14th Jun 2024. 10.31am

Weekly Briefing – Friday 14th June

| Market | Movement this week (%)* |

|---|---|

| FTSE 100 | -1.06% |

| FTSE 250 | -1.87% |

| FTSE All-Share | -1.18% |

| AIM 100 | -1.72% |

| AIM All-Share | -1.64% |

* Price movement from Monday's open at 8am

Regency View:

Weekly Briefing – Friday 14th June

Market Overview

Dear Investor,

US Federal Reserve officials took a hawkish U-turn on Wednesday, signalling just one interest rate cut before the end of 2024.

Despite cooler-than-expected consumer price index data for May, the Fed is sticking to its guns, keeping rates at a 23-year high of 5.25% to 5.5%. This stance is a significant pivot from earlier predictions and has traders scratching their heads.

Fed Chair Jay Powell, the stoic commander steering the inflation battle, found the CPI figures “encouraging” but remained conservatively cautious about future inflation. The Fed’s latest forecast is a far cry from its March predictions of three cuts this year. Instead, we’re looking at one quarter-point cut, which is a bit of a shocker for markets that had priced in two.

This conservative outlook won’t thrill President Joe Biden, who has placed economic performance and inflation control at the heart of his re-election campaign. Market reactions were swift and varied: stocks trimmed their gains on Wednesday before bouncing back, Treasury yields ticked up, and the likelihood of a September rate cut — just before the presidential election — took a hit, dropping from over 80% to around 64%.

The Fed’s updated projections show steady growth at 2.1% for 2024 but higher inflation expectations, with core PCE inflation nudging up from 2.6% to 2.8%. And unemployment is forecasted to stay at 4%, suggesting a steady labour market.

Whether the Fed will continue to hold its nerve remains to be seen, but for now the message is clear: inflation is still public enemy number one, and the path to rate cuts will be cautious and data-driven.

Wishing you a fantastic weekend,

Tom

Market Movers

On the rise: Oxford Instruments (LSE:OXIG) +5.6% on the week

Oxford Instruments shares rallied to a yearly high of £27.40 despite a drop in operating margins and earnings per share (EPS) for the year ending March 2024.

The high-tech equipment manufacturer reported a revenue increase of 9.8% to £470 million, but adjusted operating profit declined slightly to £80.3 million. Operating margin fell from 18.1% to 17.1%, and EPS decreased by 3.3% to 109p.

Oxford Instruments’ share price boost was driven by investor enthusiasm for a strategic reset aimed at simplifying operations and improving returns. The plan involves reorganising into two distinct businesses, focusing on fewer markets and streamlining the product portfolio.

The company set new medium-term targets, including annual organic growth of 5-8%, an operating margin above 20%, cash conversion over 85%, and maintaining R&D spending at 8-9% of revenue.

Additionally, Oxford Instruments announced the acquisition of Swiss company FemtoTools for CHF 17 million (£14.9 million), with a potential additional payment of CHF 7 million (£6.1 million) based on performance.

REGENCY VIEW:

Oxford Instruments’ strong order book for the current financial year is expected to bolster their earnings forecasts. The company benefits from a solid cash position, offering flexibility to pursue additional bolt-on acquisitions that can complement their organic growth strategy. This financial strength positions Oxford Instruments well to capitalize on opportunities for expansion and strategic development in their sector.

Shares in UK housebuilder Crest Nicholson dropped this week after it reported disappointing financial results amidst challenging conditions in the property market.

The company announced a pre-tax loss of £30.9 million for the six months ending in April, a stark contrast to the £28.4 million profit recorded during the same period last year. This unexpected swing into the red marks Crest Nicholson’s fourth profit warning in the past year, underscoring persistent difficulties exacerbated by volatile mortgage rates and weakening demand.

Investor confidence waned further as Crest Nicholson revealed a 12% decline in the number of homes completed compared to a year ago, reflecting broader industry struggles. The company’s projections for the full financial year also fell short of expectations, with adjusted pre-tax profit forecasted to range between £22 million and £29 million, significantly below analysts’ earlier predictions nearing £39 million.

Additionally, Crest Nicholson faced unforeseen costs related to rectifying building defects, necessitating a substantial one-off charge of £31.4 million, nearly double the initial estimate. In response to these financial pressures and to conserve capital, Crest Nicholson made the decision to slash its interim dividend by more than 80%, reducing it to just 1p per share.

REGENCY VIEW:

UK housebuilders are facing tough market conditions due to delayed expectations for interest rate cuts and the political uncertainty that comes with a general election. Despite stable mortgage rates, prospective buyers remain hesitant to enter the market, contributing to a subdued environment for property transactions.

Sector Snapshot

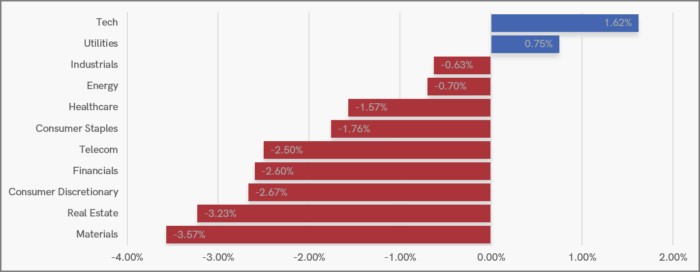

The UK market continues to have a defensive tilt as the market pulls back from highs. Utilities continue to show high levels of relative strength, and Tech leads the pack with semi-conductor stocks making gains.

Real Estate has shown weakness due to disappointing earnings and the anticipation of higher for longer interest rates. Materials are bottom this week with mining and packaging stocks taking losses.

UK Price Action

In last week’s UK Price Action we mentioned that “a break below the wedge could trigger a retest of last week’s lows”. This played out within the first two days of trading this week and the market has found support at the swing lows.

The current pattern in play is a descending triangle. A break below the triangle should see the market retest the broken Feb 2023 highs / new support. While a break above the triangle could reignite the FTSE’s long-term uptrend.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.