10th May 2024. 11.15am

Weekly Briefing – Friday 10th May

| Market | Movement this week (%)* |

|---|---|

| FTSE 100 | +3.43% |

| FTSE 250 | +3.22% |

| FTSE All-Share | +3.38% |

| AIM 100 | +2.75% |

| AIM All-Share | +2.55% |

* Price movement from Monday's open at 8am

Regency View:

Weekly Briefing – Friday 10th May

Market Overview

Dear Investor,

The Bank of England chose to keep its benchmark interest rate steady at 5.25% yesterday. However, it hinted at a possible rate cut in the summer if inflation remains low.

Governor Andrew Bailey stated that while a rate cut in June wasn’t ruled out, more evidence is needed before making a decision. The Bank’s message suggested a cautiously optimistic tone regarding future rate adjustments.

There’s division within the Monetary Policy Committee regarding the timing of rate cuts. Some members advocate for immediate cuts due to a downward trend in inflation. However, uncertainty persists, particularly regarding the labour market and services price inflation, which remains high at 6%.

Forecasts indicate that inflation will briefly reach the bank’s 2% target before rising again. Despite projections of economic growth, the overall outlook remains modest. The Bank predicts a slight increase in GDP but at a slow pace. This suggests a cautious approach to future interest rate adjustments.

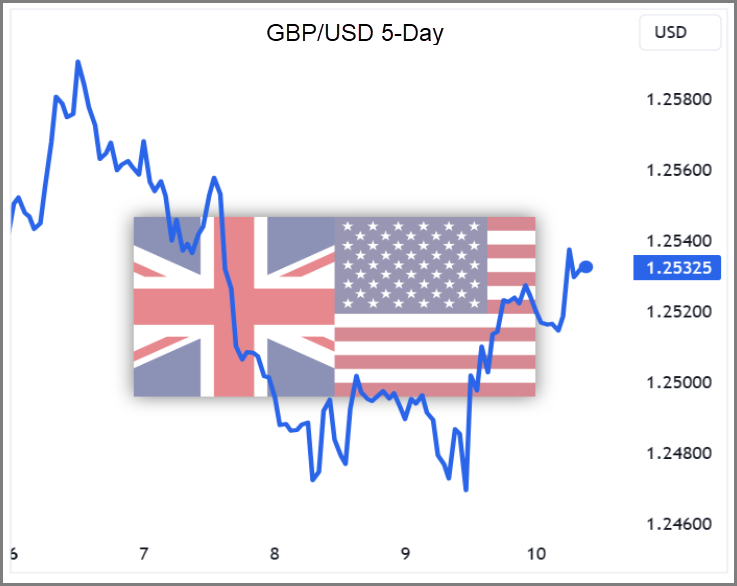

The reaction across financial markets was relatively muted, GBP/USD put in a ‘drop and pop’ as the market priced-in Bailey’s back tracking while the FTSE 100 barely flinched as it continued its strong recent run higher.

Wishing you a fantastic weekend,

Tom

Market Movers

On the rise: Wood Group (LSE:WG.) +29.6% on the week

Engineering services firm, Wood Group saw a surge in its shares this week following the rejection of a takeover bid from Dubai’s Sidara.

The bid valued Wood at over £1.4bn, representing a significant premium, but Wood’s board deemed it undervalued the company.

Sidara now has until June to decide on another offer. Wood had faced similar bids before, notably from Apollo. The event reflects a trend of foreign firms eyeing undervalued London-listed companies.

Wood Group operates globally, providing consultation, management, and engineering services primarily to the oil and mining sectors. It employs around 6,500 people in the UK, mostly in Aberdeen.

In recent times, Wood has focused more on sustainable ventures amidst the energy transition. The firm aims to assist companies with decarbonisation efforts, aligning with broader environmental goals.

REGENCY VIEW:

Whilst the bid rumours have bolstered Wood Group’s performance, the shares have all the hallmarks of a momentum trap. Topline growth has is muted, free cashflow is negative the company’s balance sheet has high levels of debt relative to cash. And with the shares trading on a eye-wateringly high forward price-to-earnings multiple of 25, we would stay clear.

Shoe Zone’s share price has continued to fall following a disappointing trading update in March.

The retailers share price is down -11.9% over the last month and more than -20% since the turn of the year – dramatically underperforming the wider market.

In March, Shoe Zone said current trading had been impacted by various factors, including higher labour costs, increased container expenses due to ongoing Suez Canal issues, property portfolio upgrades, and a slower end to the Autumn/Winter season.

Whilst their has been no significant newsflow since the March AGM statement, the shares have continued to tumble as investors price in the impact of a downturn on the British high street.

REGENCY VIEW:

Shoe Zone operates a strong business model which generates plenty of cash and delivers impressive returns to shareholders (1yr Return on Equity 42.1%). However, the negative outlook for the retail sector is weighing on the share price, and this week’s update hasn’t helped change this narrative.

Sector Snapshot

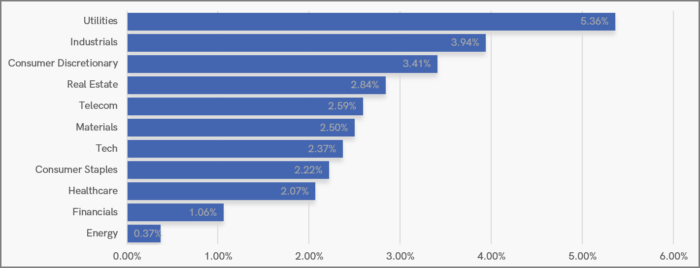

It’s another week of gains for our Sector Snapshot, but this week an interesting sub plot is developing…

Utilities, the most defensive sector, is leading the pack. This can indicate that investors are becoming concerned that valuations are high following the recent bull run – buying defensive stocks to protect themselves against potential profit taking across the wider market.

UK Price Action

The FTSE’s bull run has continued this week with the market posting several consecutive sessions of gains. For long-term investors, this is a great time to spring clean your portfolio and get rid of any underperforming dead wood. Short-term traders will be watching for signs of buying exhaustion – weak closes relative to intra-day highs.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.