16th Feb 2024. 9.28am

Weekly Briefing – Friday 16th February

| Market | Movement this week (%)* |

|---|---|

| FTSE 100 | +0.99% |

| FTSE 250 | +0.81% |

| FTSE All-Share | +0.96% |

| AIM 100 | +1.65% |

| AIM All-Share | +1.08% |

* Price movement from Monday's open at 8am

Weekly Briefing – Friday 16th February

Market Overview

Dear Investor,

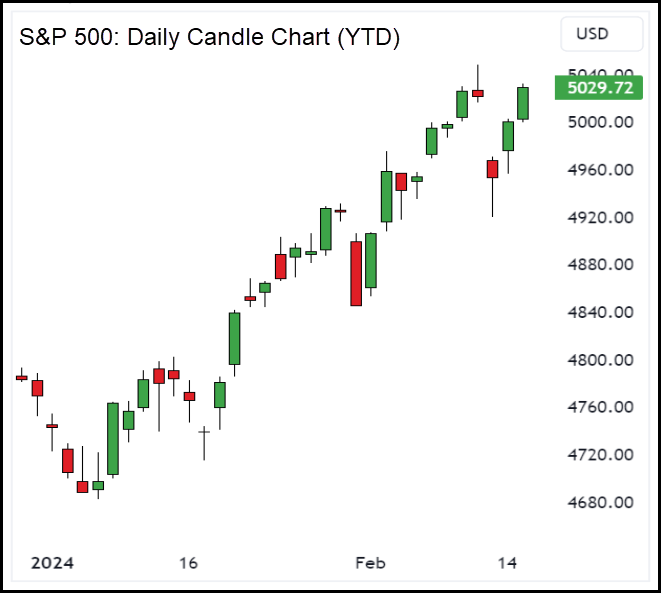

This week inflation was at the forefront of market discussions. Key data releases on both sides of the Atlantic triggered a flurry of activity among traders on Wall Street and in the City, prompting a swift recalibration of rate cut expectations.

In the US, the release of the latest Consumer Price Index (CPI) data for January took center stage. The unexpected uptick in the year-on-year inflation rate to 3.1%, exceeding market forecasts, set off a chain reaction. The S&P 500 took a 1.4% dip on Tuesday, and the Nasdaq Composite saw a 1.8% decline. However, both markets have since bounced back and erased their losses – underlining of the US bull market.

Meanwhile, UK inflation held steady at 4% for January, defying analyst predictions of a slight increase to 4.2%. The surprise figures led traders in the swaps market to swiftly adjust their expectations for Bank of England (BoE) interest rates. The probability of a quarter-point rate cut by June surged to 65%, up from 40% prior to the data release.

This inflationary jolt prompted shifts in currency markets, with sterling sliding 0.3% to $1.2550. On the flip side, interest rate-sensitive two-year gilt yields dropped, while the FTSE 100 experienced a 0.7% uptick on Wednesday – taking it back into positive territory on the week.

As investors, these developments highlight the delicate balance central banks face in navigating inflationary pressures. ‘Higher for longer’ looks set to be an emerging theme for those playing interest differentials this year.

Wishing you a fantastic weekend,

Tom

Market Movers

On the rise: Coca-Cola HBC (LSE:CCH) +12.2% on the week

Coca-Cola HBC, a major Coca-Cola bottling partner, reported record results, causing its shares to gap higher this week…

The company delivered a better-than-expected performance and increased its dividend by 20%, attributing record profits to a 2% volume growth. Organic revenue saw a 17% increase, driven by strong demand for energy drinks and coffee products, while still product volumes fell by 4%.

The acquisition of Finlandia Vodka is expected to boost growth in the premium spirits category, with premium spirits volumes increasing by 13% during the year. Emerging markets, particularly in countries like Nigeria and Egypt, led in both organic revenue and volume performance.

Despite overall volumes contracting in developing and established markets, double-digit revenue growth was achieved through pricing actions. Free cash flow reached a record €712 million, up 10.3% from the previous year, and comparable operating profit rose by 17.7% to €1.08 billion.

REGENCY VIEW:

CCH is outperforming rival Pepsi, and the company’s shares trade at 12 times forward consensus earnings, compared to a 5-year average of 17 times. While growth is expected to moderate in 2024, management forecasts organic revenue and operating profit to grow by 6-7% and 3-9%, respectively, reinforcing the perception that CCH is undervalued.

Close Brothers, a FTSE 250 group, has suspended its dividend due to uncertainty surrounding the impact of a regulatory investigation into motor financing deals by the Financial Conduct Authority (FCA).

The FCA is examining discretionary commissions on car financing deals dating back a decade, with concerns that such agreements incentivised lenders and dealers to raise interest rates for customers.

Close Brothers has warned of significant uncertainty about the FCA’s review outcome, and the financial impact cannot be reliably estimated.

The company’s shares plunged 27%, and it plans to decide on dividend reinstatement in 2025 post FCA’s review completion.

The FCA probe, likened to the payment protection insurance mis-selling scandal, could potentially cost the industry an estimated £13-16 billion.

REGENCY VIEW:

Close Brothers lowly valuation of just 4 times forward consensus earnings will no doubt attract bargain hunters. However, the FCA investigation cloud is likely to loom large over the stock for the next year and any fine is likely to be very substantial which could lead to a recapitalisation of the balance sheet.

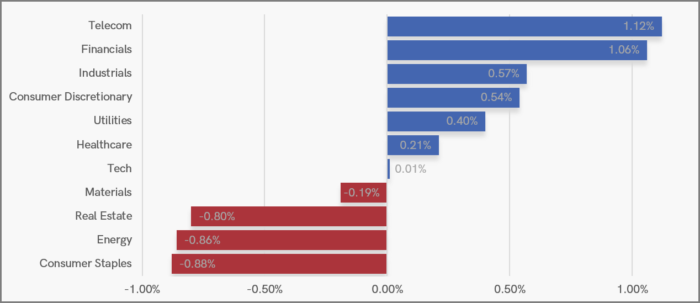

Sector Snapshot

This week’s sector snapshot is a split deck; the Telecom sector is having an uncharacteristically strong week after Vodafone rallied in response to the appointment of e& chief executive, Hatem Dowidar to its board.

The higher for longer interest rate story has played out at the sector level with Financials showing strength and Real Estate showing weakness.

Consumers Staples, having led the pack last week have given back some of their gains and sit bottom of the pile this week.

UK Price Action

This week’s price action on the FTSE 100 has taken the form of a whip-saw V-shaped reversal – carving out a new higher swing low.

Perhaps the most interesting observation we can make this week is that we’re starting to see higher swing lows and lower swing highs. This potentially indicates that the market could start to be funnelled into a ‘wedge’ pattern in the coming weeks.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.