12th Jul 2024. 10.42am

Weekly Briefing – Friday 12th July

| Market | Movement this week (%)* |

|---|---|

| FTSE 100 | +0.42% |

| FTSE 250 | +1.81% |

| FTSE All-Share | +0.64% |

| AIM 100 | +1.48% |

| AIM All-Share | +1.52% |

* Price movement from Monday's open at 8am

Weekly Briefing – Friday 12th July

Market Overview

Dear Investor,

This week, the UK economy and the English football team have both scored unexpected goals. Just as Ollie Watkins’ last-minute winner propelled England to their first final on foreign soil, Thursday morning’s UK GDP data revealed surprising buoyancy.

For the English football team, Watkins’ dramatic goal in the final moments of the match against the Netherlands epitomised resilience and tenacity. It was a moment of brilliance that defied expectations of extra time, securing England’s place in the Euro 2024 final.

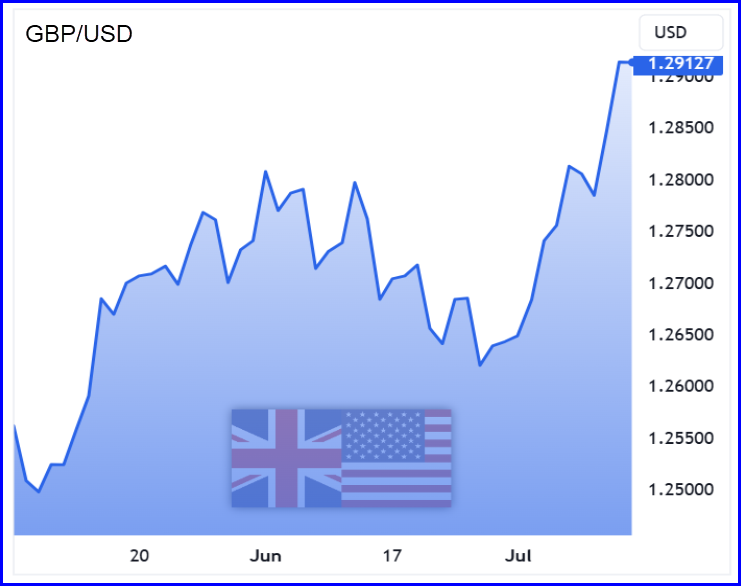

Similarly, the UK’s economic performance in May, with GDP growth of 0.4%, exceeded modest forecasts of 0.2%. This growth, driven by robust activity in the services sector and a rebound in housebuilding, reflects the economy’s ability to bounce back despite previous stagnation. The positive growth figures gave sterling a boost – taking GBP/USD towards 12-month highs.

Both the football victory and the economic growth share themes of resilience, strategic execution, and the importance of critical contributions at pivotal moments. Just as the football team’s success hinged on standout performances from players like Watkins and Foden, the economy’s growth was supported by key sectors demonstrating strength and adaptability.

While I’ve stretched the parallels between economics and English football far enough, there’s an undeniable sense of optimism and positivity in the air. Let’s hope we continue to feel this way after Sunday’s final!

Wishing you a fantastic weekend,

Tom

Market Movers

On the rise: The Gym Group (LSE:GYM) +16.5% on the week

Shares in The Gym Group surged higher this week following a strong trading update that highlighted continued positive trading trends in the first half of 2024.

The company, known for its low-cost gym model, reported a 12% increase in revenue, amounting to £112.1 million compared to £99.8 million in H1 2023. Membership also saw a rise, with numbers reaching 905,000 as of 30 June 2024, up from 867,000 the previous year and 850,000 at the end of 2023.

Key metrics showed robust performance, with the average revenue per member per month (ARPMM) up by 9% to £20.44, from £18.81 in H1 2023. Additionally, like-for-like revenue grew by 9% year on year. The company expanded its footprint by opening four new gyms during H1 2024, bringing the total to 237 gyms, with another four in the pipeline set to open shortly. The Gym Group aims to open a total of 10-12 new gyms by the end of the year, aligning with its expansion strategy.

Financially, the Group improved its cash flow, reducing net debt to £54.6 million as of 30 June 2024, from £66.4 million at the end of 2023. CEO Will Orr expressed confidence in the Group’s progress under its Next Chapter growth plan, emphasising good growth in membership and yield, along with a strengthened financial position.

REGENCY VIEW:

Gym Group plans to fund its opening of 50 sites over the next three years from free cash flow – this self funded growth is a strong sign and the company expects to achieve full-year results at the higher end of market expectations. However, whilst top line growth is strong, Gym Group’s track record for profitability is weak, and its debt heavy balance sheet is a concern.

PageGroup’s share price dropped sharply on Tuesday after the company issued a profit warning, citing a continued hiring slowdown.

The Surrey-based recruitment firm reported a gross profit of £224.3 million for the second quarter, which is down 12% year-on-year in constant exchange rates. This decline is attributed to employers becoming increasingly risk-averse and tightening their recruitment budgets amidst a harsh economic climate. The company also noted that despite strong salary levels, job offers were not as competitive as in the previous two years, and candidates were reluctant to change jobs.

PageGroup’s outlook for the remainder of the year is cautious, with no immediate signs of improvement in most of its markets. As a result, the company expects its annual operating profits to fall to around £60 million, significantly lower than the £118.8 million reported last year and below analysts’ expectations of approximately £90 million.

The recruiter operates in 37 countries and reported weak results across most of its markets, including the US, France, Germany, and Britain. In the UK, profits fell by 17.4%, while mainland China saw a 25% decline, and Hong Kong’s profits dropped by 38%.

Despite the initial sell-off on Tuesday morning, the shares have since bounced back and erased some of the losses, the shares are down more than 13% year-to-date.

REGENCY VIEW:

Whilst PageGroup have robust underling financials, the shares trade on a forward price-to-earnings ratio of 20. This premium valuation looks unappealing against a backdrop of tightening market conditions in the recruitment sector.

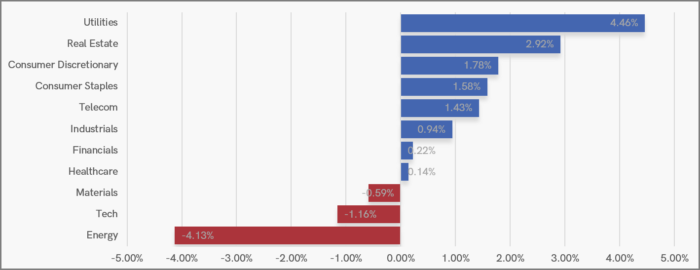

Sector Snapshot

Utilities surged higher this week as water regulator Ofwat announced it would allow average bills to be raised by 21%.

While the Energy sector was dragged lower by BP after the firm flagged it expects to post an impairment of up to $2 billion in the second quarter and warned of lower refining margins weighing on its results.

UK Price Action

The FTSE’s consolidation phase has continued this week with prices continuing to funnel within a wedge pattern. This form of sideways consolidation is typical of the summer months, where trading volumes tend to be lower.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.