised that inflationary pressures were easing, allowing for a more cautious path ahead. However, he also stressed the need to avoid cutting rates too quickly to prevent a resurgence in inflation.

In currency markets, GBP/USD has strengthened by 1.09% since the Fed’s announcement and is up more than 4% this year, reflecting the relative resilience of the pound and ongoing recalibrations in monetary policy across both economies.

Looking ahead, market participants are left wondering: Will the Federal Reserve continue cutting rates cautiously, or could future economic data accelerate their easing pace? Similarly, will the Bank of England’s gradual approach to policy loosening hold steady, or could we see an earlier rate cut if UK inflation continues to moderate?

Wishing you a fantastic weekend,

Tom

Market Movers

On the rise: Kingfisher (LSE:KGF) +14.4% on the week

Kingfisher, the owner of B&Q and Screwfix, has seen its share price soar this week despite facing a mixed performance in its latest trading update.

The company’s half-year results for the six months ending July 31, 2024, revealed a slight overall sales decline of 1.8%, down to £6.75 billion from £6.9 billion in the previous year. This dip was primarily attributed to a challenging retail environment, particularly in France, where sales fell by 7.2% amid a soft consumer backdrop. Additionally, sales of big-ticket items dropped by 6.8%, reflecting a broader hesitation among consumers to invest in larger purchases.

However, there were notable bright spots in the report that contributed to the rally in share prices. Operating profit increased by 2% to £374 million, showcasing the company’s ability to manage costs effectively and optimise operations during a challenging period. Earnings per share also rose by 3.9% to 12.8p, indicating solid underlying performance despite the headwinds.

Following the update, Kingfisher’s share price surged more than 10% on Tuesday, and the stock is currently over 36% higher year-to-date, reflecting growing investor confidence in the company’s strategic direction and potential for future growth.

REGENCY VIEW:

Kingfisher has shown real resilience this year in tough trading conditions. Despite a dip in sales, the company’s strong online performance and increase in operating profit position it well for potential growth as the housing market shows signs of recovery.

Shares in iconic shoemaker Dr. Martens plunged on Friday as the company’s largest shareholder, IngreGrsy, executed a significant sell-off, offloading approximately 70 million shares.

This placing, which was facilitated by Goldman Sachs, saw shares priced at 57.85p each—representing a discount of around 9.8% from the last closing price.

The immediate market reaction was stark, with Dr. Martens shares dropping 14% to 54.85p, reflecting investor concern over the potential implications of such a large shareholder divestment. This sharp decline highlights the sensitivity of the stock to changes in shareholder composition, especially given IngreGrsy’s prominent role in the company.

This drop comes on the heels of a recent AGM trading update on July 11, where the company indicated that trading had been in line with expectations since the beginning of the financial year. While the guidance for FY25 remained unchanged, management highlighted that Q1 tends to be the smallest period, with the current financial year heavily weighted towards the second half, particularly regarding profits.

REGENCY VIEW:

Dr. Martens is currently facing significant challenges, with a 12% drop in revenue and a staggering 60.1% decline in share price over the past year, reflecting investor concerns about its growth prospects. Despite a strong dividend yield of 3.57% and a solid return on equity of 17.9%, the company’s declining momentum and upcoming cost action plans will be critical for regaining investor confidence.

Sector Snapshot

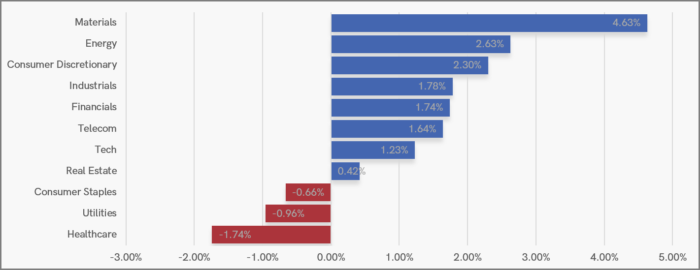

Last week’s defensive looking Sector Snapshot has turned on its head…

This week we have risk on Materials leading the pack for the first time in many months following the prospect of aggressive rate cuts from the Fed.

While Consumer Staples and Utilities, which had previously been leading the pack have started to lag behind this week.

We will be monitoring closely to see if this marks a change in sector rotation or just a period of mean reversion.

UK Price Action

Last week’s small consolidation range has evolved into a small descending channel which is pressing the market towards the recent swing highs. A break below the channel could trigger a retest of the August lows.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.