1st Dec 2023. 11.00am

Weekly Briefing – Friday 1st December

| Market | Movement this week (%)* |

|---|---|

| FTSE 100 | +0.27% |

| FTSE 250 | -0.86% |

| FTSE All-Share | +0.08% |

| AIM 100 | -0.36% |

| AIM All-Share | -0.34% |

* Price movement from Monday's open at 8am

Regency View:

Weekly Briefing – Friday 1st December

Market Overview

Dear Investor,

The price of gold surged to a six-month high this week, reaching $2,014.55 per ounce. This climb represents a significant uptick of over 10% since early October and places gold just 3% below its peak in August 2020.

This rise in gold value is attributed to several key factors. Firstly, there is a growing consensus that the US Federal Reserve won’t increase interest rates further – causing the US dollar to decline more than 3% against other currencies in November. This dollar decline has made purchasing gold more affordable for investors using different currencies.

Soft economic data in the US further supports the belief that interest rates won’t see an upward trend, possibly even predicting rate cuts in the upcoming year. When rates are lower, gold becomes relatively more attractive as it doesn’t yield interest.

Another factor driving gold higher has been rising geopolitical tensions. The metal is often considered a safe-haven asset during uncertain times, and a glance at golds price chart will show that the inception of the recent rally coincides exactly with the start of the war in Gaza.

Central bank purchases of gold have also increased this year with the People’s Bank of China, Poland, and Turkey, have been major purchasers, buying 800 tonnes of gold in the first three quarters of 2023.

And with seasonal catalysts such as Christmas and Chinese New Year fast approaching, gold looks set for a buoyant festive season.

Wishing you a fantastic weekend,

Tom

Market Movers

On the rise: Rolls Royce (LSE:RR.) +12.5% on the week

Rolls-Royce are topping the FTSE’s highest risers list this week after CEO, Tufan Erginbilgic outlined an ambitious plan to quadruple profits within the next four years.

The engine maker aims to achieve an operating profit of up to £2.8 billion by approximately 2027, a fourfold increase from the previous year. To support this, Rolls-Royce plans to increase operating margins to 13-15%, especially within its civil aerospace division, targeting margins of 15-17% compared to the 2.5% reported in 2022, aligning more closely with industry rivals like General Electric.

Cost-cutting measures, including seeking annual savings of up to £500 million and workforce reductions of up to 2,500 jobs, are integral to these growth plans. Additionally, the company aims for £3.1 billion in free cash flow by 2027.

Rolls-Royce’s strategic actions involve optimising engine flight hours, reducing maintenance costs, and phasing out low-margin contracts within its civil aerospace segment. The company plans to divest assets, including its electric aircraft division, to raise between £1 billion and £1.5 billion over the next five years while maintaining commitment to nuclear activities in small modular reactors.

Looking ahead, Rolls-Royce said it aims to explore partnerships in power generation, battery storage, and potentially collaborating with another manufacturer to re-enter the narrow-body aircraft market.

REGENCY VIEW:

The pursuit of profitability and cash flow improvements suggests a shift in focus from maximising market share to prioritising better financial performance. This strategic shift has been well received by investors, evident in the significant increase in Rolls-Royce’s share value this year.

However, Rolls-Royce’s valuation remains challenging due to past asset write-downs – the shares trade on a forward PE ratio of 27. And without paying a dividend, it’s hard to justify buying the stock at current prices.

Petrofac’s share price has plunged this week without any negative news catalyst.

The oil and gas engineer has faced various challenges in recent years including; legal issues related to bribery, declining revenues, unprofitable legacy contracts, and increased debt.

However, there have been recent positive developments, such as winning a substantial contract in the offshore wind sector and securing an extension of its banking facilities, which improved market sentiment.

The company’s involvement in a bribery scandal and subsequent penalties raised concerns about its future conduct, although it’s perceived that such occurrences are less likely to happen again due to heightened scrutiny. Despite some signs of potential recovery, including the expectation of reaching cash neutrality in 2023, uncertainties remain regarding its financial performance and the timeline for reinstating dividends. Petrofac’s share price is down more than -75% year-to-date.

REGENCY VIEW:

Petrofac is one the most-shorted stocks in the UK market with nearly 5% of its equity capital out on loan.

Whilst bargain hunters will be circling, long-term investors should be wary of catching this falling knife until Petrofac can prove its profitability.

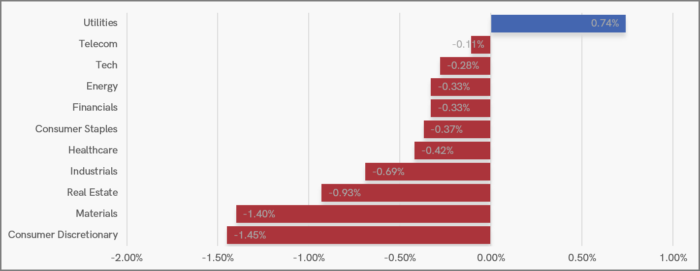

Sector Snapshot

Our UK Sector data represents a 7-day snapshot which is why this weeks chart has a more bearish tone than perhaps the last two days would suggest.

Utilities top the charts on a 7-day basis and they also top the strength charts on a 3-month basis – underlying the heightened levels of risk aversion in the UK market.

Consumer Discretionary is the weakest sector on a 7-day basis and it is the second-weakest sector on a 3-month basis – highlighting concerns over economic growth.

UK Price Action

The squeeze that we highlighted last week between the Volume Weighted Average Price (VWAP) anchored to the September highs and the VWAP anchored to the October lows have continued this week.

Having bounced from the lower VWAP on Thursday, prices are currently retesting the mid-November swing highs – a break above this level could set the stage for a rally towards the top of the long-term range near 7,700.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.