30th Apr 2025. 9.01am

Regency View:

BUY Wise (WISE)

- Growth

Regency View:

BUY Wise (WISE)

Wise: Money in motion

Wise (WISE) has quietly become one of the UK’s standout growth stories—a profitable fintech with real traction, strong margins, and a business model that’s eating the banks’ lunch. Shares have pulled back in recent weeks, but the longer-term trend remains firmly up, and the fundamentals have only strengthened. For investors who like their growth companies with free cash flow and pricing power, this is well worth a second look.

Momentum may have cooled since the start of the year, but we’re not talking about a broken story. Wise continues to grow, both in users and earnings, and is doubling down on product innovation, global reach, and platform efficiency. When fundamentals remain strong and price action starts to base out, it’s usually a sign to start paying attention.

Built to disrupt

Wise makes it easier—and much cheaper—for people and businesses to move money across borders. Traditional banks still rely on slow, expensive correspondent networks to shuffle funds around the world. Wise doesn’t. It’s built its own infrastructure, allowing it to settle transactions instantly in many cases, while offering much lower fees.

That infrastructure-first model is the heart of Wise’s moat. It’s why over 9 million customers trusted it to move £39.1bn in the last quarter alone. Whether you’re an individual sending remittances or a business managing payroll across multiple currencies, the value proposition is the same: speed, simplicity, and total transparency. Wise charges no hidden markups and has grown largely through word-of-mouth—proof that it’s solving a real problem at scale.

A direct approach

Wise took an unusual route to the London Stock Exchange in 2021. Rather than opting for a traditional IPO, it became the UK’s first major tech company to go public via a direct listing—a route more familiar to Silicon Valley than the Square Mile.

There were no flashy roadshows or underpriced placements. Instead, existing shareholders simply sold their stock directly into the market, and the opening price was determined by demand. It was a bold move that reflected the company’s ethos: cut out the middlemen, reduce friction, and pass on the benefits.

That decision also set the tone for Wise’s relationship with the market. There’s no quarterly guidance theatre, no growth-at-all-costs narrative. Just a transparent, well-run business that’s building long-term value—and has the financials to back it up.

What’s driving growth

Wise ended FY25 with strong momentum across the board. Cross-border volumes rose 28% year-on-year in Q4 to £39.1bn, while customer balances climbed 33% to £21.5bn. Active customers grew 17% to 9.3 million for the quarter, and full-year customer growth hit 21%, taking the total base to 15.6 million.

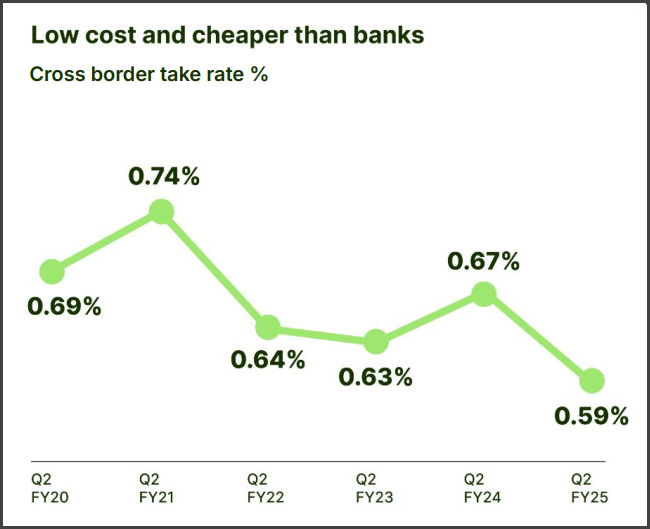

While the cross-border take rate edged down slightly to 0.53%—a reflection of higher-volume customers using the platform—that shift aligns with Wise’s long-term vision of building volume and scale. Underlying income grew 13% to £350.4m in Q4 (15% in constant currency), and for the full year, Wise delivered 18% constant-currency income growth to £1.39bn.

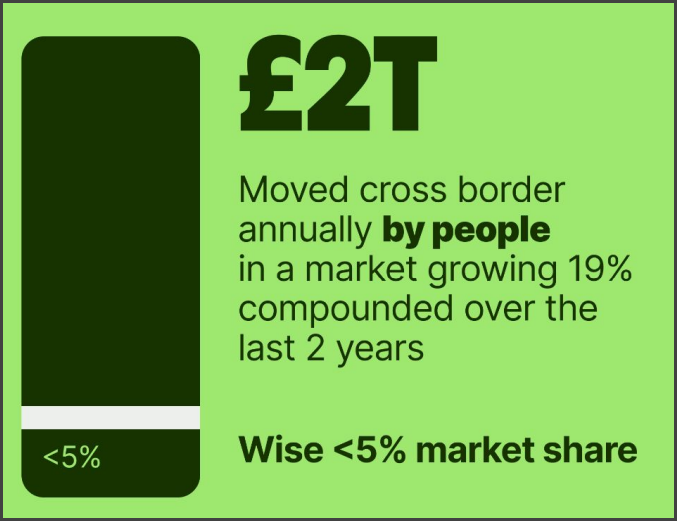

Globally, more than £2 trillion is transferred across borders each year—a figure that’s grown at a 19% compound rate over the past two years. Wise currently commands less than 5% of that market, underlining just how much headroom remains for long-term growth.

This is a business firing on all cylinders. Wise continues to deepen its international footprint, launching in Mexico, expanding Wise Business in Hong Kong, and striking a new platform deal with Itaú Unibanco in Brazil. New products like the interest-earning feature in Australia are broadening the account’s utility, while infrastructure investment—like the new Hyderabad hub—supports further growth in high-potential regions.

As co-founder and CEO Kristo Käärmann put it: “We continue to move closer towards achieving money without borders by investing in our long-term growth.”

A rare breed: Profitable and scalable

Wise isn’t your typical high-growth tech stock. It’s profitable, asset-light, and throwing off free cash flow. Preliminary FY25 underlying PBT margin came in at around 20%, ahead of expectations and well above its 13–16% target range. The company expects margins to remain near the top of that band in FY26.

Return on capital remains high, free cash flow conversion is strong, and there’s zero net debt on the balance sheet. Simply put, this is a company with discipline—reinvesting in long-term growth while keeping profitability front and centre.

On valuation, Wise trades on a forward PE of around 27x. Not cheap, but justified when you consider high-teens revenue growth, expanding international partnerships, and industry-leading returns on capital. Strip out the cash pile, and the multiple looks even more reasonable for a business with this kind of operating leverage.

Price action worth watching

After a strong rally in the second half of 2024, Wise shares have been consolidating between 950p and 1,050p. That might look dull to some, but to those who like our charts with a bit of tension—it’s getting interesting. There’s clear evidence of buyers stepping in on dips, and volume has picked up around the 975p level.

The 200-day moving average continues to rise beneath price, and the structure suggests this is a pause in trend rather than a reversal. If the shares can break above 1,050p with conviction, it opens the door to a retest of the January highs. And if the fundamentals continue to deliver, that could just be the start.

In short: the chart is coiled, sentiment has cooled, but the business remains on top form. When that kind of setup appears—where price is resting, not falling, and fundamentals are quietly improving—it often sets the stage for the next leg higher. Wise won’t stay quiet forever, and this could be a case of the market giving you a second chance.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.