17th Jan 2025. 11.18am

Weekly Briefing – Friday 17th January

| Market | Movement this week (%)* |

|---|---|

| FTSE 100 | +2.8% |

| FTSE 250 | +4.1% |

| FTSE All-Share | +2.9% |

| AIM 100 | +0.93% |

| AIM All-Share | +0.72% |

* Price movement from Monday's open at 8am

Regency View:

Weekly Briefing – Friday 17th January

Market Overview

Dear Investor,

It’s been a strong week for stocks on both sides of the Atlantic as inflation numbers brought some much-needed optimism to the markets.

In the UK, inflation unexpectedly eased to 2.5% in December, down from 2.6% the previous month, driven by softer prices in restaurants and hotels. This triggered a significant rally in gilts, with 10-year yields posting their best day in over a year, and the FTSE 100 has hit all-time highs with traders now expecting a February rate cut from the Bank of England.

Services inflation, closely watched by the BoE, also slowed sharply, offering policymakers a bit more breathing room. The pound edged higher on the day, adding to the sense of relief across markets.

Across the pond in the US, inflation data delivered a similar boost. Core inflation dipped slightly to 3.2% from 3.3%, helping to spark the best day for US equities since Trump’s 2016 election win.

The S&P 500 climbed 1.8% on Wednesday following the numbers, while the Nasdaq jumped 2.5%, with banks like Citigroup and Goldman Sachs leading the charge after strong quarterly earnings. The softer inflation print has also shifted expectations for Federal Reserve rate cuts, with markets now eyeing a potential move as early as July.

For now, the mood is upbeat, with investors on both sides of the Atlantic cheering signs that inflation might finally be loosening its grip.

Wishing you a fantastic weekend,

Tom

Market Movers

On the rise: Trustpilot (LSE:TRST) +18.1% on the week

Shares in Trustpilot surged higher on Thursday following a strong trading update for the twelve months ended 31 December 2024, which highlighted robust growth across key metrics.

The company reported a 21% increase in constant currency bookings, reaching $239m, and an impressive 23% year-on-year growth, driven by particularly strong performance in North America, where bookings rose 26% on a constant currency basis.

Trustpilot’s annual recurring revenue (ARR) climbed to $231m, representing a 21% rise in constant currency terms, while revenue grew by 18% at constant currency. The company attributed its success to product innovation and the introduction of new pricing and product packages, which also boosted its net dollar retention rate to 103%, up from 99% in 2023.

The update also highlighted adjusted EBITDA expected to come in ahead of consensus, alongside strong cash generation, even as the company completed $43m of its £40m share buyback programme. CEO Adrian Blair pointed to strategic progress in 2024, emphasising new customer acquisition across all focus markets and continued confidence in the platform’s growth potential.

REGENCY VIEW:

Trustpilot’s impressive bookings growth and adjusted EBITDA ahead of consensus reflect a strong year, driven by product innovation an impressive performance in key markets like North America. While the stock has surged, the lofty valuation metrics and a forward P/E of 82.4x suggest that investors are pricing in significant future growth, leaving little margin for error.

Petro Matad continued their sell-off this week after a mixed operational update that left investors with lingering concerns about execution risks and the timeline for monetising production.

While the company reported stable production at the Heron-1 well, averaging over 200 barrels of oil per day under natural flow, the details around ongoing challenges appear to have tempered market enthusiasm.

The Heron-1 well has delivered 15,750 barrels of oil to the neighbouring TA-1 facilities in Block XIX, but the awaited signature on the Cooperation Agreement, now expected in February, remains a bottleneck for commencing sales revenue.

On the exploration front, the announcement of a new Production Sharing Contract for Block VII in southern Mongolia is said to add technical upside to Petro Matad’s portfolio. The block spans 41,141 square kilometers and holds promise due to its proximity to oil-prone basins in northern China, where both oil and gas have been discovered.

CEO Mike Buck emphasised the company’s focus on increasing Heron-1 flow rates through cost-effective surface modifications and using associated gas, as well as the importance of advancing the Block VII exploration program.

REGENCY VIEW:

Petro Matad’s extended track record of operating losses and negative cash flow makes it a highly speculative investment. While revenue has recently declined and the share price has dropped sharply over the past year, the company’s exploration activities in Mongolia remain its key focus, with long-term viability dependent on a major operational breakthrough.

Sector Snapshot

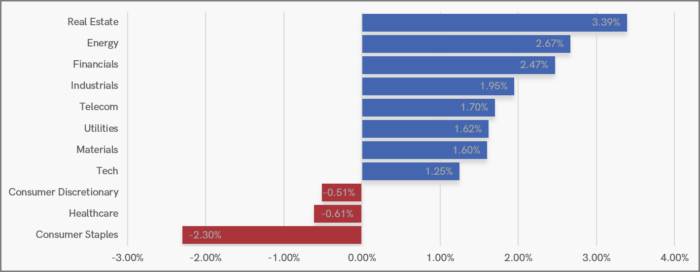

This week’s UK Sector Snapshot is a sea of blue with eight of our eleven sectors making gains during the last seven trading sessions. Top of the pops is Real Estate which has enjoyed this week’s inflation data. Cooling inflation raises the possibility of another drop in interest rates causing residential REITS to jump more than 7% this week.

Consumer Discretionary and Consumer Staples have both underperformed this week. Discretionary has continued to struggle following an underwhelming festive period, while Consumer Staples have fallen in response to the inflation data.

UK Price Action

The FTSE daily rolling futures are set for their strongest week since July 2023. The index has surged through the cluster of swing highs that formed last year and has broken to all-time highs.

A weekly close above the highs would be a very bullish signal that could indicate the start of a new trending phase higher after a prolonged period of sideways consolidation.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.