14th Mar 2025. 11.09am

Weekly Briefing – Friday 14th March

| Market | Movement this week (%)* |

|---|---|

| FTSE 100 | -1.06% |

| FTSE 250 | -1.53% |

| FTSE All-Share | -1.12% |

| AIM 100 | -1.33% |

| AIM All-Share | -1.22% |

* Price movement from Monday's open at 8am

Regency View:

Weekly Briefing – Friday 14th March

Market Overview

Dear Investor,

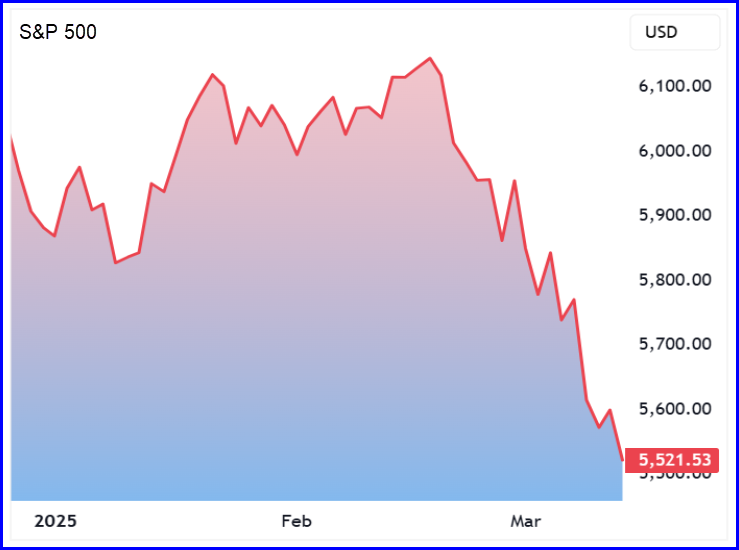

This month’s global equity sell-off has felt significant, not just in the US, but in Europe too. The S&P 500 moved into correction territory, dropping over 10% from its February peak, while the FTSE 100 and DAX have also taken a hit, falling by just over 1% and 2%, respectively, this week. Volatility has spiked, with the VIX breaking above 29, signalling a growing sense of uncertainty across the markets.

So, what’s been behind this? The trigger seems to be a combination of factors—frothy valuations, geopolitical tensions, and shifting risk appetites. President Trump’s continued use of tariffs as a negotiating tool has sparked waves of economic uncertainty, adding to concerns already bubbling up about rising bond yields, inflationary pressures, and slowing growth. At the same time, tech stocks—especially high-flying names like Nvidia, Tesla, and Palantir—have taken a significant hit, with their valuations now under closer scrutiny after a period of impressive (but perhaps unsustainable) gains.

Meanwhile, across the Channel, European markets have also been caught in the sell-off, though the losses have been more modest. The FTSE 100 has been on a downward trend over the past couple of weeks, while the DAX has seen heavier losses as concerns over the health of the Eurozone economy continue to mount. With mixed economic data and growing doubts over growth, there’s a sense that Europe is facing more headwinds than initially expected.

The big question now is whether this correction is merely a healthy reset—shaking out the excesses in the market—or whether it’s the start of something more sustained. Some argue this is a much-needed correction, and history shows that after such shakeouts, markets often find their footing and resume their upward trend. Others, however, remain cautious, pointing to the risks of rising inflation, tightening central bank policies, and the potential for disappointing corporate earnings in the months ahead.

Either way, a more volatile period seems likely. As always, we’ll be watching closely for key levels in the major indices, particularly to see whether investors are ready to buy the dip or if risk appetite continues to wane. One thing’s for sure—there’s plenty to keep an eye on in the weeks ahead.

Wishing you a fantastic weekend,

Tom

Market Movers

On the rise: Skinbiotherapeutics (AIM:SBTX) +25.3% on the week

Shares in AIM-listed SkinBioTherapeutics surged higher this week in anticipation of their upcoming half-year results. The stock jumped more than 28%, continuing a strong rally that has seen the shares increase fourfold since their lows in March 2024.

The rise in share price comes as investors remain optimistic about the company’s growth prospects. Key developments, including the finalisation of commercial agreements like the one with Croda for the SkinBiotix product line, have contributed to the positive sentiment.

SkinBioTherapeutics has also made strategic acquisitions, such as Dermatonics and Bio-Tech Solutions, which are expected to strengthen its market position. These moves have helped diversify the company’s product offering and expand its operational capabilities.

With the company forecasting a cash-flow-positive position for FY25 and an official launch of SkinBiotix in April 2025, investors are keen to see how the upcoming half-year results reflect these developments and the ongoing growth of the business.

REGENCY VIEW:

Skinbiotherapeutics is showing strong momentum, but it remains a highly speculative small-cap with limited revenue growth and negative profitability. Despite its impressive price action, the stock’s high valuation and ongoing financial losses suggest caution, with its market position still fragile.

Shares in JD Sports fell by as much as 3.2% on Wednesday, dropping to 72.8 pence, after a bleak forecast from Puma raised concerns about the wider sports retail industry. The retailer, which is a key player on the FTSE 100 index, was among the top losers in the market following the announcement. Puma’s forecast highlighted ongoing geopolitical tensions and economic challenges in 2025, which are expected to dampen consumer sentiment and impact sales growth in the sector.

Puma’s warning, which included slower-than-expected sales growth, pointed to macroeconomic challenges such as trade disputes, currency volatility, and a general weakening of consumer demand. Analysts are now concerned about the potential spillover effects on brands like JD Sports, especially in key markets such as North America, where competition is increasing. The warning also follows JD Sports’ own forecast revision in January, where the company acknowledged the difficult and volatile market conditions it faces.

The retail industry is already feeling the strain, with poor results from Puma and Inditex, the parent company of Zara, adding fuel to fears of slowing consumer demand. Inditex, too, reported weaker-than-expected sales in the Americas, where analysts believe tariff uncertainties may be weighing on consumer confidence. The combination of these developments is creating a challenging environment for global retailers, with both Puma and Inditex struggling to meet growth expectations.

As JD Sports continues to navigate these economic headwinds, investors will be watching closely for any signs of recovery or further deterioration in market conditions. While the company is still facing significant challenges, particularly in the US, its ability to manage the external pressures, including potential tariff impacts, will be key to its performance in the coming months.

REGENCY VIEW:

JD Sports is struggling with a significant drop in momentum, down 43% over the past year, despite solid revenue growth. While its low PE ratio and healthy margins offer some value, the stock remains under pressure as broader retail challenges persist.

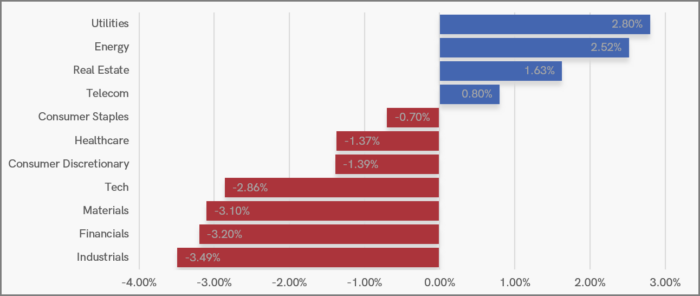

Sector Snapshot

Defensive sectors and energy held up best in an otherwise weak UK market this week. Utilities led the way, while energy stocks also posted gains, supported by a stabilisation in oil prices. Real estate managed to stay in positive territory, possibly reflecting shifting interest rate expectations. Meanwhile, risk-sensitive sectors bore the brunt of the sell-off—industrials, financials, and materials were among the worst performers as economic concerns and weaker sentiment weighed on cyclical stocks. Tech also struggled, mirroring the broader global rotation away from high-growth names.

UK Price Action

The FTSE’s retreat from its recent highs has extended this week, with the index now testing a key support level formed by the broken 2024 highs. Price action has already shown signs of stabilisation at this level, and the focus now shifts to whether buyers can regain control more convincingly in the coming week.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.