23rd Apr 2025. 9.01am

Regency View:

Update

Regency View:

Update

DCC refocuses leadership and streamlines strategy

DCC (DCC) has announced a series of leadership changes as it sharpens its focus on the energy sector, following its strategic shift outlined in November 2024. Kevin Lucey, currently Chief Financial Officer, will step into the newly created role of Chief Operating Officer from July 2025, working closely with CEO Donal Murphy to drive the performance of the company’s energy business. Conor Murphy, currently CFO of DCC Energy, will take over as Group CFO and join the Board at the same time.

The changes follow the planned departure of Fabian Ziegler, CEO of DCC Energy, who will leave the business in July. DCC said its leadership restructure is aimed at building commercial agility and sector expertise to scale its energy division into a global player, while continuing to support growth in its Healthcare and Technology arms.

As part of this strategy, DCC has also agreed to sell its Healthcare division to HealthCo Investment Limited for £1.05 billion. DCC said the deal, which is expected to complete in Q3 2025, reflects a strong valuation—around 12 times DCC Healthcare’s 2024 adjusted operating profit—and is expected to generate net proceeds of £945 million. The company plans to return a significant portion of this capital to shareholders while maintaining a solid investment-grade balance sheet.

DCC Healthcare contributed roughly 13% of Group profit last year, with revenues of £859.4 million and operating profit of £88.1 million. CEO Donal Murphy described the sale as a key step towards simplifying the Group and accelerating growth in energy. The divestment allows DCC to focus more intensively on its highest-return business, with the expectation that the new ownership under Investindustrial will be well placed to support DCC Healthcare’s continued success.

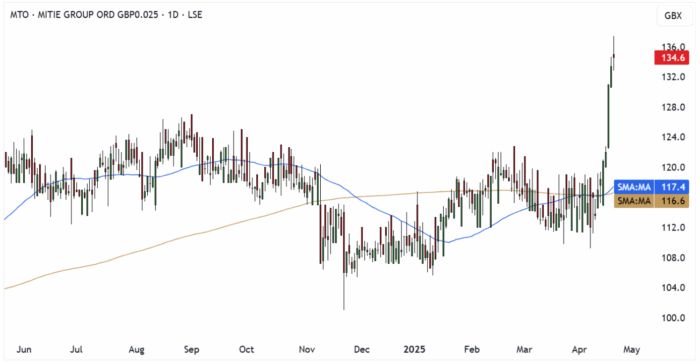

Mitie upgrades guidance and launches new buyback

Mitie’s (MTO) share price surged higher last week following a strong FY25 trading update that featured upgraded profit guidance, robust revenue growth, and the announcement of a fresh £125m share buyback programme. Investors responded positively to signs that Mitie’s transformation plan is delivering tangible financial benefits, with organic growth of around 9% helping to drive full-year revenues to a record £5.1bn. The company also confirmed that its telecoms business – previously a drag on margins – had returned to breakeven in the fourth quarter.

The upgraded operating profit forecast of approximately £230m marks a clear step up from last year’s £210m, with management crediting both project wins and the early impact of margin enhancement initiatives. Q4 revenues rose 9% year-on-year, ahead of guidance, thanks to strong demand across key accounts and upsell activity. Though the group’s operating margin dipped slightly to 4.5%, this was largely due to investment into its three-year transformation programme and acquisition integration.

Cash generation was another highlight, with free cash flow of £135m well ahead of guidance and helping fund both a £100m completed buyback for FY25 and the launch of a larger £125m programme for FY26. Management continues to strike a balance between strategic M&A and returning surplus capital to shareholders, keeping leverage at the lower end of its target range. Mitie also secured several major contract wins in Q4, including a £136m per annum deal with the Department for Work and Pensions, contributing to a record £7bn in total contract value for the year.

Momentum into FY26 looks strong, with a £24bn pipeline of opportunities and a growing focus on how AI and automation can push margins above 5% by FY27. The firm’s strategic acquisitions, low leverage, and proactive approach to capital deployment have added to investor confidence, and full-year results due on 5 June will be closely watched to see if Mitie can keep up the pace.

Solid performance and strategic shake-up at Norcros

Norcros (NXR) has confirmed that trading for the year to 31 March 2025 was in line with expectations, with underlying operating profit expected to match consensus forecasts. Despite a subdued macro backdrop, the bathroom and kitchen supplier delivered like-for-like revenue growth of 1.1%, supported by market share gains in the UK and stable performance in South Africa. Reported group revenue fell 6.2% to around £368m, reflecting the sale of Johnson Tiles UK in May 2024.

UK revenue was up 1.0% on a like-for-like basis, as new product launches, strong supply chain execution, and award-winning customer service helped the group grow its share in a weak market. However, the Johnson Tiles UK disposal contributed to a 9.1% drop in reported UK revenue. In South Africa, performance was steady, with 1.3% reported revenue growth despite continued pressure on consumer confidence and limited demand in tile manufacturing.

Financially, Norcros remains on a solid footing, with year-end net debt roughly unchanged at £37m and leverage sitting at 1.0x EBITDA. However, Johnson Tiles South Africa weighed on cash generation, contributing a £4.4m outflow during the year. This division generated around £12m in revenue and made a small operating loss, prompting management to launch a strategic review, expected to conclude by July 2025.

CEO Thomas Willcocks said the group remains confident despite macro uncertainty, with no direct exposure to the US and a well-established international supply chain. Norcros will announce its full-year results on 12 June and is aiming to build on its resilient platform by pursuing further market share opportunities and focusing on a capital-light, cash-generative model.

Playtech streamlines strategy as Snaitech sale nears completion

Playtech (PTEC) has confirmed that all necessary approvals have now been received for the sale of its Italian business, Snaitech, to a subsidiary of Flutter Entertainment. The deal is expected to complete by the end of April 2025. This marks a major milestone in Playtech’s strategic shift, enabling the company to double down on its B2B operations and focus on technology-led growth in fast-expanding gambling markets.

Following the completion of the transaction, Playtech intends to return €5.73 per share to shareholders by way of a special dividend, payable in June 2025. The company will issue further updates in due course, including the option for shareholders to receive the payout in sterling. The one-off return is set to reward investors as Playtech simplifies its business model and leans into a B2B-first strategy.

Alongside the Snaitech update, Playtech also announced the appointment of John Gleasure as a Non-executive Director and Chairman Elect. He will succeed Brian Mattingley as Chairman following the AGM in May. Gleasure brings a strong track record in the sports, media and tech sectors, having held senior roles at DAZN, The Sporting News, Perform, and Sky Sports.

The leadership change comes at a key juncture in Playtech’s evolution. With the Snaitech exit in sight and a renewed focus on B2B growth, Gleasure’s experience in digital media and data-driven businesses aligns with the company’s ambitions. His appointment has been welcomed by the outgoing Chairman, who emphasised that Playtech is well-positioned for its next phase of growth.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.