14th Feb 2025. 11.11am

Weekly Briefing – Friday 14th February

| Market | Movement this week (%)* |

|---|---|

| FTSE 100 | +0.47% |

| FTSE 250 | +0.83% |

| FTSE All-Share | +0.51% |

| AIM 100 | +1.30% |

| AIM All-Share | +1.07% |

* Price movement from Monday's open at 8am

Regency View:

Weekly Briefing – Friday 14th February

Market Overview

Dear Investor,

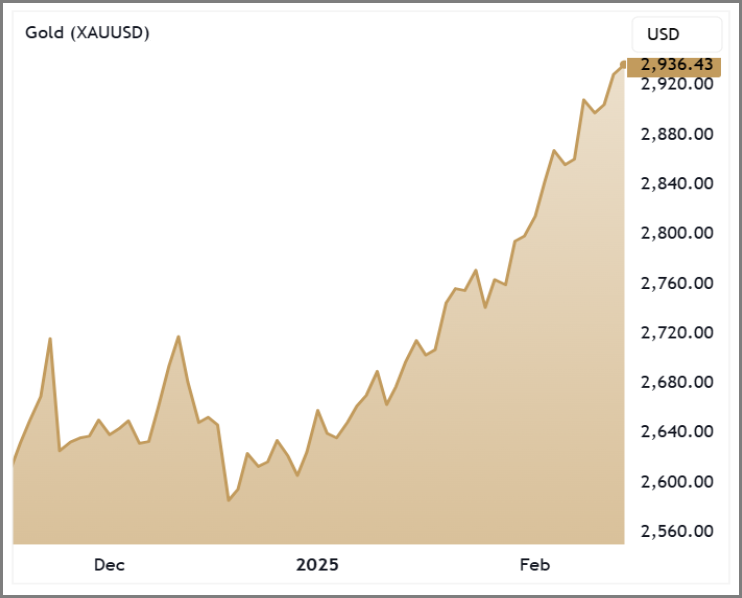

With it being Valentine’s Day, it seems only fitting that I write a love letter to gold…

This week, the precious metal has not only reached new highs but is also proving to be the standout trade in the latest round of Donald Trump’s tariff war. As 25% tariffs are imposed on steel and aluminium imports, gold continues to shine as the ultimate safe haven, drawing in investors seeking stability.

Markets have responded to the escalating trade tensions in a more erratic fashion. Stocks exposed to global supply chains, such as car manufacturers and consumer-focused names, have come under pressure, while currency markets have seen sharp reversals. USD/CAD surged to a 20-year high last week before swinging lower, highlighting the uncertainty. Gold, on the other hand, has reacted in a far more predictable manner—rising steadily as inflation fears creep higher and trade risks grow.

This latest move by Trump reinforces the underlying themes that have been supporting gold for some time. Uncertainty around trade policy, concerns over inflation, and the ongoing push by central banks to diversify their reserves all continue to drive demand. With governments and institutions increasing their gold holdings, the broader trend remains firmly in place.

With Trump’s trade policies keeping markets on edge, gold remains one of the standout performers this year. Whether this trade war escalates further or cools down in the months ahead, the market’s message is clear—gold is in demand.

Wishing you a fantastic weekend,

Tom

Market Movers

On the rise: Audioboom (AIM:BOOM) +24.6% on the week

Audioboom shares have been among the top risers this week, even in the absence of fresh operational news since their positive January trading update. The only notable development has been Chairman Michael Tobin increasing his stake through two separate purchases, bringing his total holding to 5.3% of the company.

While no clear catalyst has emerged, the strong share price movement may indicate that investors are reassessing Audioboom’s growth potential. The January update showed solid progress, with adjusted EBITDA turning from a loss into a $3.4 million profit, while revenue grew 13%. Of particular note was the impressive 56% year-on-year growth in Showcase, Audioboom’s high-margin ad marketplace, which continues to drive a significant portion of revenue.

With over $54 million already secured in revenue for 2025 at higher ad rates, the market might be beginning to recognise the company’s turnaround potential. Whether driven by the operational progress or sentiment shift, the recent price action suggests that Audioboom is gaining increasing favour among investors.

REGENCY VIEW:

Audioboom’s share price has surged on strong momentum, but the company remains a highly speculative play with volatile earnings and a weak profitability profile. Despite a forecasted return to profitability, its valuation looks stretched, and the stock’s momentum-driven rise could make it vulnerable to sharp reversals.

Tate & Lyle’s share price dropped sharply this week following a trading update that, while highlighting solid operational performance, also pointed to some challenges ahead…

The company reported volume and EBITDA growth, with strong cash flow and continued productivity savings, yet revenue for its Food & Beverage Solutions division was down 4% due to input cost deflation. Sucralose was a bright spot, posting a 19% increase in revenue, but Primary Products Europe saw a steep 24% decline.

The completion of the CP Kelco acquisition in November was a strategic milestone, expanding Tate & Lyle’s capabilities in pectin and speciality gums. Integration is progressing as planned, with management reaffirming their confidence in achieving US$50 million in cost synergies by 2027. However, market demand has remained softer than anticipated, and while contract renewals for 2025 suggest volume and revenue growth, geopolitical uncertainty and pricing pressures remain headwinds.

The revised full-year outlook reflects these pressures, with revenue now expected to decline in the mid-single digits and EBITDA growth forecast at the lower end of the previously guided 4-7% range. While Tate & Lyle continues to execute its long-term strategy, the cautious tone on near-term demand has weighed on investor sentiment, leading to the share price decline.

REGENCY VIEW:

Tate & Lyle’s shares have had a tough run recently, with the stock down over 16% in the last year. Despite this, the company remains financially solid, with strong cash flow and a healthy dividend yield of 3.6%, though there is some pressure on earnings growth moving forward.

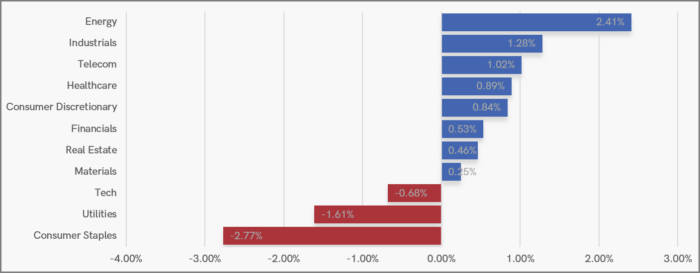

Sector Snapshot

It’s been a strong week for Energy with BP making gains following a stake increase from an activist investor. Industrials and Healthcare are having another strong week following last week’s earnings-season gains.

In terms of weakness, defensive Utilities are lagging again, and Consumer Staples are bottom of the pack with British American Tobacco dropping on earnings.

UK Price Action

It’s been another trend continuation week for the FTSE with the index powering to new highs on Wednesday before pulling back on Thursday. We’ll be watching the two ascending trendlines to see which will hold as the trend progresses.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.