4th Sep 2024. 9.01am

Regency View:

BUY TP ICAP (TCAP)

- Value

- Income

Regency View:

BUY TP ICAP (TCAP)

TP ICAP: A prime example of quality, value, and income

At Regency, our investment strategy centres on identifying high-quality stocks with robust fundamentals and promising growth potential. TP ICAP (TCAP) has been a standout choice for us due to its crucial role in global financial markets and its impressive operational track record.

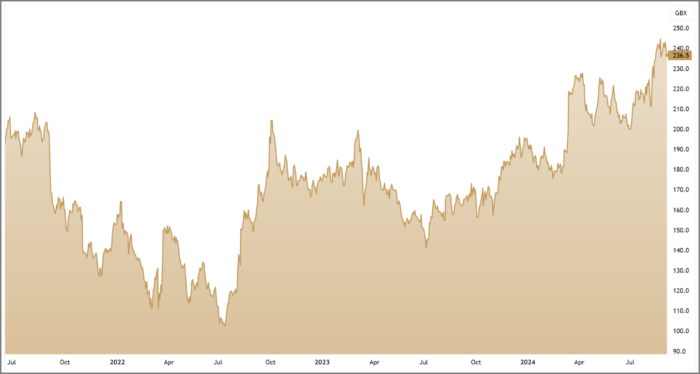

After building two positions in TP ICAP post-pandemic, we took profits earlier this year when the stock faced resistance. However, with the shares now breaking to new trend highs following a strong set of half-year results, we believe fresh catalysts make TP ICAP a compelling buy once more.

TP ICAP: The cornerstone of financial markets

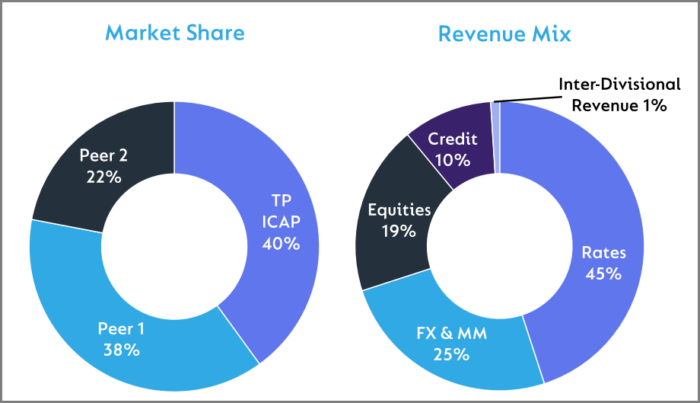

TP ICAP operates as a vital intermediary in the global financial ecosystem, offering market-making and liquidity services across a diverse range of asset classes, including interest rates, foreign exchange, equities, and commodities.

Their business model thrives on high-frequency trading, leveraging sophisticated technology and extensive networks to provide unparalleled market access and efficiency. This innovative approach and strategic adaptability have cemented TP ICAP’s position as a key player in financial brokerage.

Market-beating half-year results

TP ICAP’s half-year results for 2024 showed the company’s exceptional performance and strategic acumen. Revenue grew by 3% to £1.144 billion, bolstered by significant gains in key divisions.

The Energy & Commodities sector saw an 8% revenue increase, driven by high trading volumes in oil, power, and gas. TP ICAP’s market data subsidiary, Parameta Solutions excelled with a 10% revenue rise, reflecting the increasing demand for data and analytics. Institutional trading network, Liquidnet also contributed with an 8% revenue boost, highlighting a recovery in equity markets.

Adjusted profit before tax surged by 10% to £160 million, surpassing market expectations. Effective cost management was evident as operating expenses decreased slightly to £1.017 billion. Despite substantial investments and debt repayments totalling £192 million, TP ICAP generated a solid operating cash inflow of £117 million.

The company’s commitment to returning value to shareholders was demonstrated through its £30 million share buyback program and an interim dividend of 4.8 pence per share, maintaining consistency with the previous year. The results underlined TP ICAP’s financial strength and strategic focus, setting the stage for continued growth and value creation.

Bull flag follows breakout

TP ICAP’s share price has shown high levels of relative strength this year. Following a strong upward trend this year, the stock broke through previous highs, reaching new trend levels in August after announcing its impressive half-year results. This breakout marked a new high and confirmed the strength of the ongoing uptrend.

In the weeks that followed, TP ICAP’s shares entered a consolidation phase, forming a bullish continuation pattern known as a bull flag. This pattern is characterised by a brief period of horizontal price action following a strong rally. The flagpole represents the recent surge in the share price, while the flag itself consists of a series of small swings, indicating a pause in the upward momentum.

The consolidation near trend highs typically signals a continuation of the uptrend. The share price remains above both the 50-day and 200-day moving averages, with the 50-day average positioned above the 200-day average, reflecting a strong underlying trend. This technical setup suggests that the recent consolidation is a temporary pause before further upward momentum, positioning TP ICAP’s stock for potential upside.

TP ICAP’s trifecta: Quality, value, and income

TP ICAP TCAP offer investors quality, value and income in equal measure…

Quality: TP ICAP’s financial metrics demonstrate a strong foundation of operational efficiency and profitability. Despite market fluctuations, the company maintains robust operating margins and a healthy return on equity (ROE). The recent half-year results highlighted the firm’s ability to generate significant earnings while controlling costs, underscoring its resilient performance.

Value: TP ICAP’s shares are attractively priced, trading at a Price-to-Earnings (PE) ratio of 7.7, below the industry average. This low valuation multiple suggests that the market may be undervaluing the company’s growth potential. Additionally, a Price-to-Book ratio of 0.88 indicates that the shares are trading below their book value, further reinforcing the value proposition for investors.

Income: For income-focused investors, TP ICAP offers a compelling dividend yield of 6.44%. The company’s dividend policy reflects a commitment to returning capital to shareholders, with an interim dividend of 4.8 pence per share consistent with the previous year. This attractive yield, combined with a stable dividend cover, highlights TP ICAP’s ability to support ongoing dividend payments, making it a strong option for those seeking reliable income.

Together, these attributes create an impressive investment profile for TP ICAP. Its high-quality earnings, appealing valuation, and generous income distribution make it a standout choice for a diverse range of investors.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.