19th Oct 2018. 2.12pm

Regency View:

Update Example

Regency View:

Update

Kape’s H1 operating profit jumps 299%

Kape Technologies (KAPE) have been a standout performer in our AIM Investor portfolio this year and have consistently beat market expectations…

In this week’s Half-Year results, the digital security company announced a 299% jump in operating profit to $13.6m and a 61.9% increase in revenue to $95.5m.

High levels recurring revenue and cashflow are the key elements of a well-executed Software as a Service (SaaS) model and Kape have seen recurring revenue increase 16.4% to $59.1m and operating cashflow jump 114% to $12.6m.

Commenting on the strong numbers, CEO Ido Erlichman said:

“2021 is shaping to be a truly exceptional year for Kape. Pleasingly, our underlying business has continued to deliver record financial results alongside the hugely impactful acquisitions of both Webselenese, and more recently, ExpressVPN…”

“We believe Kape is positioned better than ever before to capitalise on the growth in the digital security and privacy market, which is showing no signs of abating, and we look to the future with confidence in delivering ongoing growth and realising significant value for all our key stakeholders” he added.

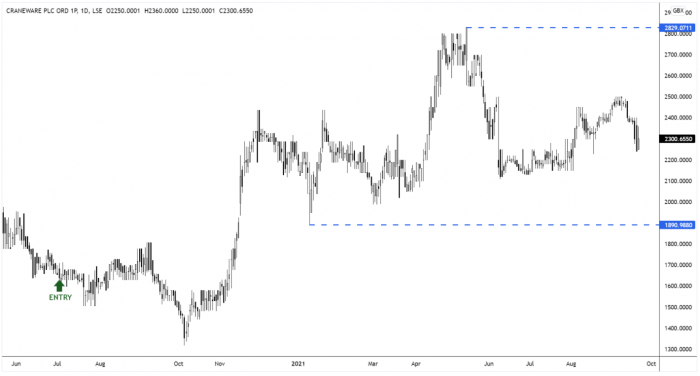

Craneware sees strong adoption of cloud-based platform

Craneware (CRW) released a solid set of Final Results this week in which Full-Year revenue increased 6% to $75.6m and adjusted earnings jumped 8% to $27.1m.

The US-focused healthcare fin-tech group said they had seen a strong adoption of their Trisus cloud-based platform, paving the way for accelerated future growth.

CEO Keith Neilson commented:

“With a strong balance sheet, high levels of recurring revenues, high customer retention rates and visible revenue in the next three years of $471.2m, we have a strong financial foundation from which to accelerate growth and to fulfil our potential, thereby increasing future shareholder value.”

Mr Neilson also commented on Craneware’s ‘transformational’ acquisition:

“The successful completion of the acquisition of Sentry Data Systems following the end of the year marks a transformational point in our journey, considerably expanding our customer base, data sets, product offering and market presence.”

Central Asian Metal’s balance sheet continues to strengthen

Central Asian Metals (CAML) saw Free Cash Flow surge 131% to $48.9m during the first half of 2021.

The copper miner said strong commodity prices had driven the increased cashflow and a 51% jump in earnings during the period.

CAML’s balance has continued to strengthen with accelerated debt repayments and $54.3m cash in the bank – allowing CAML to declare a dividend of 8p per share.

Copper production at their Kounrad mine hit 6,214 tonnes, up from 6,607 tonnes (H1 2020). While Zinc production at their Sasa mine dropped to 11,292 tonnes from 12,203 tonnes (H1 2020).

CEO Nigel Robinson commented:

“The outlook for the remainder of 2021 is positive for CAML, with strong demand for the metals that we produce, and we are on track to meet our output guidance from Sasa and Kounrad.”

Whilst the shares have tracked sideways during the last three months, they have shown high levels of strength relative to their large-cap peers and we are happy to continue to hold them in our AIM Investor portfolio.

Learning Technologies upbeat on performance of enlarged group

Growth via acquisition group Learning Technologies (LTG) saw a solid 29% improvement in Half-Year revenue to £82.6m with first time contributions from Reflektive, PDT Global and Bridge.

Organic revenue growth came in at 7% during the period thanks to a strong recovery in professional services.

Recurring revenue dropped to 77% verses 81% (H1 2020), while adjusted earnings increased 20% to £22m.

CEO Jonathan Satchell commented:

“Following this excellent first half performance, including the integration of our three most recent acquisitions, we are excited about the potential to generate further substantial shareholder value from the addition of GP Strategies, which is expected to complete in Q4 2021…”

“The enlarged business provides a platform for further organic growth in a marketplace that is increasingly receptive to solutions that help organisations efficiently recruit, train, motivate and retain their people” he added.

Cohort expect to return to higher rate of growth by 2023/24

Defence tech group Cohort (CHRT) released a brief trading update alongside their AGM statement this week…

Cohort said it “entered the new financial year with a substantial long-term order book of £242.4m, underpinning nearly £100m (2020: £84m) of current financial year revenue, representing 64% of expected consensus revenue for the year.”

The update highlighted several headwinds created by the pandemic such as restrictions on travel, work and social interaction and global supply chain challenges.

However, despite the headwinds, Cohort expect current year performance to be “slightly ahead of that achieved for the year ended 30 April 2021”, and they remain “optimistic that the Group will return to a higher rate of growth in 2023/24, based on current orders for long term delivery and our strong pipeline of opportunities”.

Restore achieved further positive trading momentum

Restore (RST) released an upbeat trading statement last week in which it said trading in July and August has continued the positive momentum achieved throughout the year…

The document storage specialist said customer demand continued to increase across all business units with particularly strong demand growth experienced in Technology, Datashred and Harrow Green in August.

Restore also said it continues to deliver positive net box growth in its Records Management business and restated previous guidance of between 1-2% box growth for 2021.

Charles Bligh, CEO, commented:

“I am particularly pleased with the sales activity levels across all the business units which shows real demand for our mission critical services. The summer period saw first half positive momentum continued and consequently the Board remains very confident in delivering its full year expectations and in line with our objective of significant growth.”

The shares have started to form a strong uptrend in recent weeks, and the shares look set to retest their pre-pandemic January 2020 highs at 560p.

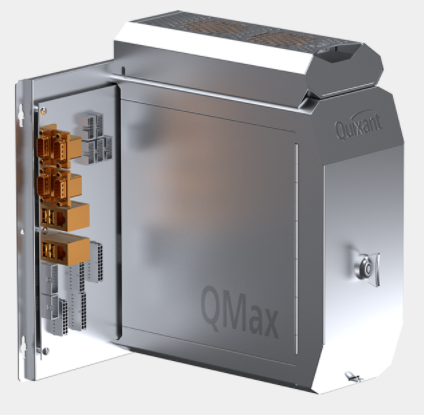

Quixant delivers double-digit revenue growth

Quixant’s (QXT) Interim Results made for pleasant reading with double-digit revenue growth across all divisions…

The casino and gaming tech firm said a strong order intake provides 115% order coverage of full year revenue expectations and visibility into 2022.

However, they cautioned that component shortages and price inflation is expected to persist and continue to cause temporary profit margin volatility.

Group revenue jumped 31% during the six months to June 30 2021 to $36.5m and gross profit increased 25% to $11.1m.

“The long-term outlook is positive given increasing demand and the Group’s strategic market positioning” read the closing statement.

We’ve been pleased with how Quixant’s share price has performed during since entering at the start of the year. We will continue to monitor Quixant’s price action as its uptrend evolves.

Character Group’s trading update disappoints

Character Group (CCT) broke lower last week following a disappointing trading update…

The children’s toy creator said full year results have been affected by “global logistical challenges” such as the ongoing delays at ports, shipping and container shortages, exponential increases in freight rates, and increased costs of inland transportation in China and the UK.

Character also said that pressure on the costs of production in China due to higher raw material and labour costs had impacted profitability.

“The immediate outlook for an early improvement in supply chain efficiency to ensure timely fulfilment is currently unclear” read the statement – spooking investors.

The shares gapped lower on the trading update and have since been consolidating in a tight range. We will continue to monitor Character’s price action and the ongoing impact of the pandemic on their supply chain problems.

Keywords Studios sees revenues rise as games industry gears up

Keywords Studios (KWS) recent Interim Results showed continued growth in profitability and cash generation…

Organic revenue in the First Half jumped 22.9% while total revenue leapt 37.6% to €238.7m – boosted by four acquisitions totalling €105m during the period.

Keywords cash conversion was also very strong with Adjusted Free Cash Flow of €37.7m (H1 2020: €10.9m) and an Adjusted Cash Conversion rate of 94.9% (H1 2020: 50.2%).

Keywords CFO, Jon Hauck expects the strong demand to continue with “full year performance in line with recently increased market expectations”.

“Our financial strength leaves us well placed to continue to complement organic growth with value-accretive acquisitions” he added.

The shares have recently undergone a key technical breakout – pushing above the January and April highs.

This has been followed by a steady retracement, taking prices back down into the broken resistance level which we would now expect to provide support moving forward.

Xpediator’s H1 revenue jumps 27.1%

Freight forwarding and logistics firm, Xpediator (XPD) released a robust set of Interim Results last week…

Group revenue jumped 27.1% to £126.6m and Adjusted profit before tax increased more than 70% to £3.6m.

Freight Forwarding revenue increased 28.5% to £100.8m, driven primarily by growth in CEE, enhanced sea freight rates and successful implementation of a UK customs clearance department.

Logistics and Warehousing revenue increased by 22.0% to £22.9m, with a continued strong performance from the Romania Pallex business. And Transport Support Services revenue increased by £0.5m to £3.0m.

Chairman, Alex Borrelli commented:

“The Group is expecting a further strong operational and financial performance in H2 2021.”

It’s very early days for our position in Xpediator and we expect the shares to hold support at 64p.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.