4th Mar 2021. 8.58am

Regency View:

BUY Serica Energy (SQZ)

Regency View:

BUY Serica Energy (SQZ)

Serica’s strong cashflow stands out from the pack

A lot can change in a year.

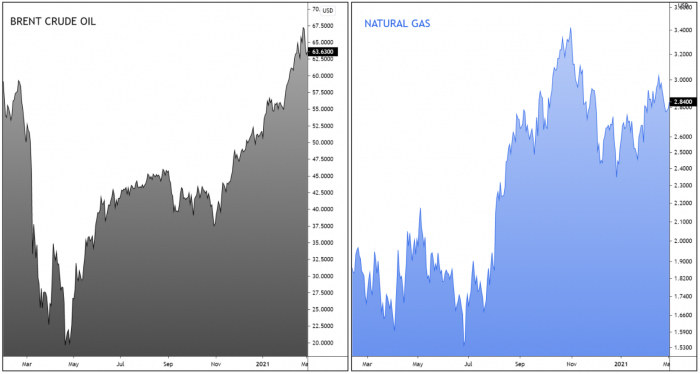

When Brent crude touched $17 a barrel and WTI went sub-zero, the oil market looked broken.

Fast forward twelve months, Brent’s back at $63 and two of the biggest banks on Wall Street are calling a new “supercycle” in oil.

JPMorgan Chase and Goldman Sachs both predict crude prices will head towards $100 this year as the pandemic abates and economic stimulus measures kick in.

The price of natural gas, while considerably more stable than crude, has also undergone a sharp recovery from its spring 2020 lows…

Like oil, the medium-term outlook for natural gas is bullish, with the supply side of the market remaining tight as it heads into ‘injection season’ (April-October) – the time when natural gas is injected into salt caverns for storage.

Supercycle or not, the oil & gas sector is building momentum and we’re keen to add some exposure to this in our AIM investor portfolio…

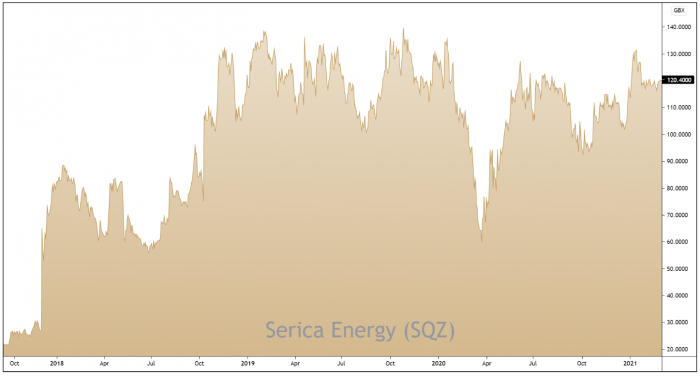

Serica Energy (SQZ) is a British upstream oil & gas producer with operations centred on the UK North Sea.

It is debt free with strong cash flows and a high-quality asset base – making it the outstanding candidate from the many AIM-listed stocks within the oil & gas sector.

Following the completion of a series of deals at the end of 2018, Serica became a major player in the UK Continental Shelf (UKCS) – the region of waters surrounding the UK, in which it has mineral rights…

Serica bought the Bruce, Keith and Rhum assets (known as BKR) from BP, Total and BHP – taking Serica’s average net production from around 2,000 boe/d (barrels of oil equivalent per day) to over 30,000 boe/d – making it one of the largest independent operators on the UKCS.

Alongside BKR, Serica is also a partner in the producing Erskine field and is the development operator for the Columbus gas-condensate field, both located in the UK North Sea.

Over 80% of Serica’s production is natural gas, and for 2021 & 2022 Serica has swaps (hedging derivatives) in place “covering up to 25% of retained gas sales” and this protects them against severe downside from a drop in gas prices while allowing most of the upside benefit.

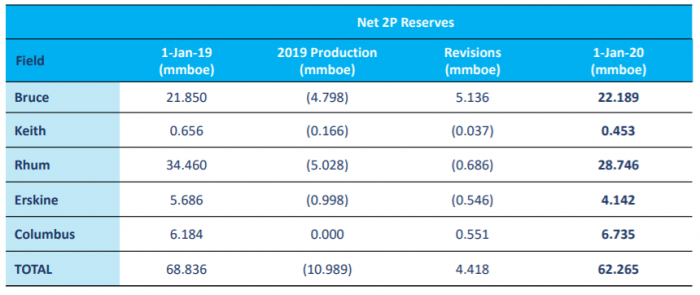

Last year, Serica commissioned a new Competent Person’s Report (specialised review of reserves) and it identified several upgrades to 2P Reserves estimates (proven reserves + probable reserves).

Strong cashflow set to get even stronger

As part of the deal for the BKR fields, Serica agreed to pay a staggered cut of Net Cash Flow to the original vendors.

This meant that Serica received 40% of the Net Cash Flow from BKR in 2018, rising to 50% in 2019, 60% in 2020 & 2021 and 100% thereafter. Hence next year, Serica is set to receive a considerable boost to its operating cash flow (up 66% from current levels).

This boost to cashflow comes from an already robust position…

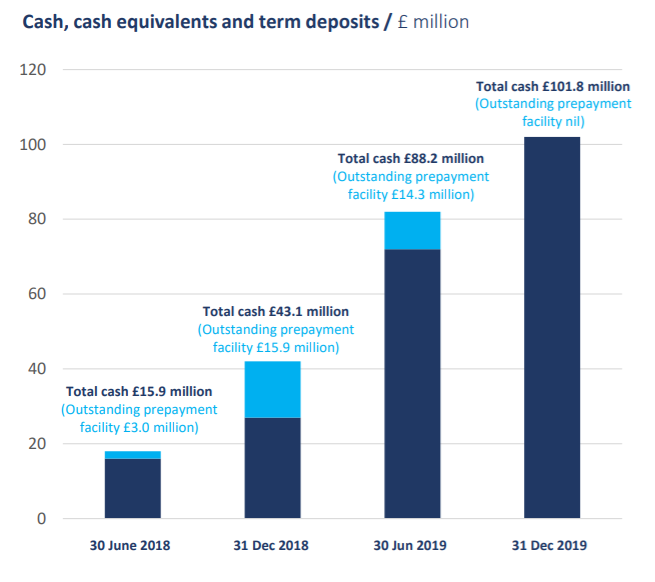

Serica has paid off its debt and has a net cash position north of £100m – allowing the board to approve a 3p/share maiden dividend in July last year.

The balance sheet was stress-tested prior to the dividend announcement and Serica said that even with a three-month production outage plus extended low natural gas prices it can still afford the dividend.

High-quality growth opportunities

Just as cashflow is set to increase in 2022, so too is Serica’s production capabilities.

The Columbus field, of which Serica own 50% is set to come on-line later this year and is expected to yield net production rates of around 3,500 – 4,000 boe/d.

There are also other project opportunities within the BKR area which could provide further production growth. One example, which is already underway is the Rhum field’s third well project (R3).

R3 is an old BP-drilled well that was never put into production and has the potential to add “significant production volumes” according to Serica CEO Mitch Flegg.

Serica are also looking to use their cash pile for acquisitive growth with a focus on value not volume.

“We aim to expand the portfolio at all stages – exploration, appraisal and production” said Flegg…

“Nobody really cares how many barrels we produce. They care how many dollars we make…”

“If there’s a deal that brings fewer barrels but gives us more value, then that’s what we want to do.”

Serica’s shares are currently changing hands at a very reasonable forward price/earnings multiple of 5.9.

This looks attractive relative to their peer group (14th out of 41 companies in the Oil & Gas sector), and relative to their forecasted boost in earnings and cashflow.

Serica are by no means a ‘big bang’ high stakes exploration company, but their rock-solid balance sheet, high-quality asset base and shareholder-friendly focus, makes them a strong addition to our AIM investor portfolio.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.