13th Mar 2024. 8.57am

Regency View:

Update:

Regency View:

Update:

Aviva surges on strong full-year results, share buyback, and upgraded guidance

Aviva (AV.) has posted better-than-expected full-year results, prompting an upgrade in its medium-term guidance.

General Insurance gross written premiums saw a 13% increase, driven by strong growth in the UK & Ireland and Canada. Operating profit rose by 9%, reaching £1.5bn. The solvency II ratio, measuring capital levels, decreased slightly to 207%.

Aviva announced a new £300mn share buyback and a final dividend of 22.3p. The company has set a new operating profit target of £2bn per year by 2026, with the dividend policy expected to grow by mid-single digits.

The market responded positively, leading to a continuation in Aviva’s recent uptrend which has seen the shares retest a key area of resistance created by the August 2022 highs. With fundamental and technical momentum pulling in the same direction we expect Aviva’s share price to continue higher.

Clarkson delivers record preliminary results

A recent addition to our FTSE Investor portfolio, Clarkson (CKN) is off to a strong start after positing a strong set of preliminary results last week.

The shipping services provider reported record underlying profit before taxation of £109.2 million for the year ended December 31, 2023, representing an 8.2% increase from the previous year.

Underlying earnings per share also rose by 9.9% to 275.0p, and the full-year dividend reached 102p, marking the 21st consecutive year of dividend growth. The company’s strong balance sheet, with free cash resources of £175.4 million, positions it well for future investment.

The preliminary results highlight robust performance in core markets, including the UK & Ireland and Canada, contributing to a revenue increase of 5.9% to £639.4 million. The Board remains confident in the company’s prospects, reflecting optimism about sector trends and global trade growth.

Clarkson’s positive outlook aligns with sector trends, global trade expansion, and the ongoing green transition in shipping. Clarkson is well-positioned to capitalise on opportunities, evidenced by a record forward order book of secured 2024 revenues amounting to $217 million.

Keller climb on impressive results

Keller (KLR), jumped higher last week after reporting a record-breaking performance, laying the groundwork for long-term growth.

Financial highlights included:

- Revenue reached £2,966.0 million, demonstrating stability compared to the previous year.

- Underlying operating profit margin surged to 6.1%, a notable increase from the 3.7% reported in 2022.

- A substantial improvement in free cash flow, totalling £103.2 million, marked a significant positive shift compared to the £33.8 million outflow in 2022.

- Net debt decreased by 33% to £146.2 million, resulting in a net debt/EBITDA leverage ratio of 0.6x, aligning with the lower end of the Group’s target range of 0.5x-1.5x.

In terms of operational performance, underlying operating profit witnessed a remarkable 67% increase at constant currency, reaching £180.9 million. This growth was driven by improved foundations performance, resilient Suncoast pricing in North America, and a strong performance in Keller Australia.

Underlying diluted earnings per share experienced a substantial 53% increase, reaching 153.9p. Keller reported a robust year-end order book of £1.5 billion. In recognition of the excellent performance and future prospects, the Keller is recommending a 20% increase in the total dividend for 2023.

CEO Michael Speakman expressed confidence in Keller’s future despite potential short-term uncertainties. Strong current trading levels, a robust order book, diverse revenues, and improved operational delivery underpin the company’s expectation of another year of underlying progress in 2024.

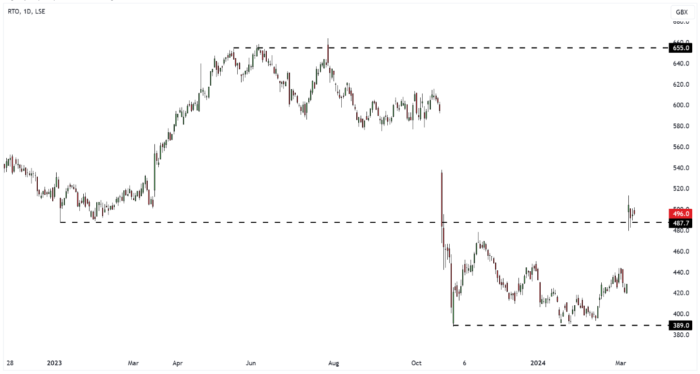

Rentokil rally as North America worries ease

Rentokil’s (RTO) shares surged 18% last week in response to the release of its full-year profits, alleviating concerns surrounding its Terminix acquisition.

CEO Andy Ransom stated that organic revenue growth in North America is expected to be around 2% in the first quarter and between 2-4% for the full year. The company reported a substantial increase in revenues for the year ending December, rising by 45% to £5.38 billion, and underlying profits saw a 44% increase to £766 million.

Ransom highlighted Rentokil’s overall strong operational and financial performance in 2023, achieving 4.9% organic revenue growth and a 16.6% margin, despite weaker growth in North America. The combination with Terminix is creating significant value, leading to an upgrade in expectations for total gross cost synergies by $50 million to $325 million, to be delivered by 2026.

Additionally, Rentokil announced a 15% increase in dividends, raising it to 8.68p. The positive financial performance and strategic developments have contributed to a more optimistic outlook for Rentokil, reflected in the market’s favourable response to the results.

TP Icap beat City forecasts and eye spin off or analytics arm

TP Icap (TCAP) jumped higher this week after announcing record annual profits, positive guidance, a new £30 million share buyback, and the exploration of a potential separate listing for its Parameta Solutions data and analytics arm.

The inter-dealer broker reported a revenue of £2.2 billion for 2023, marking a 4% increase from the previous year (or 3% excluding currency fluctuations).

By division, Global Broking revenues remained relatively flat, Energy & Commodities saw an 18% increase, Parameta experienced an 8% rise, while Liquidnet (institutional trading network and dark pools) declined by 1%.

Underlying profits reached £300 million, the highest level ever achieved by the group, marking a 9% increase. Energy & Commodities achieved record growth, with adjusted EBIT up by 45%. Adjusted earnings per share outperformed expectations, jumping 17% to 29.2p, surpassing the City consensus forecast of 25.5p. The dividend was increased by 15% to 14.8p, including a final payment of 10p.

CEO Nicolas Breteau highlighted the positive outlook, with expectations that interest rates will decrease in 2024 but remain elevated compared to recent history. He noted ongoing market volatility, driven by factors such as global elections and geopolitical events, which are supportive of the Global Broking and Energy & Commodities businesses.

TP Icap also said it is considering the possibility of an IPO for a minority stake in Parameta Solutions, as the intrinsic value of Parameta is believed to be inadequately reflected in the company’s share price.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.