19th Jan 2024. 10.40am

Weekly Briefing – Friday 19th January

| Market | Movement this week (%)* |

|---|---|

| FTSE 100 | -1.80% |

| FTSE 250 | -1.07% |

| FTSE All-Share | -1.72% |

| AIM 100 | -1.22% |

| AIM All-Share | -1.41% |

* Price movement from Monday's open at 8am

Regency View:

Weekly Briefing – Friday 19th January

Market Overview

Dear Investor,

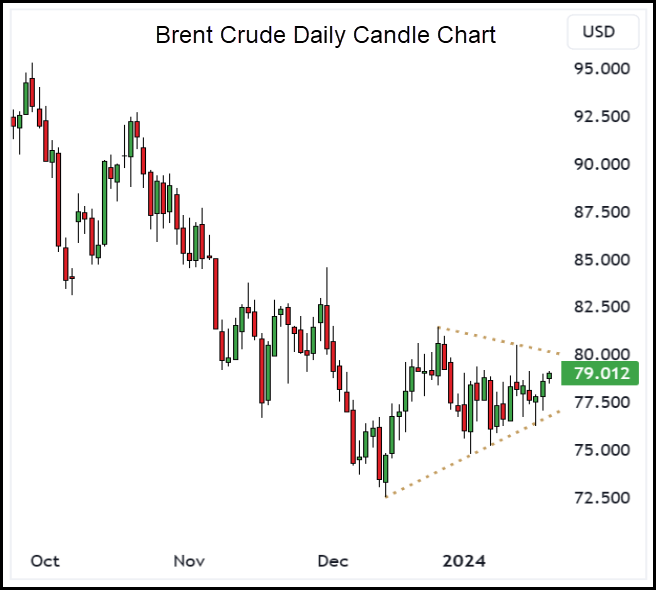

The global oil market is experiencing volatility in early 2024, driven by Saudi Arabia’s unexpected price cuts and geopolitical tensions in Yemen. The market is divided on the medium-term trajectory of oil prices, considering factors like softening global demand and robust US supply growth, along with geopolitical influences.

Adding to the complexity, the International Energy Agency (IEA) this week predicted a significant slowdown in oil demand growth for 2024. The IEA anticipates a halving of growth from 2.3 million barrels per day (bpd) in 2023 to 1.2 million bpd. This is attributed to factors such as the diminishing impact of China’s Covid rebound, slower growth in major economies, and the increasing adoption of electric vehicles.

Interestingly, this IEA forecast contrasts with OPEC’s prediction of flat demand growth in 2024. The IEA also points out that non-OPEC producers, including Brazil, are expected to contribute to a record supply of 103.5 million bpd, potentially resulting in a substantial surplus in the oil market.

Amid these dynamics, technical analysis reveals a persistent downtrend in Brent crude. However, a triangle consolidation pattern has emerged, indicating higher swing lows since December. This pattern suggests a potential shift in trend dynamics, with a decisive break above the wedge signalling a change, while a break below could breach long-held support levels. The oil market, as always, remains highly sensitive to geopolitical events and the delicate balance between global forces and market sentiment.

Wishing you a fantastic weekend,

Tom

Market Movers

On the rise: Flutter Entertainment (LSE:FLTR) +21.1% on the week

Flutter Entertainment, the owner of Paddy Power and Betfair, saw its shares surge higher this week despite reporting lower-than-expected fourth-quarter revenues. Investors were optimistic about the company’s upcoming listing on the New York Stock Exchange (NYSE) on January 29, with significant growth potential in the key US market.

Flutter, known for operating FanDuel, the largest sportsbook in the US, reported a 26% year-on-year increase in fourth-quarter US revenues. However, a decline in net revenue margin and higher promotional activity resulted in revenues falling below guidance. The company paid out $343 million due to “customer-friendly sports results,” limiting US gross revenues to $1.42 billion.

Excluding US operations, the fourth-quarter results were in line with expectations. Flutter’s full-year sales increased by 24% to £9.51 billion. The company remains optimistic about its momentum, especially outside the US, with strong performance in the UK&I and international markets.

Flutter’s CEO, Peter Jackson, noted that while sports results were customer-friendly, the underlying momentum in the business remains strong heading into 2024. He highlighted continued strong momentum in the UK&I, supported by recent product enhancements, and international growth driven by their ‘Consolidate and Invest’ markets.

Despite the hit from customer-friendly sporting results in the US, investors looked past it due to excitement about the NYSE debut and positive commentary on the business’s continued momentum. Analysts hope that Flutter’s focus on the emerging US sports betting market will lead to a higher valuation, especially given the significant growth of its FanDuel business in the US.

REGENCY VIEW:

Flutter is a market leader with a uniquely strong position in the US sports betting market. However, the shares trade on a forward PE of 30.4 – which looks expensive relative to its peer group and to forecast EPS growth of 19%.

High-street clothing brand, Superdry is facing financial challenges and has enlisted PricewaterhouseCoopers (PwC) to assess its debt-raising options. This decision follows a pre-Christmas profit warning attributed to weak sales caused by unusually mild autumn weather.

The company, founded by Julian Dunkerton, saw its shares hit a record low, resulting in a market capitalisation below £30m. Despite having existing debt facilities exceeding £100m through arrangements with Hilco and Bantry Bay Capital, Superdry’s financial situation remains a concern.

Superdry had taken previous steps to strengthen its balance sheet, including modest equity raises and brand licensing deals in Asia-Pacific and India. However, its shares continued to decline, prompting the recent appointment of PwC to review debt-raising options.

There has been speculation about Dunkerton, who owns roughly a quarter of Superdry’s shares, considering taking the company private. About a year ago, he engaged Interpath Advisory, a restructuring firm, to develop cost-cutting plans for the business.

Superdry has yet to provide an update on its Christmas trading performance, but market commentators have suggested that the colder weather may have positively impacted sales.

REGENCY VIEW:

The storm clouds are gathering for Superdry, revenues have stagnated during the last five years and profitability has been elusive. Bargain hunters will not that Superdry’s market cap has fallen below its free cashflow levels, but net debt outstrips cash by more than 3.6:1 on Superdry’s balance sheet and this puts the company in a precarious position.

Sector Snapshot

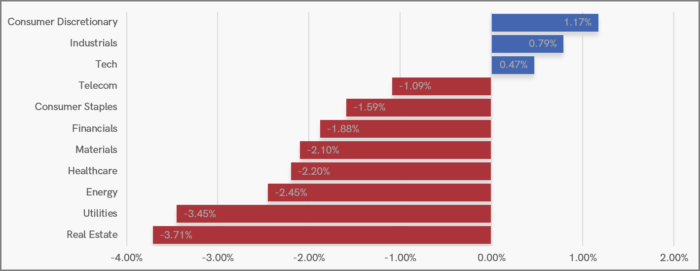

An unexpected rise in UK inflation prompted traders to reconsider rate cut expectations from the Bank of England – causing Real Estate to tumble this week.

While Consumer Discretionary has shown high levels of relative strength this week following gains from Flutter Entertainment, Intercontinental Hotels and Deliveroo.

UK Price Action

The FTSE’s retreat from resistance has accelerated this week with the market dropping more than 200 points between Mon-Wed before clawing back from of the losses yesterday.

With prices snapping the ascending trendline and breaking below the volume-weighted average price from the October lows, the market looks set for a retest of the bottom of the range.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.