13th Sep 2024. 10.48am

Weekly Briefing – Friday 13th September

| Market | Movement this week (%)* |

|---|---|

| FTSE 100 | +0.78% |

| FTSE 250 | +1.46% |

| FTSE All-Share | +0.86% |

| AIM 100 | +0.34% |

| AIM All-Share | -0.15% |

* Price movement from Monday's open at 8am

Regency View:

Weekly Briefing – Friday 13th September

Market Overview

Dear Investor,

It’s been an eventful week on the economic front, with new data from China, the UK, and the US giving us plenty to digest. While each economy is dealing with its own set of challenges, the overarching theme seems to be uncertainty, with inflation, labour markets, and consumer demand all in the spotlight.

In China, inflation continues to cool, with core inflation hitting its lowest level in over three years at just 0.3% year-on-year in August. Even the broader consumer price index (CPI) increased by only 0.6%, falling short of expectations despite food prices rising due to bad weather. On top of that, passenger vehicle sales have now dropped for the fifth consecutive month, reflecting soft consumer demand. All of this is raising concerns about China’s ability to hit its GDP growth target of 5%, with calls growing louder for more drastic measures to combat deflationary pressures.

Closer to home, the UK saw some improvement with unemployment dropping to 4.1% for the three months to July, down from 4.4% in the previous quarter. However, wage growth has slowed to 5.1%, its lowest since June 2022, and youth unemployment has surged to 13.3%, its highest in three years. Job vacancies have also been shrinking, which suggests the labour market may be tightening, but we’re still above pre-COVID levels. The UK’s aging workforce and disengagement from work are still dragging on productivity, and these issues will need to be addressed if the labour market is to strengthen further.

Across the pond, US inflation cooled to 2.5% in August, setting the stage for a widely anticipated interest rate cut from the Federal Reserve at their meeting on September 18. Core inflation remains steady at 3.2%, driven largely by rising shelter costs, but energy prices have pulled back, giving the Fed room to manoeuvre. With the probability of a 0.25% rate cut now at 85%, there’s cautious optimism that the Fed will continue to ease up on rates, though some still think a larger cut could be on the table depending on the labour market’s next move.

So, while the headlines are a bit of a mixed bag, there are signs of progress in some areas, and more clarity may come as central banks adjust their policies. We’ll keep a close eye on these developments as we move forward.

Wishing you a fantastic weekend,

Tom

Market Movers

On the rise: Endeavour Mining (LSE:EDV) +10.9% on the week

Endeavour Mining’s share price surged higher this week following a significant milestone for the company.

The West Africa-based gold producer successfully achieved commercial production at two of its major projects: the Sabodala-Massawa BIOX Expansion in Senegal and the Lafigué mine in Côte d’Ivoire. These developments, which were both delivered on budget and on schedule, marked an important step in the company’s growth strategy.

The commencement of commercial production at these sites will drive improved operational performance in the second half of the year, reinforcing Endeavour’s production guidance. Both projects are expected to contribute to low-cost production, extend the life of the mines, and enhance the company’s geographic diversification.

CEO Ian Cockerill expressed confidence in the company’s ability to meet its production goals, noting that the projects have de-risked the construction and ramp-up phases. As a result, investors reacted positively, propelling the stock higher in anticipation of strong future returns.

REGENCY VIEW:

Endeavour Mining’s commercial production success, strong EPS growth forecast, and a 4.28% dividend yield highlight its growth potential. Despite recent losses and modest margins, it’s appealing for investors seeking gold sector exposure. However, its volatility may pose risks for more conservative investors.

Oil and gas explorer, Chariot’s share price dropped sharply on Wednesday following the latest operational update regarding the Anchois-3 well in Morrocco. The sell-off can be attributed to several key factors highlighted in the announcement.

The primary reason for the sharp drop was the disappointing outcome of the well’s initial exploration objectives. The Anchois Footwall prospect, which was expected to hold promising reserves, was found to be water-bearing. This discovery led to the plugging and abandonment of the initial Pilot Hole, marking a significant setback for the project. Investors had high expectations for this exploration, and the failure to meet these expectations triggered a negative reaction in the market.

Additionally, while the well is still drilling and preliminary results suggest the presence of gas-bearing reservoirs in the B sands, these are part of the appraisal objectives rather than confirmed reserves. The need for further detailed analysis introduces uncertainty about the potential of these findings. The market generally reacts negatively to uncertainty, especially when initial results do not align with earlier projections.

The sharp drop in share price was also influenced by the timing of the announcement. It appears that the update was released earlier than anticipated, potentially due to Energean’s reporting requirements. This premature disclosure, combined with the less-than-expected results, may have exacerbated the market’s reaction.

REGENCY VIEW:

Chariot’s financials highlight ongoing difficulties, with a market cap of £44.28 million, a net loss of £15.6 million for 2023, and minimal revenue of £61.34k. Given these factors and the steep decline in key financial metrics, Chariot remains a highly speculative and risky investment.

Sector Snapshot

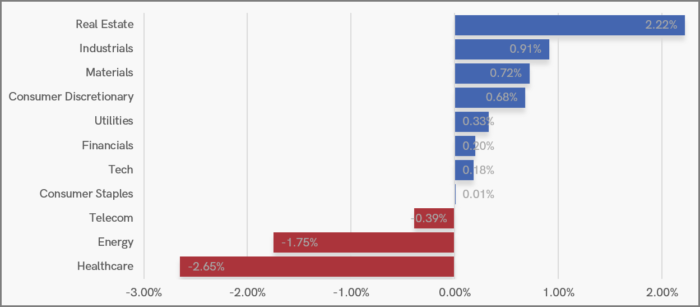

This week’s Sector Snapshot is very much a split pack with Real Estate bouncing back from last week’s losses and Healthcare showing weakness due to a sell-off in pharma stocks.

On a 3-month basis (not shown below), the UK market has a defensive tilt, with Utilities and Consumer Staples making the largest percentage gains, and Energy and Materials lagging the wider market.

UK Price Action

This week’s price action on the FTSE 100 is indicative of a market in short-term equilibrium. A small range has formed around the 50 day moving average (MA). Those looking to trade the index can use this mini-range as a catalyst for trading breakouts in either direction.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.