Regency View:

Update

HSBC’s Q4 profits surge 92%

HSBC (HSBA) has been our pick of the UK-listed banks, and this bank earnings season has served to reinforce that view.

The Asian-focused bank saw quarterly profits surge 92% to $5.2bn as rising interest rates boosted net interest income.

Our stance that pressure from activist investor Ping An would be a positive for shareholders has come to fruition with HSBC hiking its dividend to its highest level in four years.

HSBC set its dividend at 32 cents per share for 2022 (up from 25 cents in 2021 and the highest level since 2018) and said a planned 21 cent special dividend next year would be a “priority use of the proceeds” from the sale of its Canadian business.

However, HSBC’s failure to raise performance targets for 2023 left investors wondering if interest rates may have peaked.

HSBC also said that annual expected credit losses would rise to $3.6bn, more than the $3.2bn analysts had estimated, due to rising inflation pressuring borrowers and lingering problems in China’s property market.

The market’s reaction has been broadly positive with HSBC’s powerful uptrend showing no signs of slowing.

Litigation fears cause Indivior to fall

Opioid addiction specialist, Indivior (INDV) said it has set aside $290m to deal with the potential fallout from litigation, causing profits to fall and the shares to drop.

The legal provisions are in relation to lawsuits by 42 states in the US accusing Indivior of using underhanded methods to shield its opioid addiction drug Suboxone from competition.

Indivior reported a pre-tax loss of $95m (FY22) as a results of the provisions – causing the shares to tumble 12% last week.

“Because these matters are in various stages, Indivior cannot predict with any certainty how these matters will ultimately be resolved, or the costs, or timing of such resolution. In particular, any final aggregate costs of these matters, whether resolved by settlement or trial, may be materially different from this provision” the company said.

Indivior has now entered into mediation to reach a settlement ahead of its September court date.

And this uncertainty has well and truly taken the shine of some strong underlying numbers. Indivior expects net revenue for 2023 to be in the range of $950m to $1.02bn, “reflecting strong growth in Perseris and Sublocade”.

Given Indivior’s unique market-leading position, we believe it is worth riding out the storm and waiting for a settlement.

Centrica to extend share buyback as annual profit triples

Centrica’s (CNA) annual profit more than tripled on high energy prices, robust electricity generation and gas production levels.

The British Gas owner reported adjusted operating profit for 2022 of £3.3bn from 948m in the previous year.

As a result of the surge in profits, Centrica said it would extend its existing share buyback programme, resulting in it buying back 10% of its capital.

Centrica CEO, Chris O’Shea commented:

“Our performance in 2022 demonstrates the benefits of our balanced portfolio and our strong balance sheet”.

“We invested £75m in supporting our energy customers in 2022, which was greater than the £8 post-tax profit per customer earned by British Gas Energy. Whilst customers may see some relief given recent easing of prices, it remains clear that some will continue to need help and we will do what we can to support them in the year ahead” he added.

The shares gapped higher on the numbers, pushing our position into a very healthy profit.

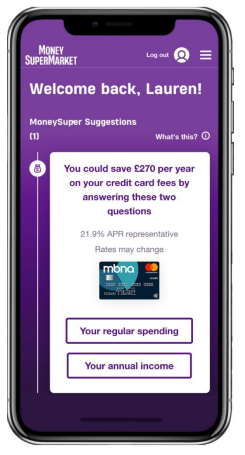

MONY confident of meeting full year expectations despite Q4 slowdown

Moneysupermarket (MONY) reported a 22% rise in full-year revenue to £387.6m and said it would meet full year expectations.

Pre-tax profits for the year to 31 December 2022 increased to £85.2m from £70.2m, but gross margins fell around 3 percentage points driven by the impact of the Quidco consolidation.

The group’s money division saw Q4 growth slow to 10% after it grew 47% for the first nine months of its financial year. However, its insurance division was boosted by car revenue returning to growth and its travel insurance revenue growth of almost 50% higher than 2019 levels.

Moneysupermarket CEO, Peter Duffy said the group were confident of meeting full year expectations:

“The first few weeks of 2023 have seen similar trends as in Q4 in Insurance and Money”.

“As previously guided, the ongoing conditions in the energy market mean it is unlikely that switching will return in 2023. On this basis the board is confident of delivering market expectations for the year.”

The market’s reaction to the trading update was volatile but broadly neutral with the stocks recovery uptrend remaining intact.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.