17th May 2024. 10.47am

Weekly Briefing – Friday 17th May

| Market | Movement this week (%)* |

|---|---|

| FTSE 100 | -0.24% |

| FTSE 250 | +0.45% |

| FTSE All-Share | -0.12% |

| AIM 100 | +0.23% |

| AIM All-Share | +0.26% |

* Price movement from Monday's open at 8am

Regency View:

Weekly Briefing – Friday 17th May

Market Overview

Dear Investor,

The year of the dragon is proving lucky for Chinese stocks. Since mid-January, the FTSE China A50 Index, representing the top 50 companies in China’s A-share market, has rallied more than 18%.

China’s government is taking bold steps to stabilise the market and shape indices, marking a departure from its past discreet actions. Entities like Central Huijin Investments are increasing their holdings in Mainland stocks, particularly in mega-cap companies, significantly bolstering investor confidence.

Moreover, the Chinese State Council’s recent issuance of “9 Key Points” reflects a strong commitment to enhancing corporate governance and fostering dividend payments, signalling a positive outlook for China’s capital markets.

Notably, China’s GDP growth has surpassed expectations in Q1 2024, indicating a strengthening economy. This is further supported by rising consumer confidence, evident in increased spending on services like travel, both domestically and internationally.

As a consequence, global investors are showing renewed interest in Chinese equities, gradually overcoming previous concerns such as trade tensions and regulatory issues.

Wishing you a fantastic weekend,

Tom

Market Movers

On the rise: BT Group (LSE:BT.A) +26.6% on the week

BT’s share price surged this week as the new CEO, Allison Kirkby, conveyed a strong resolve to address short sellers.

Her proactive approach resonated positively with investors, signalling confidence in the company’s future direction.

Kirkby’s determination to counter short sellers by implementing cost-cutting measures and strategic initiatives instilled optimism in the market regarding BT’s prospects under her leadership.

These initiatives include the announcement of £3 billion in additional cost savings, building upon the company’s earlier achievement of hitting a £3 billion target for gross annualized cost savings ahead of schedule.

Additionally, Kirkby’s transparent communication about the company’s plans, including achieving adjusted revenue growth and increasing cash flow, contributed to bolstering investor confidence in BT’s turnaround strategy.

Overall, the surge in share price reflects the market’s favourable response to Kirkby’s proactive leadership style and strategic vision for BT’s growth.

REGENCY VIEW:

BT’s top line has been in steady decline for the past five years. However, double-digit margins ensures the business generates plenty of cash and a forward dividend yield of 6.8% looks attractive.

Long-term we believe BT lack financial quality. It’s debt laden balance sheet is likely to weigh heavy on the business and we see few catalysts to propel the stock higher once the short squeeze has finished.

Sage Group experienced a significant tumble in its share price, declining over 10% to 1,070p, despite posting strong first-half numbers. The stock had seen remarkable growth over the past year, rising nearly 50% and reaching an all-time high of 1,285p.

While the results for the six months ending in March showcased a 10% increase in underlying revenue to £1.15 billion, the organic growth of 9% fell slightly short of the City’s consensus forecast of 9.5%. Recurring revenue growth, however, met expectations at 11%.

Underlying earnings per share rose by 23% to 18.2p, aligning with forecasts. CEO Steve Hare noted the robust demand for Sage’s accounting, HR, and payroll products from small and mid-sized businesses, expressing confidence in the company’s strategy amidst ongoing macroeconomic uncertainty.

Looking ahead, Sage anticipates organic revenue growth for the full year to be “broadly in line with the first half,” signalling a slight downward adjustment from previous expectations.

REGENCY VIEW:

Sage is a high quality growth stock, but has a high valuation to match. This has been evident in the market’s reaction to what was strong results. Expectations have run ahead of themselves and the lack of an upgrade in organic growth forecasts have damped market sentiment towards the stock.

Sector Snapshot

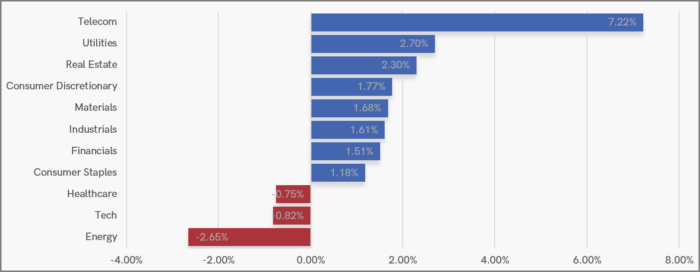

The Telecom sector is top of the pops this week, buoyed by impressive gains from BT and Vodafone. Utilities have continued last week’s gains with solid performances from National Grid, SSE and Centrica.

Bottom of the pack is Energy with oil & gas giants BP and Shell losing ground during the last seven sessions.

UK Price Action

The FTSE’s bull run has taken a pause for breath this week. The index has consolidated sideways within a series of tight trading ranges. A break below the small consolidation range could trigger a deeper retracement.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.