16th Oct 2024. 9.00am

Regency View:

BUY Volution (FAN) Second Tranche

- Growth

Regency View:

BUY Volution (FAN) Second Tranche

Volution takes flight: Time to capitalise on growing momentum

In a dull market that has tracked sideways since the summer, Volution (FAN) is starting to shine…

The sustainable ventilation solutions provider has bags of bullish momentum—fuelled by earnings-enhancing acquisitions and impressive preliminary results.

With a surge of volume coming into the stock in recent sessions, it’s clear that investor enthusiasm is on the rise. This provides a golden opportunity to capitalise on the strength of Volution as we add to our position.

Acquisition power: Fantech joins the fold

A key driver behind Volution’s recent impressive performance is its strategic acquisition of Fantech, announced on September 20th.

With an initial consideration of AUD$220 million (£113.4 million), this acquisition is poised to significantly bolster Volution’s earnings potential. By bringing Fantech into the fold, Volution not only enhances its existing product portfolio but also reinforces its commitment to delivering sustainable, low-carbon solutions in the Heating, Ventilation, and Air Conditioning (HVAC) sector.

The integration of Fantech is expected to unlock new revenue streams and solidify Volution’s competitive position within the HVAC industry. Fantech’s established market presence combined with Volution’s innovative technologies, is set to see the merged entity provide a wider array of advanced solutions. This strategic alignment is anticipated to drive operational synergies and enhance overall profitability.

Investor sentiment surrounding the acquisition has been overwhelmingly positive, with Volution’s shares surging more than 9% on the day of the announcement. This market reaction underscores the confidence investors have in the potential of this acquisition to propel Volution forward as a leader in the HVAC sector.

Strong preliminary results: Operating cash flow per share on the rise

Adding to this positive sentiment, Volution’s preliminary results, announced last week, showed a solid financial performance.

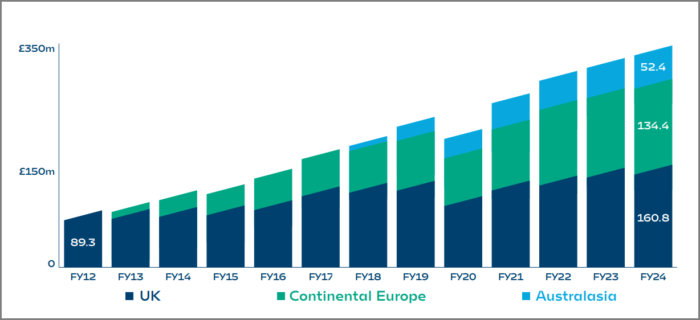

For the fiscal year ending July 31, 2024, Volution reported total revenue of £347.6 million, reflecting a 6% increase compared to the previous year’s revenue of £328 million. Net income for the year reached £37.4 million, a solid 7% increase. This growth translated to an earnings per share (EPS) increase from 18.7p to 21.4p, marking an impressive growth rate of 14%.

In addition to revenue and earnings growth, Volution’s operating profit also saw a significant rise, climbing to £62.9 million from £55.3 million the previous year. The operating margin improved to 18.1%, up from 16.8%, indicating enhanced operational efficiency. The company’s commitment to cost control and strategic investments in high-demand product areas has allowed it to navigate market fluctuations effectively.

Volution’s cash flow generation remains robust, with operating cash flow per share rising to 37.9p, up from 34.3p, and free cash flow per share increasing to 34.2p from 30.3p. This healthy cash flow position, coupled with a dividend growth rate of 12.5% over the past year, provides a strong foundation for future investments and enhances the attractiveness of Volution as a dividend-paying stock. The company’s focus on maintaining a dividend cover of 2.38x further demonstrates its ability to balance returns to shareholders with reinvestment in growth initiatives.

Momentum backed by volume

Volution’s share price is a picture of relative strength right now, with gains of 19% over the last three months and an impressive 46% year-to-date.

Both the 50-day and 200-day moving averages are sloping higher, illustrating a clear bullish trend. Recent price action has seen the shares consolidate in a small flag formation, taking prices back to the dynamic support of the 50-day moving average.

During this consolidation phase, we have observed a significant increase in volume—up by 225% over the past ten days compared to the three-month average. This uptick indicates that shares are being accumulated ahead of another move higher.

From a valuation standpoint, Volution is trading at a forward P/E ratio of 18.5, which is slightly above the industry average of 16.2. However, given the company’s strong growth trajectory and superior operating margins—currently at 18.1%—we believe it’s worth paying up for quality.

In addition, Volution’s solid balance sheet, characterised by a low debt-to-equity ratio of 0.2, reflects its financial health and operational efficiency. This strength supports the company’s commitment to maintaining a dividend growth rate of 12.5%, reinforcing its appeal to income-focused investors.

Overall, Volution’s impressive combination of quality metrics, strong financial performance, and momentum creates a compelling investment case, affirming our confidence in adding to our position.