13th Aug 2025. 9.05am

Regency View:

Update

Regency View:

Update

Auction Tech announces Chairish acquisition

Auction Technology (ATG) announced the acquisition of Chairish, a leading online marketplace for vintage furniture and decor, for $85 million. The deal is intended to strengthen ATG’s position in the arts and antiques market by expanding its inventory and increasing its buyer reach.

Chairish’s curated selection and established brand will complement ATG’s existing offerings, particularly in furniture, while introducing operational synergies and unlocking further growth opportunities. The acquisition is expected to generate strong financial returns in the medium term, including double-digit revenue growth and enhanced EBITDA margins by FY28.

Despite the strategic nature of this acquisition, ATG’s share price dropped following the announcement, likely due to concerns about the company’s increased leverage. To fund the deal, ATG will use cash reserves and drawings from its existing revolving credit facility, raising its adjusted net leverage to approximately 2.3x. This move has sparked caution among investors, especially as ATG’s latest financials show Chairish had a small negative EBITDA for the year ending 31 December 2024. The market’s reaction may also reflect apprehension over the integration of the new business and the potential risks associated with ATG’s growing debt.

Looking ahead, ATG’s management remains optimistic, projecting the acquisition to be accretive to earnings per share by FY27, with significant synergies expected to be realised by FY28. The combined platform will enhance ATG’s competitive position, adding over 4.5 million monthly visits to its existing network of 25.5 million. With a strong focus on driving growth through cross-listing inventory and optimising marketing, ATG is betting on Chairish’s robust market presence to further consolidate its leadership in the global A&A marketplace.

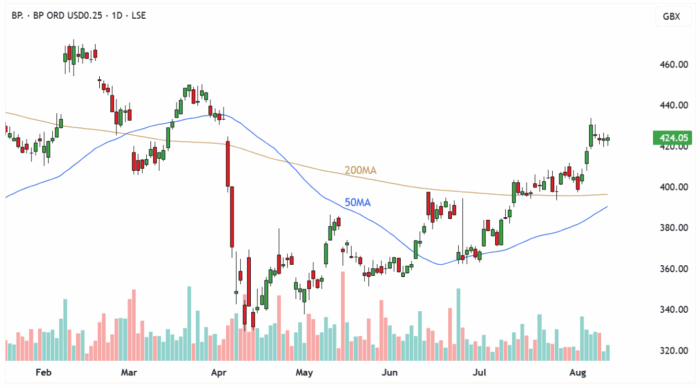

BP delivers strong quarter with operational progress and increased dividends

BP (BP.) reported strong operational results for Q2, with underlying replacement cost (RC) profit reaching $2.4 billion, a significant increase from $1.4 billion in Q1. The company’s robust performance was driven by higher refining margins and strong results from its customers and products segment. BP also announced an increase in its dividend to 8.32 cents per share, representing a 4% rise compared to the previous quarter, alongside a $750 million share buyback programme. This marks a continuation of the company’s commitment to delivering value to shareholders.

The company has made substantial progress in its strategic goals, including five major project start-ups and 10 exploration discoveries year-to-date. BP is also progressing with divestments, having already reached $3 billion in expected proceeds for the year, with a focus on streamlining operations and enhancing its portfolio. This includes the sale of its Netherlands integrated mobility business and US onshore wind business, which will further optimise its focus on core assets.

Cash flow also showed impressive growth, with Q2 operating cash flow increasing to $6.3 billion. BP’s net debt stood at $26 billion, a reduction from the previous quarter, as higher earnings and proceeds from divestments helped to strengthen the balance sheet. BP said it remains committed to maintaining a strong balance sheet and has reaffirmed its dividend policy, expecting annual increases of at least 4% per share.

Diageo reports solid organic growth amid challenging year

Diageo’s (DGE) preliminary results for the year ending 30th June revealed a modest decline in reported net sales, down 0.1% to $20.2 billion, largely impacted by adverse foreign exchange and acquisition/disposal adjustments. However, the company posted strong organic net sales growth of 1.7%, driven by a 0.9% increase in volume and 0.8% in price/mix. This growth reflects Diageo’s strong market presence, with the company holding or growing its market share in 65% of its measured markets, including the US. The performance was bolstered by standout brands such as Don Julio, Guinness, and Crown Royal Blackberry, which continue to perform well.

Despite the positive organic growth, Diageo faced pressure on profitability, with reported operating profit dropping by 27.8%, primarily due to exceptional costs related to impairments and restructuring. Organic operating profit was down by 0.7%, and the operating profit margin contracted by 68 basis points as continued investment in overheads offset slight gross margin expansion. The company also highlighted the impact of a large transaction involving Cîroc, which affected overall results. However, Diageo’s focus on cost management and productivity has led to an increase in net cash flow and free cash flow, providing the company with enhanced financial flexibility.

Looking ahead, Diageo remains committed to its long-term strategy, including its Accelerate programme, which aims to improve operational efficiency and cost savings. The company has raised its cost savings target to approximately $625 million over the next three years and expects continued organic growth in fiscal 2026, with mid-single-digit growth in organic operating profit. Diageo is focused on navigating macroeconomic uncertainties and evolving market conditions, while reinforcing its strategy to strengthen the balance sheet and deliver long-term value for shareholders.

Drax reports strong results with focus on energy security and renewables

Drax’s (DRX) financial performance for the six months to end June showed resilience, with adjusted EBITDA of £460 million, a decrease from £515 million in H1 2024. This decline was largely driven by lower operating profits, falling to £301 million, compared to £518 million last year, primarily due to exceptional items and rising costs. Despite this, Drax maintained a strong balance sheet, with £726 million in cash and committed facilities, enabling the company to support its capital allocation strategy and ongoing investments.

The company continues to play a critical role in UK energy security, contributing 5% of the country’s total power and 11% of its renewable generation. Drax achieved record pellet production in the first half, rising by 5% compared to last year. In line with its strategic goals, Drax is progressing negotiations for a low-carbon dispatchable Contract for Difference (CfD) at Drax Power Station, a move that is expected to bolster long-term revenues. The company also extended its share buyback programme by £450 million, reinforcing its commitment to returning surplus capital to shareholders.

With a strong foundation of assets and an ongoing commitment to growth, Drax remains on track to meet its full-year adjusted EBITDA target of £899 million. The company continues to focus on expanding its renewable energy capabilities, particularly in FlexGen and biomass generation, while also capitalising on opportunities in the energy transition. Through disciplined investment in projects such as pumped storage and hydro, Drax is well-positioned to address the evolving energy demands of the UK market.

4imprint posts resilient performance with strong cash flow

4imprint (FOUR) has posted a solid operational and financial performance for the six months ended 28 June, with revenue of $659.4 million, a slight 1% decrease compared to H1 2024. Despite challenging market conditions, the company continued to gain market share, driven by strong retention of existing customers and solid average order values. The operating profit margin improved to 10.7%, up from 10.5% in the previous year, reflecting effective price adjustments and the flexibility of the marketing mix. Profit before tax increased by 1%, reaching $74.0 million, while basic earnings per share rose by 2%, standing at 197.4 cents.

The Group demonstrated strong financial health, with free cash flow of $74.6 million, up from $59.1 million in H1 2024. Cash and bank deposits stood at $102.3 million, despite the payment of significant dividends earlier in the year. The company has maintained a stable dividend payout, declaring an interim dividend of 80.0 cents per share, consistent with the prior year. This solid financial footing enables 4imprint to navigate current market conditions while positioning the business for future growth. Despite these positives, the shares saw a decline following the results.

On the outlook, 4imprint said it expects full-year revenue and profit before tax to remain within the current range of analysts’ forecasts, despite some anticipated market challenges and rising product costs due to tariffs in the second half. The Board expressed confidence in the Group’s ability to navigate these conditions, delivering strong near-term financial results while positioning the business to capture opportunities as the market improves.

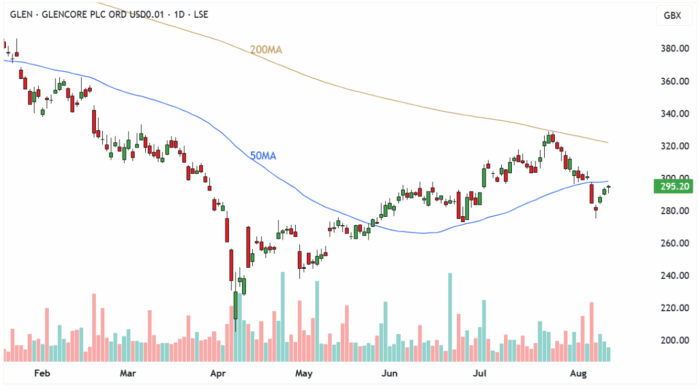

Glencore dip following lower half year results and increased debt

Glencore’s (GLEN) share price dipped last week following the release of its half-year results for 2025, which revealed a decline in adjusted EBITDA by 14% to $5.43 billion, compared to the previous year’s $6.34 billion. The decrease was primarily attributed to weaker coal prices and a drop in copper production, with key operations in Chile and Peru facing temporary challenges due to mine sequencing, lower grades, and water constraints. These factors led to a 37% drop in adjusted EBIT, which fell to $1.8 billion, down from $2.85 billion in H1 2024. Although marketing performance provided solid contributions, the overall result reflected ongoing pressures within Glencore’s industrial portfolio.

In addition to the production challenges, the company’s net debt rose by 30%, reaching $14.47 billion as of June 2025, up from $11.17 billion at the end of 2024. This increase was driven by significant capital expenditures, shareholder returns, and an increase in working capital due to commodity pre-pay transactions. Despite this, Glencore maintained a relatively healthy financial position, supported by the $900 million cash received from the sale of Viterra in early July, as well as a 16.4% shareholding in Bunge. The company announced a $1 billion share buyback programme, which was seen as an effort to return surplus capital to shareholders, although this move did not fully alleviate investor concerns about the rising debt.

On the outlook, Glencore remains cautious but optimistic. The company reiterated its full-year production guidance, with copper output expected to improve in the second half of 2025. Furthermore, Glencore’s marketing business continues to show resilience, and the company has raised its long-term marketing earnings guidance by 16%. However, geopolitical uncertainties and trade risks continue to loom, and the company is focused on cost-saving initiatives, including $1 billion in recurring cost savings expected by 2026. Despite the challenges, Glencore believes its diversified portfolio positions it well to navigate the future energy and resource needs of global markets.

HSBC’s results show short-term strain amid strategic shift

Those of you who follow our weekly briefing may have already read our summary of HSBC’s (HSBA) recent results, but here’s a recap. The bank reported a 29% drop in pre-tax profit for the second quarter, coming in at $6.3 billion versus analyst forecasts of nearly $7 billion. The decline was driven by a $2.1 billion impairment on its stake in China’s Bank of Communications and higher operating expenses linked to CEO Georges Elhedery’s ongoing restructuring programme. Despite these headwinds, UK revenues rose 7% quarter-on-quarter, and the wealth and premier banking division delivered a 19% jump in revenue during the first half.

Elhedery’s strategy remains focused on simplifying HSBC’s sprawling operations and concentrating resources on core growth markets, particularly in Asia and wealth management. Recent steps include exiting non-core businesses, such as Canadian banking operations, and investing in areas with stronger returns. The CEO also highlighted the progress in UK trade agreements as a positive for the business environment, while cautioning that global conditions, including US trade tariffs and the Chinese property downturn, could weigh on performance.

The bank ended the quarter with a robust capital position and reiterated its target of achieving $1.5 billion in annualised cost savings by 2027, with more than half expected by the end of 2025. HSBC also declared a second interim dividend of 10 cents per share and announced a $3 billion share buyback. While the results reflected short-term pressures, they also underlined the strategic shift underway to make HSBC leaner, more efficient, and better positioned for long-term growth.

MGAM warn on profit: Share price drops following weaker H1 results

Morgan Advanced Materials (MGAM) share price dropped sharply this month following a profit warning in its half-year results for 2025, which revealed a decline in adjusted operating profit of 18.7% to £58 million, compared to £71.3 million in the same period last year. The company cited weaker market conditions, particularly in its semiconductor and other industrial sectors, which significantly impacted overall performance. While the company reported progress with its business simplification programme and investments in semiconductor capacity, these efforts were not enough to offset the ongoing challenges of low demand in key markets.

Revenue for the period also dropped by 8.7%, reaching £522.6 million, reflecting a 5.8% decline in organic constant currency terms. Despite strong cash generation and a reduction in free cash flow losses, Morgan’s net debt increased by 12.1%, amounting to £249.1 million, raising concerns about its financial leverage. The company’s full-year adjusted operating profit guidance was revised downward to the lower end of the consensus range, exacerbated by foreign exchange headwinds and product mix effects. The market’s response was negative, reflecting investor concerns over the slower-than-expected recovery in the semiconductor business and the broader industrial sector.

MGAM said it remains cautiously optimistic despite current challenges. The company’s ongoing efforts in simplifying its business and investing in semiconductor capacity are expected to drive long-term value, and early signs of market stabilisation in the first half of 2025 provide hope for gradual improvement. With free cash flow expected to normalise in the second half and net debt leverage set to improve, we continue to hold the stock, believing that the company is well-positioned to recover as conditions stabilise.

Rentokil continue to recover

Rentokil’s (RTO) share price continued its recent recovery from long-term lows following the release of its half-year results for 2025. The company reported a solid 3.1% increase in group revenue, driven by strong international growth of 5.1% and an improvement in North America’s organic growth to 1.4% in Q2, up from 0.7% in Q1. Despite a slight decline in operating profit margins, the company delivered a strong free cash flow performance, with a conversion rate of 93%, ahead of the 80% guidance. The positive cash flow and operational improvements contributed to maintaining the interim dividend at 4.15 cents per share, which helped to boost investor sentiment.

Rentokil’s CEO, Andy Ransom, highlighted encouraging progress in its North America business, where its satellite branch network has expanded to 100 locations, with a goal of reaching 150 by the end of the year. The company also reported growth in residential and termite lead flow, which rose by 6.6% in June for the first time this year. These developments, along with the continued focus on cost reductions through the integration of standalone businesses, have contributed to the company’s positive performance.

Rentokil confirmed that trading remains in line with expectations and full-year results are projected to meet market forecasts. The company’s strategic initiatives, including the integration of standalone businesses and expansion of satellite branches, are expected to support continued growth. Despite some broader macroeconomic challenges, Rentokil’s strong cash flow, expanding footprint, and improving customer retention position it well for sustained performance in the second half of the year.

Smith & Nephew announce $500m share buyback

Smith & Nephew’s share price surged higher after the company reported strong first-half results for 2025, driven by impressive revenue growth and significant improvements in profitability. The global medical technology company achieved a 5.0% underlying revenue growth, with second-quarter revenue accelerating to 6.7%, supported by strong performances across all regions and business units. This solid growth was complemented by a 30.6% increase in operating profit, as well as a 36.6% rise in basic earnings per share, reflecting the successful execution of the company’s transformation strategy and operational improvements. Additionally, free cash flow surged to $244 million, compared to just $39 million in the same period last year, further boosting investor confidence.

The company’s strong cash generation allowed Smith & Nephew to announce a $500 million share buyback, reflecting its financial strength and commitment to returning value to shareholders. This move, alongside a 4.2% increase in the interim dividend to 15.0¢ per share, demonstrates the company’s confidence in its growth prospects. CEO Deepak Nath emphasized the progress made under the company’s 12-Point Plan, noting that recent product launches, including innovations in orthopaedics, sports medicine, and advanced wound care, were key drivers of growth. Smith & Nephew remains on track to meet its full-year revenue growth target of around 5%, with continued product innovation and clinical evidence expected to support further expansion.

Looking ahead, Smith & Nephew maintained its full-year guidance, with a target of 5.0% underlying revenue growth and an expected trading profit margin expansion to between 19.0% and 20.0%. The company’s robust performance, combined with a healthy product pipeline and strong cash flow generation, positions it well to navigate any market challenges and continue delivering value to shareholders. The announced share buyback further strengthens the company’s outlook, reinforcing investor optimism as the transformation of Smith & Nephew progresses.

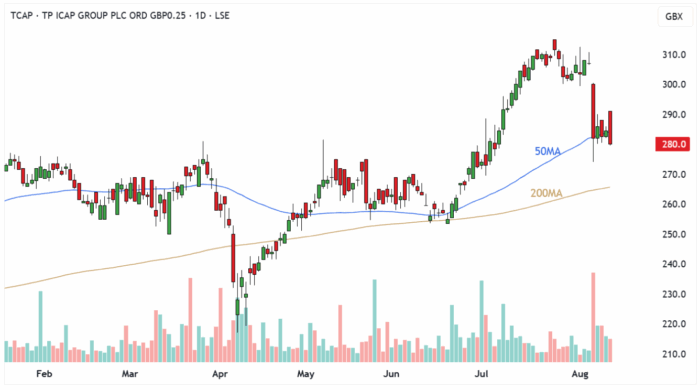

TP ICAP’s trading update disappoints with slower growth

TP ICAP’s share price took a hit this month following its interim management report for the six months ended 30th June, which showed slower-than-expected growth in key areas. Although group revenue increased by 9% to £1.2bn, the company reported a decline in adjusted operating profit margin, which fell to 15.0%, from 16.4% in the previous year. Operating profit was up 8%, but profit before tax grew by just 3%, highlighting the pressures in its core businesses. This underperformance was largely due to a 2% drop in revenue from its Energy & Commodities (E&C) division, which faced a competitive broker market, and slower growth in some of its other units.

The results were also impacted by higher costs, including the completion of several acquisitions, such as Neptune Networks, and investments in its diversification strategy. TP ICAP continues to push forward with its transformation efforts, including launching a new £30m share buyback programme, but the mixed results have raised concerns about the company’s ability to maintain its growth trajectory in the face of ongoing macroeconomic uncertainty. Despite this, the company has made substantial strides in its Global Broking and Liquidnet businesses, with both franchises posting record-high levels of profitability.

In the face of these challenges, TP ICAP maintained its full-year guidance, expecting 2025 adjusted EBIT to meet market expectations. The company’s strategic focus on diversification, including the creation of a full-service credit platform, is expected to drive long-term growth. However, the outlook remains contingent on external factors such as global trade policies and interest rate movements, which could continue to impact market volatility in the second half of 2025.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.