29th Nov 2023. 9.00am

Regency View:

Update

Regency View:

Update

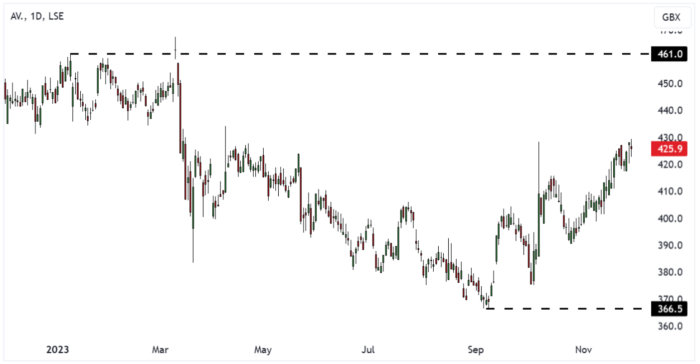

Aviva drives growth in Canada, acquires Optiom for £100m

Aviva (AV.) is buying Optiom, a top vehicle replacement insurance provider in Canada, for around £100 million.

This move fits Aviva’s plan to grow in Canada and boost Aviva Canada’s specialty lines business and distribution channels. Optiom stands out for its flexible payment options and strong distribution ties, which will help Aviva tap into a lucrative part of the Canadian insurance market.

The deal aligns with Aviva’s goal of expanding its lighter-capital businesses and sticking to its capital management strategy, ensuring steady and sustainable surplus capital returns.

Tracy Garrad, Aviva Canada’s CEO, sees potential in this acquisition to enhance services for brokers and customers. The deal builds on Aviva’s existing relationship with Optiom and is set to strengthen Aviva’s foothold in Canada’s insurance landscape.

Barclays eyes Metro Bank’s £3bn mortgage portfolio

Barclays (BARC) is in discussions for an exclusive arrangement to buy Metro Bank’s portfolio of residential mortgages worth £3 billion.

This news comes after Metro Bank’s recent steps to bolster its financial standing by raising £325 million in capital and refinancing £600 million in debt at the start of October.

Shareholders are scheduled to vote on a rescue plan intended to grant majority control to their largest investor, Jaime Gilinski, a Colombian billionaire. This move aims to stabilise the bank’s position.

Despite the reported talks, neither Barclays nor Metro Bank has responded immediately to requests for comments made by Reuters regarding this potential acquisition.

Experian surges on record profits amidst global growth and market optimism

Experian’s (EXPN) share price gapped higher earlier this month following an impressive set of first half results.

Revenue from ongoing activities climbed by 6% to $3.41 billion during the six-month period, and profit hit $928 million, propelled by heightened consumer demand for affordability assessments and investment portfolio analysis during the cost-of-living crisis.

Experian attributed its positive results to growth across all regions. Latin America experienced double-digit growth, North America demonstrated improvement by focusing on new revenue streams and analysis tools, while EMEA and Asia Pacific showed signs of improvement, and the UK and Ireland sustained steady growth.

In North America, the company adapted its strategy to emphasise revenue streams like new datasets and analysis tools, offsetting the impact of stricter lending standards. Meanwhile, British lenders are increasingly seeking comprehensive financial data due to heightened concerns about borrowers managing debts in a high-interest rate environment.

The markets response to Experian’s results has been very bullish with the shares breaking above a descending trendline which had been in place since the summer. Prices are now consolidating within a small bull flag pattern.

easyJet unveils robust plans for growth amidst turbulent conditions

easyJet’s (EZJ) financial performance for the twelve months ending September 30, showcased a record second half, pointing toward a positive outlook for fiscal year 2024.

The airline reported a substantial profit before tax of £455 million, marking a noteworthy improvement of £633 million compared to the previous year. Notably, easyJet holidays contributed significantly to this success, delivering a profit before tax of £122 million, a 221% increase.

easyJet’s full year outlook appears promising, with positive early indicators such as a 12% increase in October Revenue per Seat (RPS), ongoing improvement expected in RPS for the first quarter despite the Middle East conflict’s impact, and year-on-year growth in RPS projected for Q2 to Q4. Additionally, easyJet holidays anticipates a growth rate exceeding 35% for FY24, with a high single-digit increase in Average Selling Price (ASP).

In terms of fleet expansion, easyJet has entered conditional arrangements with Airbus to secure the delivery of additional aircraft between FY29 and FY34. This aligns with the company’s goal of fleet replacement and disciplined growth while reducing fuel burn, CO2 emissions, and operating costs per seat.

easyJet reinstated its dividend with a proposed payout of 4.5 pence per share in early 2024, expected to rise to 20% of the headline profit after tax in FY24. The board aims to ensure regular returns to shareholders, evaluating future returns in consideration of market conditions and the company’s strategic targets.

Halma achieves record first-half results

Halma (HLMA) has announced its robust first-half results for the 6 months ending September 30.

CEO, Marc Ronchetti, highlighted the success driven by their Sustainable Growth Model, leading to record revenue, profit, and dividends. These achievements stem from strategic investments, strong cash flow, and a resilient balance sheet.

Key highlights of the results incuded:

- Record revenue and profit: Revenue increased by 9%, with organic constant currency growth at 5%. Adjusted profit before taxation rose by 3%, in line with the previous year.

- Contribution from acquisitions: Recent acquisitions contributed over 5% to both revenue and profit growth.

- Strategic investment: The company increased R&D investment by 5%, completed five acquisitions, and maintained a healthy acquisition pipeline.

- Financial performance: Halma showcased a strong cash performance, achieving a cash conversion rate of 96% and maintaining a robust balance sheet.

- Dividend Growth: The interim dividend saw a 7% increase, demonstrating the Board’s confidence in the company’s growth prospects despite the ongoing uncertain environment.

Halma aims to maintain a positive outlook despite challenges presented by the current operating environment. With order intake surpassing last year’s levels and aligning closely with revenue, Halma anticipates its full-year 2024 Adjusted Profit before Taxation to meet analyst consensus expectations.

Qinetiq orders hit record high and defence spending surges

Qinetiq’s (QQ.) interim results for the six months ending September 30 made for pleasant reading…

The defence tech giant’s revenue surged to £883.1m from £673.4m in H1 FY23, while operating profit reached £91.3m, albeit slightly lower than the previous period due to a temporary FX impact related to Avantus.

Orders hit a record high of £953m, a 19% increase, with a book-to-bill ratio of 1.3x. The order backlog rose to £3,132.0m from £2,968.6m. And cash flow from operations stood at £62.2m, reflecting 50% conversion despite short-term timing differences.

In terms our outlook and guidance, Qinetiq expects full-year performance in line with market expectations, aiming for high single-digit organic revenue growth and stable operating profit margins.

Steve Wadey, QinetiQ’s CEO, expressed satisfaction with the strong first-half results, attributing them to consistent operational performance and the team’s dedication to delivering vital services for national defence and security. He highlighted organic growth, improved margins, substantial new business wins, and a growing order pipeline.

Softcat reports strong double-digit growth in Q1 2024 amidst rising IT demand

Softcat (SCT) released a solid trading update for the first quarter of its financial year…

The IT infrastructure and services company delivered a robust performance during the quarter, witnessing a double-digit growth in gross profit year-on-year. This growth stemmed from a diverse and strong demand across various sectors.

Softcat’s Board expressed contentment with this performance, which remains consistent with the company’s previously set expectations and the outlook provided during the full-year results.

CEO Graham Charlton lauded the team’s commendable performance in this quarter. The demand patterns mirrored those observed in the latter half of FY2023. Notably, there was a consistent surge in interest among customers for AI technology and the essential infrastructure supporting it.

Charlton highlighted the present time as particularly exciting for the industry, with customers requiring heightened support to navigate evolving business challenges. Softcat’s extensive range of services positions them favourably to meet these demands effectively.

Vodafone’s Germany rebound marks growth amidst streamlining efforts

Vodafone (VOD) experienced a 1.1% increase in organic service revenue in Germany, a pivotal market for the telecom giant. This marks a turnaround from previous declines and a boost to the company’s performance in Europe. The company’s focus on streamlining operations has led to the sale of its Spanish unit for up to €5bn, signalling efforts to simplify and enhance its market presence.

Germany’s positive performance contributed to Vodafone’s overall 4.7% organic growth in service revenue, the highest recorded in 15 years. Vodafone CEO, Margherita Della Valle attributes this success to strategic efforts such as relaunching family plans, targeted offers, and increased investment in customer service.

Despite a 44% drop in operating profits and a 12% decrease in cash inflow from operating activities in the first half of the year, Vodafone maintained its full-year guidance.

Della Valle’s strategy includes a focus on simplifying the business and evaluating markets that aren’t generating sufficient returns. Moves like the sale of the Spanish business and plans to merge the domestic business with Three UK demonstrate efforts to reshape and strengthen the company’s position in various European markets.

Additionally, Vodafone is undergoing a significant workforce restructure, aiming to cut 11,000 jobs over the next three years. The company continues to evaluate strategies for growth and efficiency in the dynamic telecom landscape.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.