21st Feb 2024. 8.58am

Regency View:

BUY Trainline (TRN)

- Growth

Regency View:

BUY Trainline (TRN)

Trainline: Accelerating growth in the rail ticketing revolution

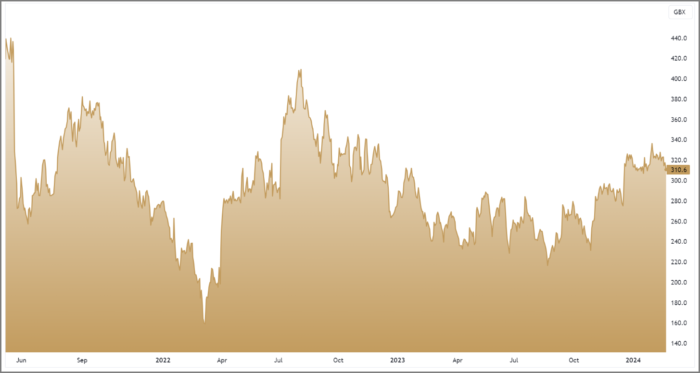

Trainline (TRN) is a trailblazer in the rail ticketing industry…

The online platform is delivering significant growth driven by its market-leading position, innovative business model, and strategic initiatives.

Let’s take a look at its highly successful business model and growth strategies, and outline why the stock’s premium valuation is justified.

Unparalleled market leader

Trainline stands as the unparalleled leader in Europe’s independent rail platform, boasting a stellar 4.9/5 app rating and over 55 million downloads.

With an impressive user base of 32 million Monthly Active Users (MAUs) and 117 million platform visits monthly, Trainline dominates the rail travel sector.

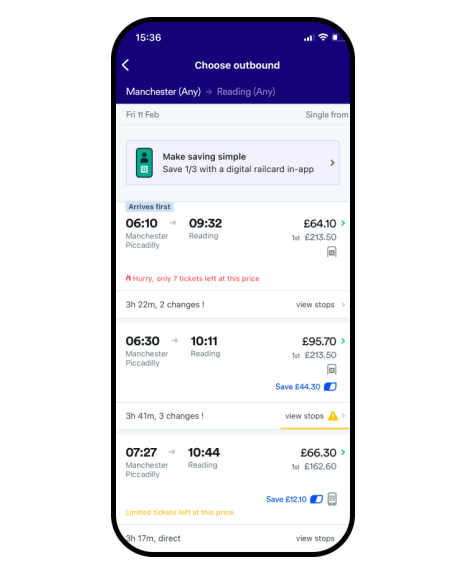

Trainline’s success hinges on its cutting-edge business model, aggregating data from over 270 carriers across Europe. Deep integration with rail and coach operators covers the entire UK rail network and 80% of Europe’s network.

Revenue streams flow from commissions, fees on ticket sales, and additional services, providing customers with an all-encompassing solution for their travel needs.

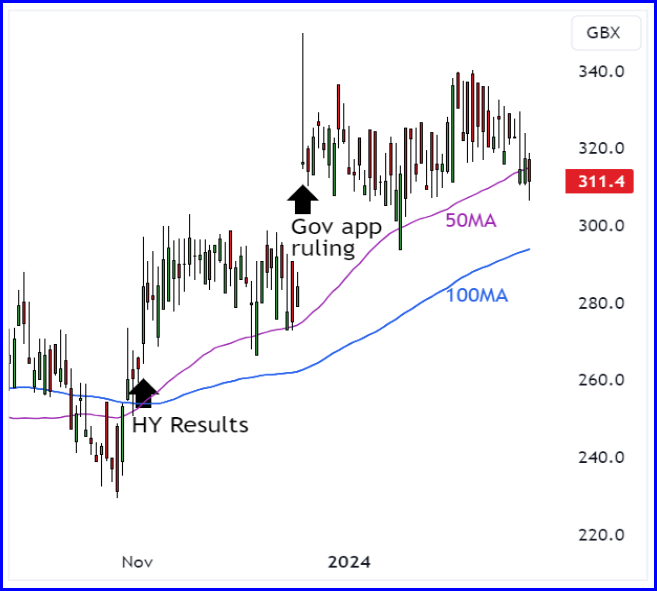

Government backing: A decisive moment for Trainline’s trajectory

A significant milestone in Trainline’s recent history unfolded in December when the UK government decided not to pursue the development of a rival rail ticketing app. This news removed a huge overhang from the stock – causing the shares to gap higher.

The government’s choice to refrain from introducing a competing app served as a resounding vote of confidence in Trainline’s capabilities and contributions to the rail travel ecosystem. It was a clear acknowledgment of Trainline’s pivotal role as a key player, not just in facilitating seamless and digital rail transactions but also in shaping the future landscape of rail travel.

As Trainline continues to lead the way in the rail travel sector, the government’s support is likely to become a key catalyst for further growth and innovation, reinforcing Trainline’s status as a linchpin in the industry’s future.

Growth horizons: Digital ticketing dominance and European expansion

In charting the course for future success, Trainline has strategically positioned itself at the forefront of two pivotal growth horizons: the relentless pursuit of digital ticketing dominance and the conquest of European rail markets.

- Digital dominance:

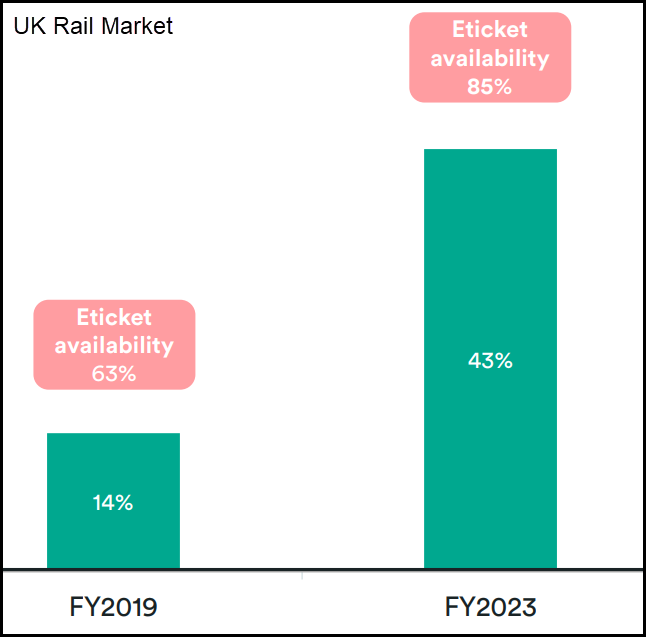

Bolstered by a remarkable 53% of all ticket sales occurring online, as revealed in the Half Year results, Trainline is at the centre of the digital shift in the UK’s rail ticketing landscape. Trainline’s substantial share of online transactions underscores its pivotal role in reshaping the industry towards a more digital-centric future.

This digital prowess extends beyond the UK, encompassing a global vision that aligns with the changing dynamics of consumer behaviour. As Trainline continues to spearhead innovations in digital ticketing, the company is well positioned to make the entire rail travel experience more seamless, convenient, and futuristic.

- European expansion:

Trainline’s growth horizons extend far beyond its UK roots, with a strategic focus on expanding its influence in the liberalised European rail markets of France, Spain, and Italy.

As highlighted in the Half Year results, Trainline’s European division has not only achieved solid double-digit revenue growth but is also progressing towards breakeven over the medium term. This success is a testament to the efficacy of Trainline’s expansion strategy, positioning the company as the premier rail retailer in Europe.

Valuation: Beyond the PE ratio

While Trainline’s stock may not be classed as a budget-friendly option, trading at a forward PE multiple of 24.5, one of the highest in its sector, it’s crucial to recognise that the value of a company extends far beyond a mere Price-to-Earnings (PE) ratio…

The PE ratio, often a cornerstone for evaluating a stock’s value, provides a snapshot of the market’s expectations concerning a company’s future earnings. In Trainline’s case, this ratio, although relatively high, reflects a broader consensus among investors regarding the company’s growth potential and market dominance.

We’ve had to make a similar judgement call with AutoTrader and Experian, both dominant market leaders that trade on a high valuations. In the case of Trainline, we also believe the company’s market leader status is worth paying for. The business has a cash-rich balance sheet and a stable track record for profitable growth.

In short, we expect Trainline to continue to lead, innovate, and capture an increasing share of the rail travel market.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.