1st Mar 2024. 9.39am

Weekly Briefing – Friday 1st March

| Market | Movement this week (%)* |

|---|---|

| FTSE 100 | -0.22% |

| FTSE 250 | -0.04% |

| FTSE All-Share | -0.20% |

| AIM 100 | -1.64% |

| AIM All-Share | -1.42% |

* Price movement from Monday's open at 8am

Regency View:

Weekly Briefing – Friday 1st March

Market Overview

Dear Investor,

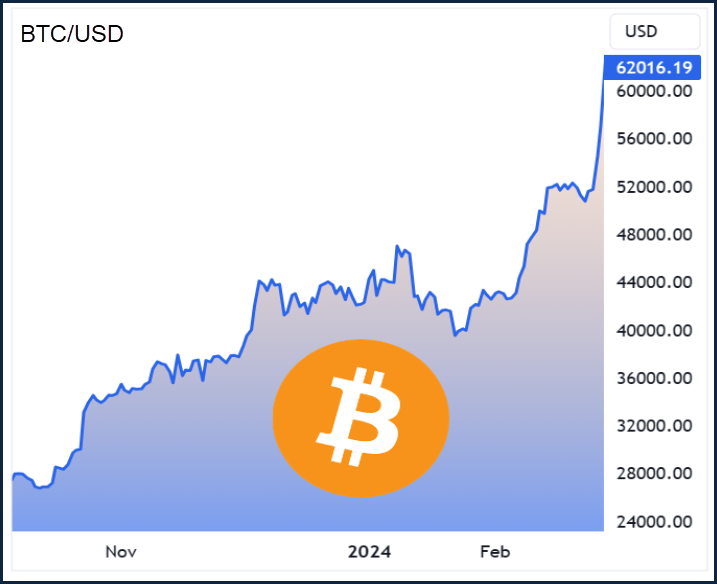

Cryptocurrency seems to be having a resurgence in 2024. Bitcoin hit the $60,000 mark this week, boasting a 42% gain since the start of the year. This is the first time in over two years that Bitcoin has reached the $60,000 threshold, bringing back memories of the previous crypto bull market that peaked at nearly $69,000 in November 2021.

The driving force behind this crypto comeback is the green light given to spot Bitcoin exchange-traded funds (ETFs) by US regulators in January. Mainstream giants like BlackRock and Invesco now provide these ETFs, collectively holding a whopping 303,000 bitcoins valued at $18 billion.

Despite this positive momentum, the week saw a hiccup in the form of disruptions on the crypto trading platform Coinbase (COIN). The platform experienced a tenfold surge in traffic, leading to issues like zero balances appearing on users’ accounts. It’s a reminder that while the regulatory landscape in the US is improving, the user experience in the crypto world can still be a bit clunky and illiquid.

This week’s newsflow reflects crypto’s current juxtaposition – regulatory strides on one side and user experience challenges on the other. Whether the crypto industry has truly moved past recent scandals remains uncertain, but one thing is for sure – volatility remains a constant! If you’re thinking of diving into the rollercoaster that is crypto, take a moment to assess if you’ve factored in all the associated risks.

Wishing you a fantastic weekend,

Tom

Market Movers

On the rise: Direct Line (LSE:DLG) +21.9% on the week

Direct Line Insurance Group’s shares surged 22% to 200p following reports of a rejected takeover bid from Belgian insurer Ageas.

Despite facing profit warnings in 2023 and experiencing the departure of its CEO, Direct Line managed to impress investors with a 115% growth in its motor insurance segment by the end of the same year.

Ageas, with a market cap of €7.2 billion, confirmed the bid and is contemplating a follow-up offer of £3.1 billion. This potential acquisition reflects a broader trend of businesses leaving the UK stock exchange due to poor valuations and weak liquidity.

Direct Line, valued at £2.1 billion, had suffered a series of profit warnings in 2023, leading to the exit of its chief executive. However, its most recent quarterly update showed positive results, and the company managed to offset inflation concerns through significant rate increases in the motor insurance segment, along with the initiation of the Motability partnership.

New CEO Adam Winslow, formerly the general insurance chief at Aviva, is set to take the helm after the departure of former CEO Penny James last year.

REGENCY VIEW:

Anticipation of a second bid from Ageas is likely to keep the share price buoyant. However, should Ageas end negotiations Direct Line’s share price would likely drop sharply again – investors should be wary of this risk. Direct Line are set to release full year 2023 earnings on Thursday 21st March and this is likely to be closely watched given the current bid backdrop.

Shares in Halfords took a significant hit this week after the UK bicycle and car parts retailer issued its second profit warning in two years. The company attributes this downturn to a combination of unfavourable weather conditions and the escalating cost of living.

Halfords announced that profits would be more than a quarter lower than previous forecasts. This drastic adjustment in expectations led to a sharp drop in the shares, bringing them down to 12-month lows.

The retailer explained that both its cycling and motoring segments were affected by weak customer confidence, with unusually mild and very wet weather further reducing footfall in its stores. As a result, an unscheduled trading update was issued, revising the underlying pre-tax profit forecast to a range of £35 million to £40 million for the year ending March, down from the previous estimate of £48 million to £53 million.

Halfords mentioned additional challenges, such as consolidation in the cycling sector and a trend of more customers making purchases on credit, which led to weaker profit margins in the retail business.

In January of the previous year, Halfords had already cut its forecast for pre-tax profit for the 12 months ending March 2023, citing difficulties in hiring staff for its garages and a decline in demand for tires.

REGENCY VIEW:

Having been a ‘lockdown winner’ with demand booming during the pandemic, Halfords’ is now very much a ‘cost-of-living crisis loser’. The company’s ambitious goal to double profits over the medium term looks highly ambitious given the lack of positive catalysts in its current outlook.

Sector Snapshot

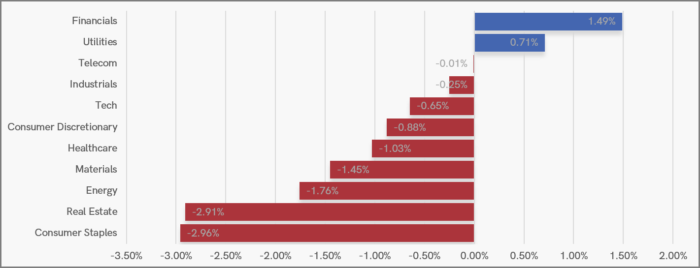

Financials are showing clear relative strength this week with all the major banks making gains following a resilient earnings season. Also showing strength is Utilities with the likes of SSE, Drax and Yu Group making gains.

Lagging the market is Consumer Staples – dragged lower by a sharp sell-off in Reckitt Benckiser following a Q4 earnings miss and revenue restatement. Real Estate has also had a poor week due to disappointing earnings from Taylor Wimpey.

UK Price Action

At first glance, this week’s price action on the FTSE looks pretty uninspiring, with the market continuing to retreat from resistance.

However, those of you who are shorter-term investors or traders may have noted that this week’s price action on the FTSE has completed an ABCD harmonic retracement. This means that the magnitude of this week’s pullback has been roughly equidistant to last week’s sell-off.

The ABCD pattern completed at the 50% retracement of the recent rally – an area that is of interest to those who follow Fibonacci patterns.

Disclaimer:

ll content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.