9th Aug 2023. 9.02am

Regency View:

Update

Regency View:

Update

Airtel Africa reports strong growth amid FX challenges

Airtel Africa (AAF) delivered a bullish set of quarterly numbers last week despite severe FX headwinds.

The African telecom company saw its customer base jump by 8.8% to reach 143.1m, driven by a rising demand for mobile data and mobile money services. Notably, data customers grew by 22% to 56.8m, while mobile money customers increased by 24.3% to 34.3m.

Airtel Africa’s financial performance was equally impressive. Revenue saw a robust 20.4% growth in constant currency, totalling $1.377bn. Mobile service revenue rose by 19.1% in constant currency, powered by strong voice revenue growth of 11.9% and an impressive 29.8% growth in data revenue. Additionally, mobile money revenue jumped by 31.2% in constant currency.

The company’s adjusted earnings (EBITDA) increased by 22.5% in constant currency and 11.1% in reported currency, resulting in a solid EBITDA margin of 49.5%. However, the financial performance was dampened by a loss after tax of $151m, primarily due to a foreign exchange headwind of $471m attributed to the devaluation of the Nigerian naira.

Investors responded positively to the update and Airtel Africa’s share price has rallied from key support at 104p (see chart below).

AstraZeneca beats estimates with strong cancer and diabetes drug sales

AstraZeneca (AZN) beat market expectations with its Q2 results, propelled by strong sales of cancer and diabetes drugs and a flourishing genomic medicine sector.

The company’s earnings surged by 38%, reaching $2.15 per share, surpassing the projected $1.98. Sales climbed by 17% to $11.2bn, excluding Covid-19 medicines. Key drivers were Farxiga, a type 2 diabetes and heart failure drug with a 41% sales increase, and a 25% rise in oncology drug sales.

Although AstraZeneca’s numbers were very strong, CEO Pascal Soriot, expressed concerns over potential adverse effects from US drug pricing reforms outlined in the Inflation Reduction Act. He warned that these reforms could impede returns on cancer and rare disease drugs, potentially leading to delays in product launches within the United States.

Despite this, Soriot remains optimistic, with promising data from a late-stage trial of the oncology drug datopotamab deruxtecan to be unveiled at an upcoming medical conference.

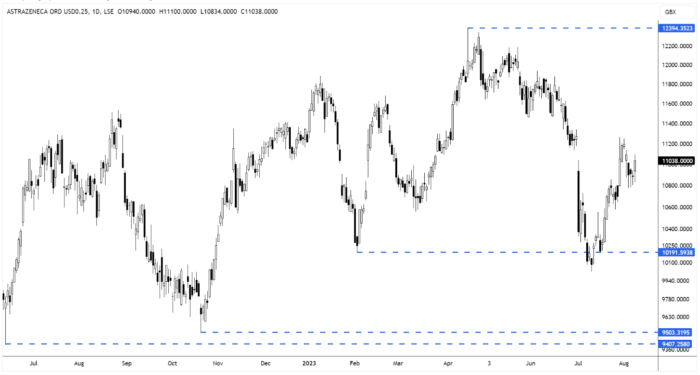

On the price chart, AstraZeneca rallied on the trading update and the shares have now made up more than half the losses suffered during the April to July sell-off.

Centamin shines with strong first half results

Centamin (CEY), recently released its interim report for the first half of 2023, showcasing improved results driven by strong operational performance and cost management.

CEO Martin Horgan highlighted the company’s third consecutive period of improved earnings aided by better gold prices. This allowed the company to invest in its portfolio and distribute returns to stakeholders.

Operational highlights include a focus on safety with zero Lost Time Injuries (LTIs) in Q2, production of 220,561 ounces of gold from the Sukari Gold Mine in Egypt, meeting 2023 guidance, and cash costs of $849/oz and all-in sustaining costs (AISC) of $1,228/oz, in line with 2023 guidance.

Financially, the company generated $426m in revenue from gold sales, with an average realised gold price of $1,936/oz. EBITDA increased by 26% to $193m. The company maintained a strong balance sheet, with available cash and liquid assets of $161m and total liquidity of $311m.

Centamin’s outlook for 2023 remains unchanged and on track, with gold production, cash costs, AISC, and capital expenditure all in line with guidance. The company also declared an interim dividend of 2.0 US cents per share.

Looking ahead, Centamin aims to update its Life of Mine Plan for the Sukari Gold Mine, continue exploration activities, and advance various projects to further enhance its performance and growth prospects.

Indivior reports substantial growth in Sublocade revenue and upbeat outlook

Pharmaceutical company Indivior (INDV) released an impressive set of financial results for Q2 2023 which showed a 58% increase in net revenue for its Sublocade product, totalling $155m.

Headline H1 2023 revenue jumped 24% to $529m compared to H1 2022, while operating profit during the period remained steady at $118m. On an adjusted basis, first half net income grew by 30% to $112m, and Q2 2023 adjusted net income rose by 24% to $56m.

The standout performer was opiate addiction medication, Sublocade which achieved revenue of $287m due to its expanded use in Organized Health Systems and higher enrolment of new patients. The FDA’s approval of OPVEE, a forthcoming overdose reversal agent, adds to Indivior’s positive trajectory, with its launch expected in Q4 2023.

Individor raised its net revenue and operating income guidance for FY 2023, reflecting increased confidence in its growth prospects.

Mark Crossley, CEO of Indivior said:

“Our progress in the first six months and positive expectations for the remainder of the year support an increase to our guidance for 2023, and further reinforce our confidence in our attractive medium-term profitable growth aspirations.”

Morgan Advanced Materials continue to recover from cyber attack

Morgan Advanced Materials (MGAM) reported a decline in its interim profits for the first half of the year, largely due to shrinking margins.

The manufacturer cited the impact of a cyber attack at the beginning of the year as the reason behind the drop in sales, profitability and cash in the short term. Despite these challenges, CEO Pete Raby said the company’s recovery process is “progressing well”, and it has taken the opportunity to invest in its IT infrastructure.

In terms of financials, the company experienced a 4.5% increase in adjusted revenues, reaching £553.9m. However, its adjusted operating profit dropped by 31% to £50m, leading to a 37.7% decline in adjusted earnings per share (EPS).

Adjusted operating profit margins also decreased from 13.7% to 9.0% and free cash flow worsened from -£1m to -£37.1m – causing net debt to double to £257.7m.

Despite the setbacks, CEO Raby remains confident about the future outlook, describing customer demand as “robust”. The company maintains its earlier projection of 2-4% revenue growth for the full year and its interim dividend remained unchanged at 5.3p per share, signalling a level of stability amid the challenges faced.

Rentokil rallies on strong half year results and M&A success

Rentokil Initial’s (RTO) share price hit fresh trend highs at the end of July following the release of a strong set of interim results.

The rat catcher’s revenue jumped 69.9% to £2.67bn in the half year to end June due to its mega merger with Terminix. Half year adjusted profit before tax also saw a significant jump of 67.3% to £377m despite a £6 million foreign exchange (FX) headwind.

Stripping out acquisitions, Rentokil achieved organic growth of 5.9% and importantly delivered growth in all business regions. The company maintained strong margin discipline and increased diluted adjusted EPS by 20.7%.

Looking ahead, Rentokil Initial’s outlook for 2023 is positive, with a clear strategy for growth and margin expansion. Despite challenges in the US pest business, the company anticipates delivering H2 organic revenue growth in North America comparable to H1.

The company remains on track to capture the benefits of the Terminix deal and is confident in achieving its guidance for operating margin growth. Despite inflationary pressures, Rentokil is confident in achieving operational and financial progress in 2023, and it anticipates early deleveraging.

On the price chart, the shares failed to maintain the breakout to new trend highs and prices have since retreated to recent swing lows as the wider market moved into riskier sectors.

Smith & Nephew’s share price falls despite upping full year guidance

Smith & Nephew’s (SN.) share price dropped despite raising its full year revenue guidance.

The medical products giant company posted weaker-than-expected first-half profits due to higher marketing costs and input inflation, which contributed to a 5% year-on-year decrease in trading profit, reaching $417m. This figure fell short of consensus analyst expectations of $442m.

Despite these challenges, Smith & Nephew’s underlying first-half revenue for the period ending 1 July increased by 7.3% to $2.7bn. And management expect a notable improvement in both trading margin and cash generation.

Smith & Nephew raised its full-year revenue growth guidance by one percentage point, now projecting growth between 6% and 7%. The company maintained its unchanged full-year profit guidance, aiming for a trading margin of ‘at least’ 17.5%.

Net debt increased by 13% to $2.65bn and Smith & Nephew anticipates maintaining an unchanged leverage ratio of two times net debt to earnings by the end of 2023. Additionally, the company announced that Chief Financial Officer Françoise Nesmes intends to step down in the second quarter of 2024.

The shares have underperformed in recent months, and prices are now trading back at a key level of support created by the March swing lows (see chart below).

Keller sees revenue and profits jump in strong first half

Keller Group (KLR) delivered a record-breaking performance in both revenue and profit during the first half of the year.

The geotechnical specialist contractor reported a revenue of £1.47bn, marking a 6% increase compared to the previous year. This growth was attributed to a strong performance from its North America Foundations business, where a focus on project execution and commercial discipline contributed to success.

Keller’s involvement in the Neom desert megaproject in Saudi Arabia, which includes a 170km linear city and an airport, has also boosted its profits. Keller’s underlying operating profit for the period was £67m, reflecting a significant 50% rise from the previous year.

The interim results also revealed that Keller faced challenges such as project losses at Austral and contract issues in the Middle East, but it expects to see improvement in the second half of the year.

Despite pricing pressures in certain European markets, the company maintains a robust order book of £1.5bn. As a result of its strong performance, the company’s CEO, Michael Speakman, expressed confidence in achieving full-year expectations and announced a 5% increase in the interim dividend, showcasing the company’s commitment to shareholder returns.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.