10th Jan 2025. 10.52am

Weekly Briefing – Friday 10th January

| Market | Movement this week (%)* |

|---|---|

| FTSE 100 | +0.97% |

| FTSE 250 | -3.33% |

| FTSE All-Share | +0.37% |

| AIM 100 | -1.37% |

| AIM All-Share | -0.99% |

* Price movement from Monday's open at 8am

Regency View:

Weekly Briefing – Friday 10th January

Market Overview

Dear Investor,

It’s the end of our first full week of 2025, and already some key narratives are starting to emerge both domestically and globally.

In the UK, the bond market has taken centre stage. Yields on 10-year gilts have reached levels not seen since 2008, driven by a deepening sell-off that has placed significant pressure on borrowing costs.

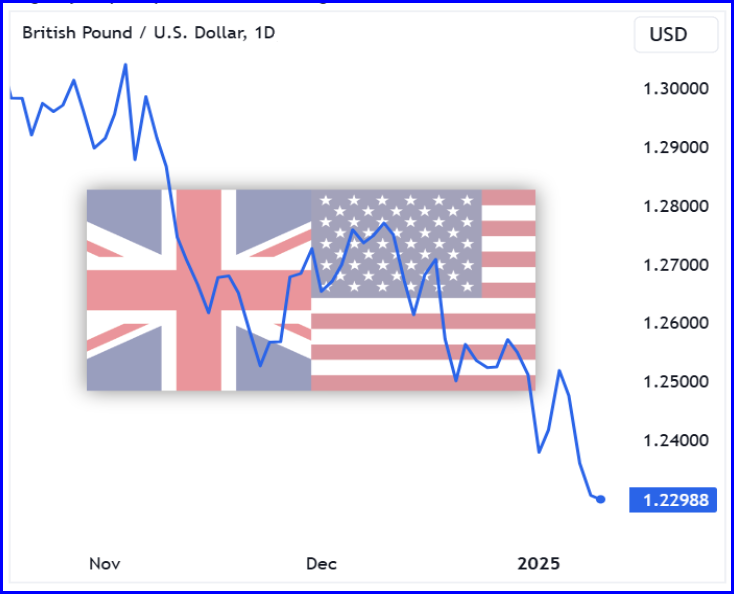

This shift comes as concerns over stagflation — the worrying combination of sluggish growth and persistent inflation — take hold. The pound has also been caught in the crossfire, dropping to its weakest level against the dollar in over a year.

The market is growing increasingly wary of the government’s fiscal prospects, particularly after Chancellor Rachel Reeves announced a tight budgetary headroom in her recent fiscal plan. Rising yields are threatening to erode this already narrow buffer, raising questions about the sustainability of current fiscal policies.

Globally, attention has turned to China, where the renminbi has hit a 16-month low against the dollar. The currency’s weakness reflects not only domestic economic pressures but also the broader implications of a resurgent dollar and fears over incoming US trade policies.

Donald Trump’s proposed tariffs on Chinese goods are stoking concerns about export competitiveness, prompting speculation that the People’s Bank of China may have to allow further currency depreciation to offset potential losses. The central bank, however, remains steadfast in its commitment to maintaining stability, even as investor impatience grows.

We expect Trump tariffs and UK stagflation to be key narratives in Q1 and the fun has started already!

Wishing you a fantastic weekend,

Tom

Market Movers

On the rise: International Consolidated Airlines (LSE:IAG) +5.4% on the week

IAG is among the FTSE 100’s top risers this week, buoyed by a bullish outlook from Citi on European airlines…

Citi highlighted strong pricing momentum on transatlantic routes, driven by supply constraints and market consolidation. With North Atlantic capacity estimated to have been constrained by around 20% this year and South Atlantic by 17%, Citi believe IAG’s strong market share in these routes positions it to take advantage of these favourable conditions.

Citi’s report emphasised IAG’s strategic advantages compared to its peers. While Lufthansa was upgraded to “buy” due to anticipated productivity gains and potential geopolitical benefits, such as a possible ceasefire in Ukraine, and Ryanair remained a top pick for its pricing power and cash returns, Air France-KLM was downgraded to “neutral” because of cost pressures and regulatory uncertainties in France.

IAG’s dominance in transatlantic travel, supported by its British Airways brand, aligned it well to benefit from the capacity constraints and pricing strength that Citi expected to continue. This optimism, combined with the airline’s market positioning, bolstered investor confidence and its share price performance this week.

REGENCY VIEW:

IAG was one of the FTSE 100’s top performers in 2024, with its share price surging nearly 91% over the year. Despite its high leverage and weaker liquidity ratios, the stock’s forward P/E of 6.2 and recovery-driven profitability suggest there’s room for further growth, underpinned by strong travel demand.

Shares of Greggs tumbled to their lowest level since November 2023, as the company reported a notable slowdown in fourth-quarter growth. Like-for-like sales rose 2.5% in the Christmas quarter, falling short of the 5% growth achieved in Q3, as weak consumer confidence weighed on demand for its festive menu and core offerings.

Despite the subdued performance, Greggs reaffirmed its full-year profit forecast, with analysts expecting underlying pre-tax profit to rise to £188 million, up from £168 million in 2023. CEO Roisin Currie acknowledged the challenges of a difficult second half in 2024 and cautioned that similar conditions are likely to persist in 2025. Nonetheless, the company plans to press ahead with its growth strategy, targeting 140–150 new shop openings in 2025, building on the 145 net additions last year. Currie also highlighted Greggs’ focus on mitigating inflationary pressures, projected to remain in the mid-single digits, by controlling costs and maintaining its value-for-money positioning.

Looking ahead, Greggs is leveraging menu innovation and customer incentives to counter weak consumer sentiment. Initiatives such as a January loyalty bonus for lunchtime sandwiches and the introduction of spicy vegetable curry bakes aim to attract footfall and drive sales. While the company faces rising costs, including higher employer taxes and minimum wage increases, it remains committed to delivering “another year of progress” by balancing cost pressures with its ongoing commitment to delivering affordable, freshly prepared food.

REGENCY VIEW:

Greggs has struggled recently as slower growth and a challenging market have dampened investor sentiment. Despite this, the company’s long-term growth potential remains intact, with steady revenue increases and plans to open up to 150 new locations in 2025.

Sector Snapshot

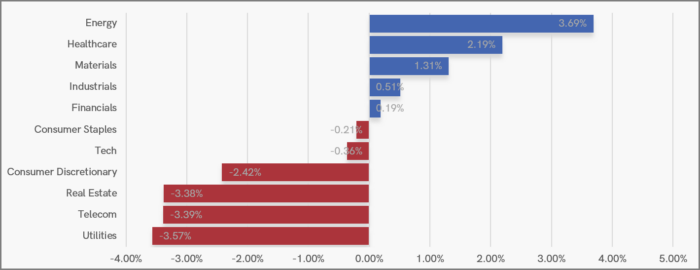

We’ve seen a clear split in our seven-day UK Sector Snapshot as we start the New Year. Energy, Healthcare and Materials are showing strength, while Utilities, Telecoms, Real Estate, and Consumer Discretionary are showing clear weakness.

Energy has been buoyed by OPEC’s decision to extend production cuts through 2026. While Consumer Discretionary has struggled following a lacklustre festive period. It remains to be seen if this New Year sector rotation is the start of a longer-term theme.

UK Price Action

The FTSE has rallied from the bottom of the range and started the New Year with strength. The index is now within touching distance of key resistance – an area if tested next week may see the market reverse.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.