10th Nov 2023. 11.02am

Weekly Briefing – Friday 10th November

| Market | Movement this week (%)* |

|---|---|

| FTSE 100 | -0.78% |

| FTSE 250 | -1.16% |

| FTSE All-Share | -0.83% |

| AIM 100 | +0.71% |

| AIM All-Share | +0.46% |

* Price movement from Monday's open at 8am

Regency View:

Weekly Briefing – Friday 10th November

Market Overview

Dear Investor,

This week’s upbeat trading statements from housebuilders, Persimmon and Taylor Wimpey, have sparked optimism and renewed confidence in the UK housing market. These statements suggest that the market may be entering a phase of recovery after a torrid period of rising rates and economic uncertainty.

Persimmon, reported “a strong pick-up” in home sales in October, signalling an increased demand for residential properties. And Taylor Wimpey, delivered an optimistic update on its profits, with expectations of annual operating profits nearing £470 million. While this figure represents a decline compared to the record levels seen in 2022, it still reflects a notable recovery in profitability.

These positive trading statements are not isolated occurrences but rather part of a broader trend in the UK housing market. Data from mortgage lenders Halifax and Nationwide recently revealed month-on-month increases in house prices, marking the first time this has occurred since the spring.

The main catalyst behind the turnaround is the Bank of England’s decision to pause its interest rate increases. Stable borrowing costs have alleviated some of the financial pressures that had previously deterred potential homebuyers.

Despite these positive indicators, it’s important to exercise caution and not assume that the UK housing market will experience an overnight transformation. The recovery is likely to be sluggish and various challenges still exist, such as ongoing affordability pressures.

However, the overall sentiment is changing and the darkest days for the UK housing market may be behind us. The coming months will provide a clearer picture of whether the recovery is sustainable. For now, the upbeat trading statements from Persimmon and Taylor Wimpey suggest that the housing market is moving in a positive direction, which is good news for homeowners, investors, and the broader UK economy.

Wishing you a fantastic weekend,

Tom

Market Movers

On the rise: Marks & Spencer (LSE:MKS) +11.1% on the week

Marks & Spencer half year numbers showed impressive sales growth, with a 10.8% increase to £6.2 billion. This growth was seen across all their business segments. Notably, UK Food outshined the rest, with a 14.7% rise in sales to £3.8 billion, driven by increased market share and higher sales volumes.

Their pre-tax profit also saw a significant boost, climbing from £208.5 million to £325.6 million. This improvement was made possible by implementing cost-cutting measures and improving profit margins in both the UK Food and UK Clothing & Home segments.

Marks & Spencer’s financial position has strengthened, as they managed to generate a free cash inflow of £25.6 million, compared to a cash outflow of £215.5 million in the previous year. Additionally, the company successfully reduced its net debt from £2.9 billion to £2.6 billion.

For shareholders, the company has reinstated dividend payments, starting with an interim dividend of 1p per share.

REGENCY VIEW:

M&S has been the best-performing retail stock in the UK during the past year, and its turnaround has been impressive given the tough macro conditions. The outlook for the future remains positive, with strong trading expected in October and a promising Christmas period.

However, the stock trades on a forward PE of 11.8 and this looks expensive relative to its peer group and the long-term challenges facing high street stores.

ITV’s share price dropped sharply this week after publishing a disappointing Q3 trading update…

The media group reported a 1% increase in third-quarter revenue, reaching £3.0 billion. However, total advertising revenue (TAR) decreased by 7%, primarily due to the challenging economic environment. Digital advertising revenues showed strong growth, but this was offset by declining traditional advertising. The Media & Entertainment sector experienced a 7% decline in revenue, amounting to £1.5 billion.

In contrast, the Studios business saw a 9% increase in revenue, totalling £1.5 billion. ITV mentioned that the demand for content from free-to-air TV has been impacted by economic difficulties, and the ongoing US writers’ and actors’ strike is causing some revenue to be deferred to the next year.

Given the challenging conditions, ITV plans to postpone £10 million of content spending to the following year and is actively reviewing its cost structure. It is anticipated that total advertising revenue will decline by 8% for the full year.

REGENCY VIEW:

ITV heavily relies on advertising revenue from its traditional television channels, but this revenue source is shrinking as companies tighten their marketing budgets due to uncertain economic conditions. While digital advertising is growing, it doesn’t yet compensate for the decline in traditional advertising.

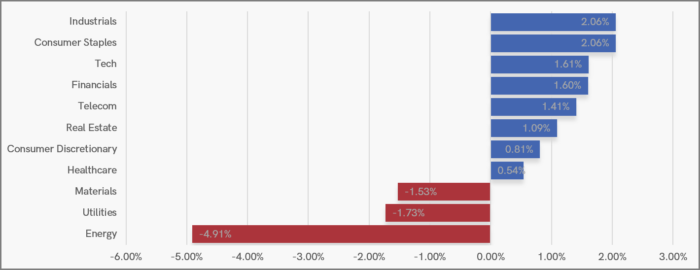

Sector Snapshot

Consumer Staples are topping the Sector Snapshot chart this week – led by Associated British Foods (ABF) which released a market-beating set of Annual Results. We published a BUY recommendation on ABF in early-October – click here to read our full report.

Energy stocks have weighed heavily on the FTSE this week as Brent crude dropped to a two-month low as the conflict in Gaza remained contained.

UK Price Action

It’s been a week of choppy sideways consolidation for the FTSE. There isn’t too much that can be taken from this price action other than the market is in short-term equilibrium – favouring short term mean reversion strategies.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.