15th Nov 2024. 10.33am

Weekly Briefing – Friday 15th November

| Market | Movement this week (%)* |

|---|---|

| FTSE 100 | +0.04% |

| FTSE 250 | -0.08% |

| FTSE All-Share | +0.02% |

| AIM 100 | -0.30% |

| AIM All-Share | -0.38% |

* Price movement from Monday's open at 8am

Regency View:

Weekly Briefing – Friday 15th November

Market Overview

Dear Investor,

We’re just over a week on from Donald Trump’s election victory, and the impact on global markets has been both swift and dramatic. Money managers appear to be recalibrating their expectations, and the reactions across asset classes and geographies are showcasing a fascinating shift in sentiment and strategy.

In the U.S., we’ve seen the S&P 500 surge more than 4% to reach new all-time highs. This rally reflects a strong wave of optimism as investors anticipate Trump’s pro-growth policies. The expectation of lower corporate taxes, increased infrastructure spending, and a more relaxed regulatory environment has created a robust outlook, particularly for sectors like industrials, financials, and energy.

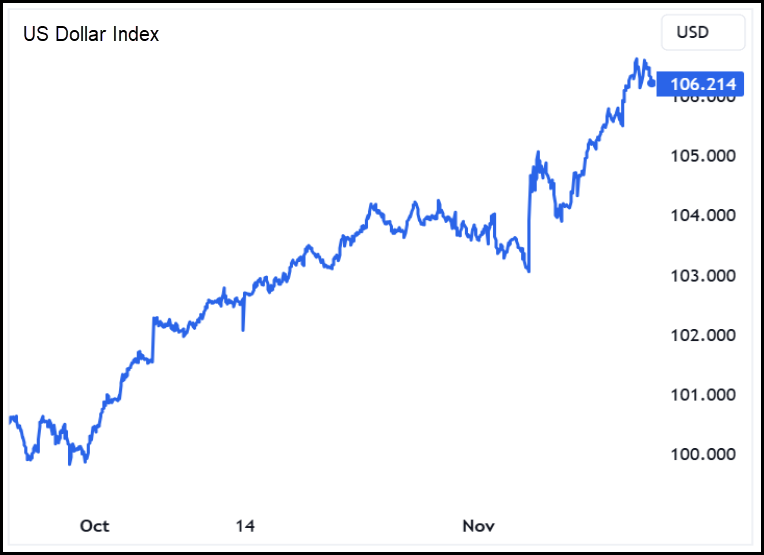

The U.S. dollar has also seen a significant boost, climbing over 3% to reach a 12-month high. A strengthening dollar often signals investor confidence in economic growth, but it also has a ripple effect, influencing everything from international trade to emerging markets. While a strong dollar benefits American consumers by increasing purchasing power for imports, it also makes U.S. exports more expensive abroad, which could pose challenges for multinational corporations. However, the dollar’s rally suggests that markets are already pricing in potential rate hikes, driven by expectations of fiscal stimulus and faster growth under Trump’s administration.

Bitcoin has also joined the rally, soaring over 30% since the election. The digital currency is increasingly seen as a hedge against traditional market fluctuations and a play on technology. With Trump’s approach potentially signalling a lighter regulatory touch on digital assets, investors appear more comfortable placing bets on Bitcoin’s future, propelling it upwards as it gains momentum as a speculative yet appealing asset in this environment.

Not every asset has benefited from Trump’s win, though. Gold has dropped more than 7% since the election—a clear signal that risk appetite has surged. Gold, traditionally a safe haven during uncertain times, is falling out of favour as investors pull back from defensive positions, moving capital into equities and other riskier assets.

Internationally, markets have been somewhat more restrained. In the UK, the FTSE 100 has dipped slightly, while Germany’s DAX and China’s A50 remain mostly flat. Investors outside the U.S. are more cautious, likely eyeing the potential trade implications of Trump’s ‘America First’ policy stance.

Wishing you a fantastic weekend,

Tom

Market Movers

On the rise: Just Eat Takeaway.com (LSE:JET) +28.6% on the week

Shares in Just Eat Takeaway.com surged higher this week after the company announced its decision to sell Grubhub to Wonder Group for an enterprise value of $650m.

The market responded positively to the news, viewing the sale as a pivotal step in Just Eat’s ongoing strategy to consolidate its operations and prioritise markets where it holds a stronger competitive edge.

With the transaction expected to close in the first quarter of 2025, Just Eat Takeaway.com stands to benefit from improved cash flow and a strengthened balance sheet, further supporting its growth ambitions across Europe.

The company will be relieved of Grubhub’s substantial liabilities, including $500m in senior notes, which will be transferred as part of the deal. This shift not only reduces Just Eat’s debt exposure but also frees up resources to bolster its European markets, where it has a significant foothold.

CEO Jitse Groen highlighted that this transaction would “increase the cash generation capabilities of Just Eat Takeaway.com and accelerate our growth,” signalling a strong commitment to maximizing shareholder value.

REGENCY VIEW:

Just Eat has struggled with declining revenue and significant losses, but the sale of Grubhub should improve liquidity and allow for more focused investment. The stock’s recent gains reflect optimism, but challenges with profitability and margins remain.

Shares in Mexican silver miner Fresnillo have taken a hit following news of operational difficulties at its Sabinas mine, which is fully owned by its partner, Peñoles.

The mine, a key source of silver for Fresnillo under their Silverstream Agreement, is facing challenges that are negatively affecting silver production. The company has confirmed that both Fresnillo and Peñoles are in discussions to evaluate the extent of the issues and their potential impact on the long-standing agreement.

These developments come at a time when the broader precious metals market is also under pressure. Silver, along with gold, has been facing headwinds this week due to a significant surge in the US dollar. As the dollar strengthens, it tends to weigh on the prices of commodities like silver and gold, which are priced in US dollars.

The operational difficulties at the Sabinas mine may not only impact silver output but could also lead to significant adjustments in the Silverstream Agreement between Fresnillo and Peñoles. While it’s still too early to determine the full scale of the adjustments, Fresnillo has acknowledged the likelihood of changes to the terms of the agreement, depending on the outcome of ongoing discussions.

Fresnillo has assured the market that it will provide further updates once more information becomes available. For now, the combination of operational issues and a weakening silver market due to the strong dollar is weighing on the stock.

REGENCY VIEW:

Fresnillo boasts a strong balance sheet with low net gearing at 5.5% and robust liquidity. However, the recent strength of the US dollar has created a headwind, which could weigh on profitability. Despite these challenges, a forward PE ratio of 10.7 and a forecasted 4.16% dividend yield may appeal to income-focused investors.

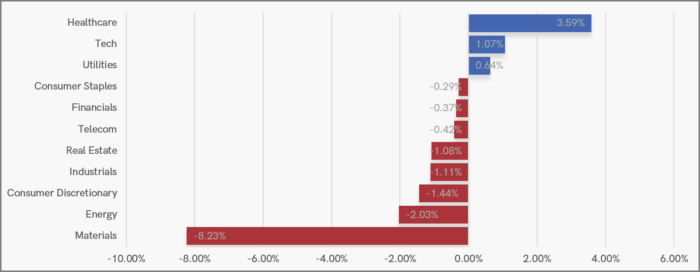

Sector Snapshot

The materials sector took a major hit this week, dropping over 8% as the strong US dollar weighed heavily on commodity prices. A stronger dollar typically makes raw materials more expensive for international buyers, reducing demand and pressuring companies in this sector.

Meanwhile, the healthcare sector rebounded by 3.59%, clawing back some of last week’s losses that stemmed from a pharma-driven sell-off. Renewed investor confidence in healthcare suggests that the sector may be stabilising after last week’s turbulence.

UK Price Action

After last week’s unsuccessful attempt to push higher, the FTSE has pulled back to a critical support area, slipping below its 200-day moving average. This breakdown challenges the integrity of its long-term uptrend and raises concerns about further downside potential.

Key levels to watch are the recent support at 8,069 and 8,016; a failure to hold above these could open the door to a deeper decline toward 7,915. However, if buyers step in to reclaim the 200-day moving average, it could signal a reversal or consolidation phase. For now, the trend appears vulnerable, with sellers retaining control until there’s a decisive bounce or break above the 50-day moving average.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.