15th Dec 2023. 11.01am

Weekly Briefing – Friday 15th December

| Market | Movement this week (%)* |

|---|---|

| FTSE 100 | +0.97% |

| FTSE 250 | +3.48% |

| FTSE All-Share | +1.37% |

| AIM 100 | +2.78% |

| AIM All-Share | +2.19% |

* Price movement from Monday's open at 8am

Regency View:

Weekly Briefing – Friday 15th December

Market Overview

Dear Investor,

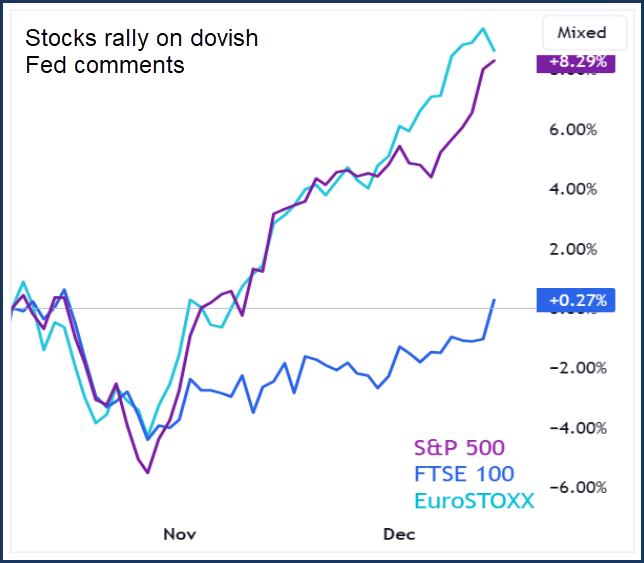

Stocks on both sides of the pond have been full of festive cheer this week after dovish comments from Fed Chair Jay Powell.

On Wednesday, the Federal Open Market Committee (FOMC) published its projections for monetary policy – revealing a substantial 0.75 percentage points in rate cuts next year, higher than the market had anticipated.

The surprisingly dovish projections sparked a sharp rally in stocks – causing the S&P 500 to breakout to new highs for the year. The German Dax extended its gains and even the sluggish FTSE 100 got in on the act with the UK’s headline index hitting highs not seen since September.

In the bond market, yields on sensitive two-year Treasuries and German Bunds fell notably, signalling investor confidence in forthcoming rate cuts. Fed Chair Jay Powell’s statement which accompanied the FOMC projections hinted at the end of the tightening cycle, further reinforcing expectations of rate cuts.

However, Thursday brought a sobering shift in tone from the Bank of England and the ECB. Both institutions refrained from declaring victory over inflation. Christine Lagarde, ECB president, cautioned that there’s still “work to be done” before inflation aligns with its 2% target. Meanwhile, Andrew Bailey, BoE governor, emphasised that the UK still has “some way to go.”

Maintaining their current interest rates—4% for the ECB and 5.25% for the BoE—Lagarde urged against complacency, stressing the need to remain vigilant against rising consumer prices.

Despite this caution, there’s a widespread expectation that the more dovish stance from the Fed will serve as a positive catalyst for stocks in the New Year.

Wishing you a fantastic weekend,

Tom

Market Movers

On the rise: Antofagasta (LSE:ANTO) +10.4% on the week

The prospect of rate cuts in the US next year sent miners rallying this week with copper giant, Antofagasta making significant gains as the outlook for global economic growth brightened.

Meanwhile workers at Antofagasta’s Centinela copper mine in Chile have successfully voted for a fresh labour contract, sidestepping the possibility of a strike. The union revealed a landslide approval, with 347 votes in favour and only 26 against the contract.

Earlier, union leader Luis Redlich had cautioned about an impending strike if the contract negotiations collapsed, slated to begin on December 19.

In this new agreement, the nearly 400 members of the Centinela District Workers’ Union secured a bonus totalling 19.6 million Chilean pesos, which equals around $22,700. Additionally, they obtained a preferential loan benefit amounting to nearly $3,500. This positive outcome brings stability and better terms for the workers at the mine.

REGENCY VIEW:

Antofagasta trades on an eye-wateringly high forward price-to-earnings ratio of 27.8. This looks expensive relative to its peer group and the wider market. It also looks expensive relative to the stocks cyclical nature and its comparatively modest dividend yield of 1.72%.

Anglo Asian Mining faced a challenging week in the market, experiencing an 18.1% drop in its share price. This came despite the company achieving notable milestones recently.

The company received a new fleet of cutting-edge Caterpillar underground mining machines at its Gedabek mine in Azerbaijan. Gedabek is known for producing gold, silver, and copper. Additionally, Anglo Asian unveiled a significant development—the maiden JORC Mineral Resource for its Gilar deposit in Azerbaijan.

This newly assessed Gilar deposit has 6.10 million tonnes of mineralisation. It’s rich in copper and gold, with average grades of 0.88% copper and 1.30 grams per ton of gold. The assessment confirmed a substantial in-situ Mineral Resource that includes 54,000 tonnes of copper, 255,000 ounces of gold, and 46,000 tonnes of zinc.

CEO Reza Vaziri expressed pride in this inaugural mineral resource estimate, highlighting its importance in understanding the deposit’s geological composition and value. Meanwhile, Vice-President Stephen Westhead emphasised ongoing efforts in tunnelling to access mineralisation. The company plans to expand exploration with both underground and surface drilling.

REGENCY VIEW:

The Gilar mine’s potential as a source of significant gold and copper positions Anglo Asian strategically for future production. It’s seen as a solution to compensate for declining grades at existing mines and is expected to start production in the medium term.

The shares look relatively cheap at a forward PE of 4.8 and dividend yield of 10.8%, but this cheap valuation reflects high levels of geopolitical risk and uncertainty over long-term production.

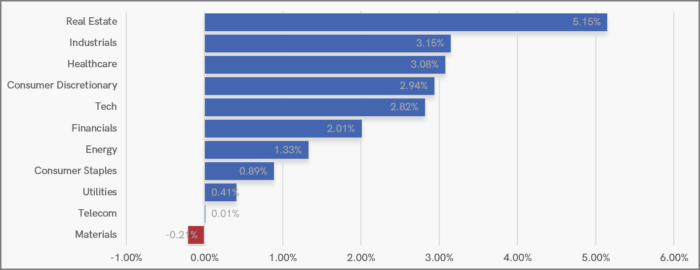

Sector Snapshot

Fuelled by the prospect of lower mortgage rates, Real Estate tops our Sector Snapshot this week. The sector is also the UK market’s strongest on a 3-month basis – signalling the strength of the recovery in UK housebuilders.

Materials are bottom of the pack during the last seven sessions, but this is slightly skewed by a sharp sell-off in Anglo American last Friday after the company revealed plans to slash mineral production to cut costs and boost profitability.

UK Price Action

Last week we noted that a break above the mid-November swing highs would “set the stage for a rally towards the top of the long-term range near 7,700” and that’s exactly what we’ve seen. The FTSE is now retesting that major resistance zone created by the July and September swing highs.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.